Home > North America > Panama > How To Get Residency in Panama: A Comprehensive Guide

How To Get Residency in Panama: A Comprehensive Guide

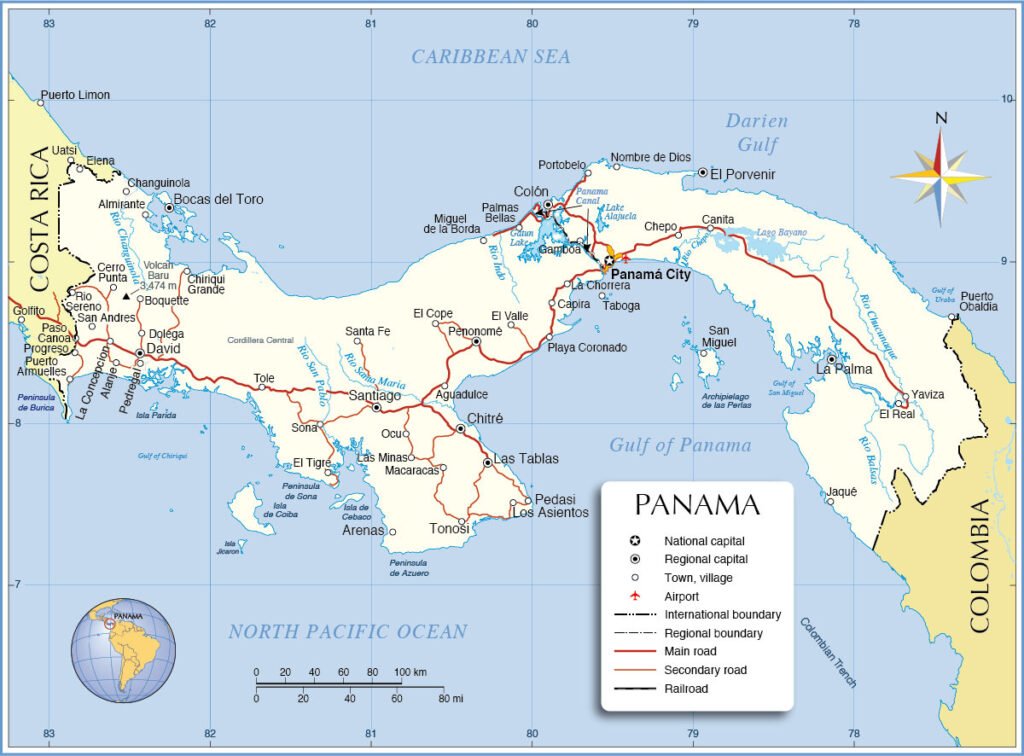

Capital: Panama City

Population: 4,337,768 (2022, 127th)

Ethic Group: 65.0% Mestizo (mixed White and Indigenous), 12.3% Indigenous, 9.2% Black, 6.8% Mulatto (mixed White and Black), 6.7% White

Area: 75,417 km2 (116th)

Offical Language: Spanish

Currency: Balboa(equal to USD) & USD

GDP per Captial (PPP): $42,772 (2025 estimated)

Human Development Index: 0.839 (59th)

Country Profile:

Panama, strategically positioned at the southernmost point of Central America, acts as a natural land bridge connecting North and South America.

Its economy is significantly boosted by the Panama Canal, a critical waterway that links the Pacific and Atlantic Oceans. This canal, along with the Colón Free Trade Zone—the world’s second-largest—generates substantial revenue that is a cornerstone of the nation’s finances.

The country is also a prominent international banking and financial hub, with a banking system that draws considerable global capital due to its strong emphasis on confidentiality and stability.

In essence, Panama is celebrated for its crucial location, vibrant service sector, and rich, diverse culture. However, it grapples with key challenges such as social inequality, the need for infrastructure upgrades, environmental protection, and navigating the volatility of the global economy.

Visa And Immigration System:

Residency By Investment:

As one of the most open economies and wealthiest countries in Central America, Panama’s immigration system offers a wide variety of investment visa options.

Actually, there’s a relatively straightforward path to temporary residency in Panama: you just need to deposit $5,000 in a Panamanian bank and register a local company. This will get you and your entire family a short-term residence permit.

From there, if you operate the company in Panama with that permit, you become eligible to apply for citizenship after five years.

Keep in mind, though, that this is a simplified view. In reality, this immigration path isn’t fully systematic. You’ll need to account for the company’s operating costs and prepare for what can be a complex and time-consuming process to apply for citizenship.

In Panama, there are six well-established and stable investment immigration programs:

1. Qualified Investor Visa: This is the main investment immigration program in Panama, including three economic options: real estate purchase, deposit, and stock purchase, with a minimum investment requirement of $300,000.

This visa allows you to obtain permanent residence directly through investment, and you only need to visit Panama once every two years to maintain your permanent residency status.

2. Business Investor Visa: This is a two-year residence visa issued to foreigners who operate a company in Panama.

To apply for the Panama Business Investor Visa, you need to invest a minimum of $160,000 locally to operate the company, and your company must create at least five long-term jobs.

3. Self-Solvency Visa: This visa is issued to foreigners who invest no less than $300,000 in real estate or deposits in Panama.

The Panama Self-Solvency Visa is a two-year residence visa. After two years, if you maintain your investment, you can apply to convert this temporary residency status to Panama Permanent Residency.

4. Reforestation Visa: This visa is specifically issued to investors engaged in reforestation and forest maintenance activities in Panama. It has two application routes:

Regular Route: You need to invest at least $100,000 and maintain the investment for more than eight years. This route grants a two-year residence visa, and if you maintain the investment, you can apply for permanent residence in Panama.

Fast Route: You need to invest $360,000 and maintain the investment for more than five years. This route allows you to directly obtain a permanent residence card in Panama after completing the investment.

5. Income Retiree Visa: This is a program run by the Panamanian government since 1987. If you deposit (usually between $260,000 and $300,000) in two local banks and ensure a monthly interest income of no less than $850, you can obtain a five-year long-term residence visa.

A notable attraction of the Panama Income Retiree Visa is that you can quickly obtain a second passport: the Panama Travel Passport, within two weeks from the application date without obtaining Panamanian citizenship.

This special passport allows the holder to travel freely (visa-free or visa-on-arrival) to 118 countries and regions, making it one of the few legal opportunities for a single nationality holder to obtain a second passport.

6. Friendly Nations Visa: This is a special investment visa issued only to citizens of 50 specific countries and regions.

The Panama Friendly Nations Visa provides a pathway to residency for citizens of a specific list of countries. To qualify, applicants must demonstrate an economic or professional connection to Panama through one of three primary options:

1. Employment: Securing a job with a Panamanian company.

2. Real Estate Investment: Purchasing Panamanian real estate with a registered value of at least $200,000.

3. Fixed-Term Deposit: Depositing a minimum of $200,000 in a fixed-term account at a Panamanian bank for at least three years.

Upon approval, applicants are first granted a provisional residency permit valid for two years. After this period, they can then apply for permanent residency, provided they continue to meet the program’s requirements.

Income Visas:

In addition to investment visas, Panama also offers two income visa options:

1. Retirees & Pensioner Visa: This is a permanent residence program that requires a monthly pension of $1,000.

If you purchase a property worth more than $100,000 locally, the pension requirement can be reduced to $750 per month.

Although primarily aimed at retirees, the Panama Retirees & Pensioner Visa is also available to those who can demonstrate sufficient passive income, even if they have not reached retirement age.

2. Short Stay Visa for Remote Workers: Launched in 2021, the Panama digital nomad visa requires applicants to be remote workers with an annual income of no less than $36,000.

This visa is essentially a tourist visa valid for nine months and can only be renewed once.

Other Visas:

In addition to these common visas mentioned above, Panama offers a variety of long-term residence permits tailored to specific circumstances, including professional and family ties.

These options include:

The Panama-Italy Treaty Visa: A unique program that provides a direct path to permanent residency for Italian citizens engaging in economic or professional activities in the country.

Work-Related Visas:

- Panama Work Permit: A general permit required for most foreigners employed in Panama.

- Panama Professional Foreigner Visa: A long-term residency permit specifically for foreign professionals with university degrees whose professions are not restricted to Panamanian nationals.

Family-Based Visas:

- Family Regrouping Visa: This allows a permanent resident to sponsor their immediate family members (spouse, children, parents) for residency.

- Married with Panamanian Visa: A pathway for foreigners married to a Panamanian citizen to obtain a residence permit.

- Parents of Panamanian Children Visa: A visa for parents of a child born in Panama who is at least five years old, providing a route to permanent residency.

Dependents:

For most long-term residence visas in Panama, the spouse and children under 25 of the principal applicant can also settle in Panama as dependents.

For those applying for the Panama Qualified Investor Visa, the parents of the principal applicant are also eligible to obtain permanent residence cards as dependents.

Taxation:

Foreigners who live in Panama for at least 6 months each year can apply to become tax residents in the country.

The annual income tax threshold in Panama starts at $11,000. For residents, there’s a 15% tax rate on the first $50,000 of income, and any income beyond that is taxed at 25%.

Both employers and employees are also required to contribute to social security taxes at rates of 12.25% and 9.75%, respectively. Additionally, they need to pay education protection taxes at rates of 1.5% and 1.125%, respectively.

Companies in Panama pay a flat 25% tax rate on taxable corporate profits.

For property taxes in Panama, if the property is valued under $120,000, it does not qualify. However, anything over that amount will be taxed between 0.5% to 0.7%.

Capital gains taxes are paid at 10% of the calculated gain. A 3% withholding is made at the closing as an advance payment against the 10% capital gains tax for real estate transactions. There are no wealth, gift, or inheritance taxes.

Panama’s VAT is known as the movable goods and services transfer tax. The standard tax rate is a flat 7%.

Furthermore, Panama does not impose wealth tax, inheritance tax, or gift tax.

Citizenship:

Permanent residents of Panama who are proficient in Spanish can apply for local citizenship after legally residing in the country for a certain period. The required time frame for naturalization ranges from 1 to 5 years, depending on the applicant’s nationality (generally, it is less than 3 years for Spanish-speaking countries).

Typically, Non-native Spanish speakers can apply for Panamanian citizenship after living in Panama for five years with permanent residency (or three years if they have a Panamanian spouse or children). Applicants must pass an interview that tests their knowledge of Spanish, Panamanian history, geography, and civic rights to qualify for citizenship.

Passport Utility:

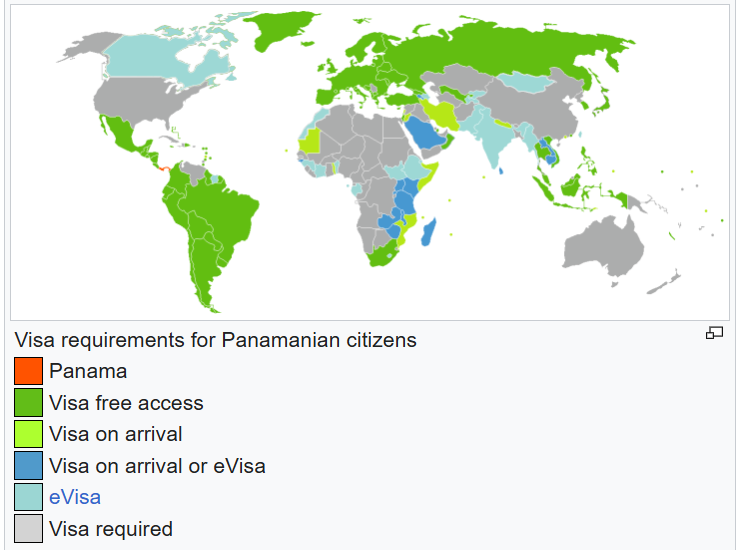

Panama’s laws do not formally recognize dual citizenship, but there isn’t strict enforcement in practice. The Panamanian passport is ranked 28th globally, and its holders can enjoy visa-free access to 147 countries and regions(Sep 9th, 2025).

Useful Links:

Panama Immigration Office:https://www.migracion.gob.pa/

Home > North America > Panama > How To Get Residency In Panama: A Comprehensive Guide