Home > North America > Grenada > How To Get Residency In Grenada | An Incomplete Guide

How To Get Residency In Anguilla | An Incomplete Guide

Country Profile:

Grenada is a Commonwealth island nation located in the West Indies, within the Caribbean Sea. Its territory primarily consists of the main island of Grenada, along with Carriacou, Petite Martinique, and other smaller islands situated 37 kilometers north of the main island.

The country’s landscape is predominantly hilly and mountainous, boasting lush tropical rainforests. Its coastlines are adorned with beautiful sandy beaches and vibrant coral reefs.

Economically, Grenada relies heavily on agriculture, tourism, and services. Often called the “Isle of Spice,” it’s renowned for its abundant production of nutmeg, cinnamon, and turmeric. Tourism is also a vital economic pillar; Grenada is famous for its stunning beaches, rainforests, and waterfalls. The annual Carnival, held every August, draws a significant number of visitors.

How to get residency in Grenada:

Saint Kitts and Nevis, Antigua and Barbuda, Dominica, Grenada, and Saint Lucia are the five Caribbean nations that offer Citizenship by Investment (CBI) programs, allowing individuals to obtain a passport through investment.

Currently, Grenada’s CBI program provides two pathways to citizenship:

- Donation Option: The minimum financial requirement for the donation route is $235,000 USD.

- Real Estate Option: The minimum investment for the real estate route is $270,000 USD.

Compared to other countries, the Grenada passport program offers two distinct advantages:

1. Its citizens can travel visa-free to China and Russia.

2. Grenada is an E-2 visa treaty country with the United States, potentially allowing its citizens to reside in the U.S. through the E-2 agreement.

In addition to its CBI program, Grenada also offers a Digital Nomad Visa for remote workers worldwide, requiring a minimum annual income of $37,000 USD.

Similar to other digital nomad programs in the Caribbean, Grenada’s Digital Nomad Visa is a non-immigrant visa. It’s valid for one year and can be renewed once, but it does not grant eligibility for Grenadian permanent residency or citizenship.

Taxation:

Grenada’s tax system is primarily composed of direct and indirect taxes, operating under a territorial tax jurisdiction. The Inland Revenue Department and the Customs and Excise Department are responsible for tax collection, which covers a variety of taxes including personal income tax, corporate income tax, property tax, as well as import duties and Value Added Tax (VAT).

The key advantage of Grenada’s tax system lies in its territorial tax principle: it does not tax residents’ foreign-sourced income. Furthermore, there are no capital gains tax, inheritance tax, or gift tax.

Passport Power:

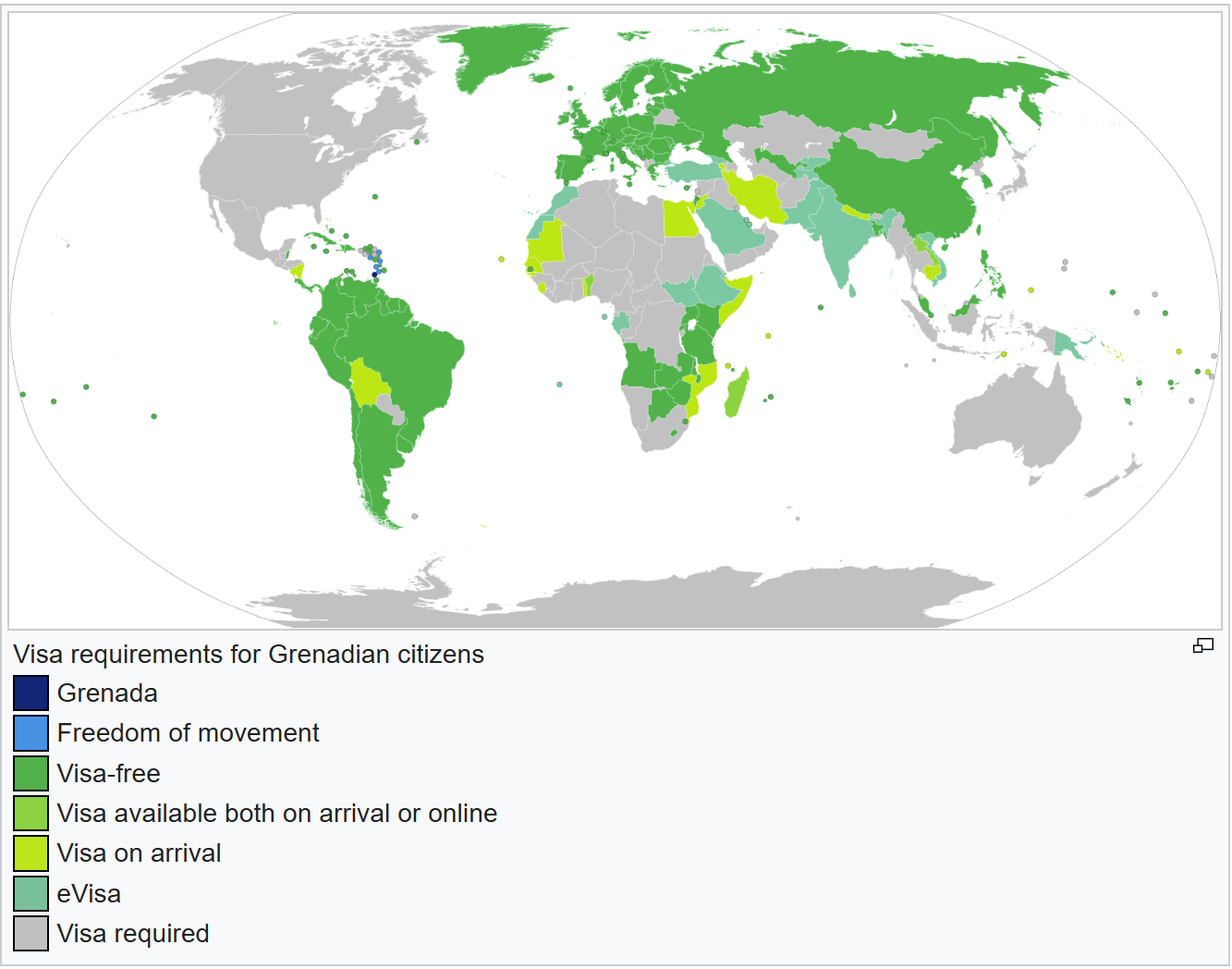

Grenada recognizes dual citizenship. Its passport ranks 28th globally, allowing its holders to travel freely (visa-free or with visa-on-arrival) to 147 countries and regions worldwide (as of June 5, 2025).

Grenada is also an E-2 visa treaty country with the United States, potentially allowing its citizens to reside in the U.S. through the E-2 agreement.

Additionally, Grenada, Seychelles, Mauritius, and Brunei are currently the only four countries in the world whose citizens enjoy visa-free access to China, Russia, the Schengen Area, and the United Kingdom.

Useful links:

Grenada CBI official site:https://cbi.gov.gd/index.php

Grenada visa apply form:https://grenadaembassyusa.org/wp-content/uploads/2016/04/Grenada-Visa-Application-Form-April-2016.pdf

Home > North America > Grenada > How To Get Residency In Grenada | An Incomplete Guide