How To Get Residency in Mauritius: A Comprehensive Guide

Capital: Port Louis

Population: 1,265,475 (as of 2019, 158th)

thEthic Groups: 67% Indian, 28% Creole, 3% Chinese, 2% French

Area: 2,040 km2 (169th)

Offical Language: English & French

Currency: Mauritian rupee (MUR)

GDP per Captial: $29,349 (61st)

Country Profile:

Mauritius is a premier Indian Ocean hub where tropical beauty meets a sophisticated, business-friendly economy. Renowned for its white-sand beaches and volcanic landscapes, it has evolved into a powerhouse for global investment and remote work.

As a politically stable republic with a low-tax regime and a multicultural population, it offers a seamless blend of luxury and opportunity. Whether you’re seeking a 10-year Occupation Permit, a vibrant digital nomad lifestyle, or a serene retirement, Mauritius provides a high quality of life within a safe, welcoming, and “future-proof” environment.

Visa & Immigration System:

Thinking of trading the daily grind for island life? Mauritius is no longer just a honeymoon destination; it has become a top-tier hub for digital nomads, investors, and retirees. However, as of late 2024 and 2025, the rules have changed.

Whether you’re looking for a 10-year Occupation Permit or the elusive 20-year Permanent Residency, here is exactly how to make the move this year.

1. The Professional Routes (Working For A Company):

The “Professional” category has been overhauled to attract specific tiers of talent.

-

ProPass (Standard Professional): This is the most common route. You need a job offer with a minimum monthly salary of MUR 30,000 (approx. $660 USD).

-

Expert Pass (New for 2025): For highly skilled experts or senior management, this new category requires a salary of MUR 250,000+ per month. It offers a faster track to permanent residency.

-

Young Professional Permit: If you graduated from a Mauritian university, you can work for 3 years without a minimum salary threshold in fields like Fintech, AI, and Robotics.

2. The Investor Route (Starting a Business):

The government now offers two distinct investment options based on how much capital you have and how fast you want your business to grow.

-

Option 1 ($50,000 USD): Best for lean startups. You must hit a turnover of MUR 1.5M in Year 1 and reach a cumulative MUR 20M by Year 5.

-

Option 2 ($100,000 USD): Best for more established ventures. The turnover requirements are lower: MUR 1M in Year 1 and MUR 15M cumulative by Year 5.

These permits are now typically issued for 10 years, but they are subject to “sturdier checks” on financial performance at the renewal mark.

3. The Self-Employed Route (One-Person Businesses):

If you’re a freelancer or consultant, you can qualify for a Self-Employed Permit by making an initial transfer of $50,000 USD into a Mauritian bank account.

To secure this route, you’ll need to demonstrate local demand by providing three letters of intent, at least two of which must be from Mauritian-based clients. Additionally, your business must hit the ground running, with a requirement to generate a minimum of MUR 750,000 in income during your first year.

4. The Retired Non-Citizen Route:

Mauritius remains one of the world’s premier retirement destinations, though recent updates ensure that the island’s growth is supported by financially stable residents.

To qualify for the Retired Non-Citizen Permit, you must transfer a minimum of $2,000 USD monthly (or $24,000 USD annually) from a source outside the country into your local Mauritian bank account. While a proposed “180-day stay” rule was heavily discussed in 2025 to encourage full-time residency, the government has maintained flexibility for now, allowing retirees to travel freely without a strict minimum-stay requirement.

The permit is granted for an initial 10-year period and is fully renewable, offering a long-term, stable path to enjoying the island’s unique lifestyle.

5. Residency Through Property :

Buying property remains the “Golden Ticket” to residency in Mauritius, but the 2025/2026 regulations have added new layers of financial strategy and cost.

To qualify for a residence permit—valid for as long as you own the asset—you must invest a minimum of $375,000 USD in approved projects like the PDS, IRS, RES, or Smart City schemes. Note that as of July 1, 2026, the registration duty for non-citizens has doubled from 5% to 10%, significantly increasing the upfront closing costs.

Additionally, new payment rules now require you to transfer your funds from abroad and have the notary pay 85% of the purchase price in Mauritian Rupees, with only the remaining 15% payable in foreign currency. These changes aim to stabilize the local currency while ensuring that foreign investment contributes more directly to the Mauritian economy.

6. The Premium Visa:

The Premium Visa remains the simplest way to “test-drive” island life for a year at no cost. To qualify, you must be employed by a company based outside of Mauritius and provide proof of comprehensive travel and health insurance. This visa is valid for one year and is fully renewable, offering a flexible, low-commitment entry point for those looking to experience the Mauritian lifestyle firsthand.

Tax Implication:

Mauritius is widely regarded as a tax-friendly jurisdiction, but it has recently moved away from its famous “flat 15% tax” to a progressive system to favor lower-income earners while introducing a “Fair Share Contribution” for high earners.

Key Principles of the Tax System:

A fundamental feature of the Mauritian tax system is its low, flat tax rates.

Corporate Income Tax is levied at a standard rate of 15%. However, certain activities, such as companies engaged in the export of goods or specific global business activities, can benefit from a reduced rate of 3% on the income attributable to those activities, provided they meet strict substance requirements.

Personal Income Tax: As of the 2025-2026 budget, individuals are taxed on a tiered scale.

You are considered a tax resident if you spend 183 days or more in Mauritius during a calendar year.

If your annual net income (including dividends) exceeds MUR 12 million, you must pay an additional 15% contribution on that income.

The Remittance Basis for Individuals:

There is no capital gains tax on the sale of shares or property, nor is there any inheritance or wealth tax, making it a highly attractive location for wealth preservation.

Furthermore, Mauritius maintains an extensive network of Double Taxation Avoidance Agreements with over 45 countries, ensuring that foreign residents aren’t taxed twice on the same income.

Retirees benefit from additional exemptions on foreign-sourced pensions, provided those funds are not remitted into a Mauritian bank account, further cementing the island’s status as a top-tier financial sanctuary.

Other Taxes:

In addition to income tax, a Value Added Tax (VAT) is levied at a standard rate of 15% on most goods and services.

A mandatory Corporate Social Responsibility (CSR) Fund contribution, typically a percentage of a company’s chargeable income, must also be set aside annually.

Finally, there is the Corporate Climate Responsibility (CCR) Levy, a recent introduction, which is applied at a rate of 2% on the chargeable income of companies with turnover above a certain threshold to fund national climate initiatives.

Permanent Residency & Citizenship:

The Permanent Residence Permit (PRP) is a 20-year renewable permit that allows you to live and work freely without being tied to a specific employer or business activity. You can generally transition to this after holding a standard 10-year Occupation Permit (OP) for at least 3 to 5 years, provided you meet these strict financial benchmarks:

-

Investors: You must show a minimum annual turnover of MUR 15M for three consecutive years, or an aggregate turnover of MUR 45M over that three-year period. Alternatively, investing $375,000 USD in a qualifying business activity can grant you immediate eligibility.

-

Professionals: You must hold a basic monthly salary of at least MUR 150,000 for three consecutive years.

-

Self-Employed: You need an annual business income of at least MUR 3M for three consecutive years.

- Retirees: You must have transferred at least $54,000 USD (aggregate) into your local account over the three years preceding your application.

Mauritius does not have a “direct” citizenship-by-investment program. Instead, you must first be a resident and then apply for Naturalization. The requirements vary based on your background and investment level:

-

Standard Naturalization: Most foreigners must legally reside in Mauritius for a total of 7 years (with a continuous 12-month stay immediately before the application).

-

Commonwealth Citizens: If you are from a Commonwealth country (like the UK, Canada, or Australia), the residency requirement is reduced to 5 years.

-

The Accelerated Route: If you invest at least $500,000 USD in the Mauritian economy, you may be eligible to apply for citizenship after only 2 years of residency.

-

Language & Character: You must be proficient in English, French, or Creole and pass a “good character” check (no criminal record).

Passport Power:

While Mauritius allows dual citizenship for those born in the country, the law is stricter for naturalized citizens. In many cases, the government may require you to renounce your original nationality to become a Mauritian citizen.

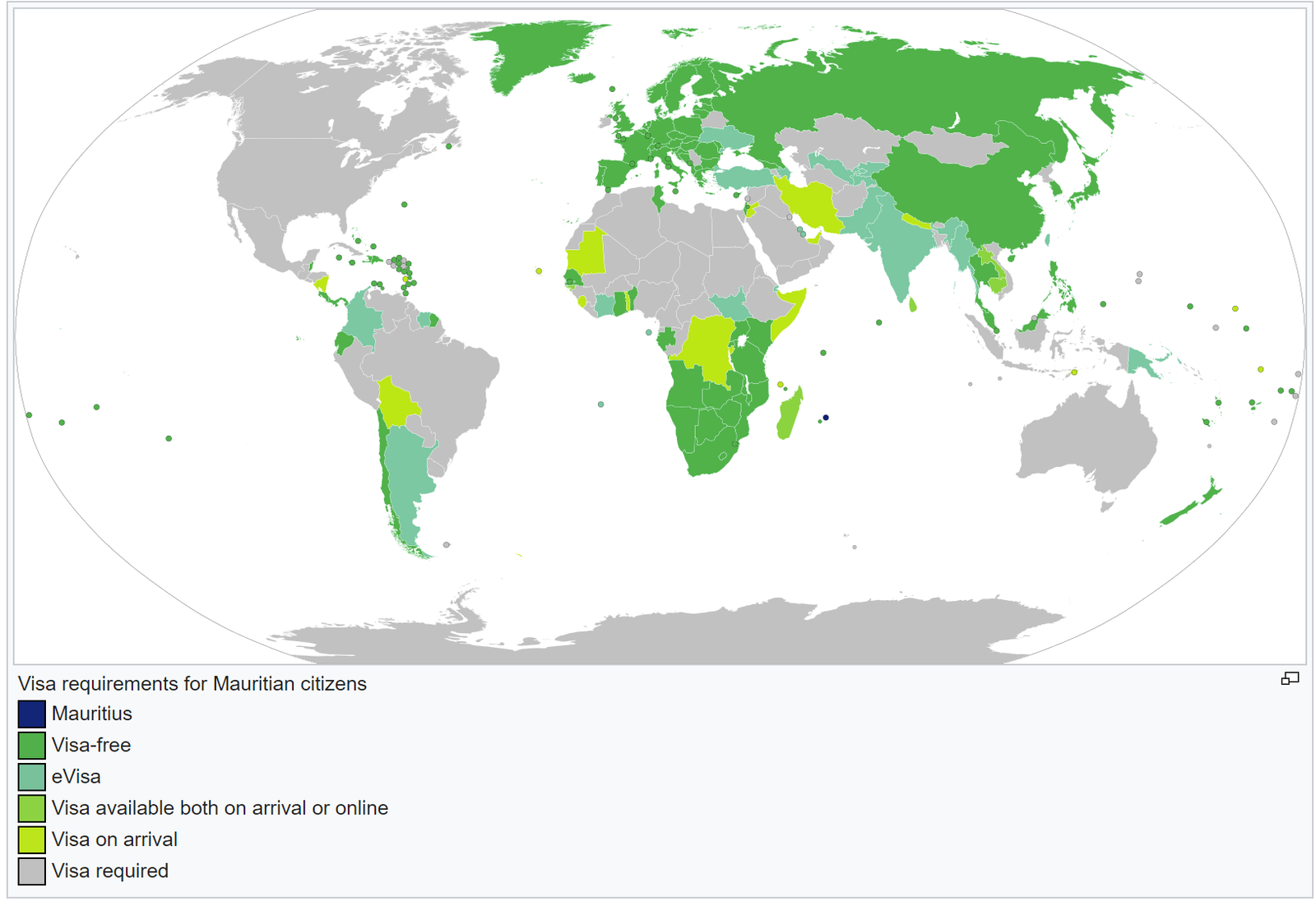

The Mauritian passport is ranked 30th globally, granting holders visa-free or visa-on-arrival access to 147 countries and territories worldwide.

As of April 2019, Brunei, Grenada, Mauritius and Seychelles are the only countries whose citizens may travel without a visa to China, Russia, Schengen Area and the United Kingdom.

Official Links:

Mauritius Economic Development Board: https://residency.mu/