Home > North America > Anguilla > A Comprehensive Guide To Long-Term Residency In Anguilla

A Comprehensive Guide to Long-term Residency in Anguilla

Capital: The Valley

Population: 15,753 (2021)

Ethnic Group: 85.3% Black, 4.9% Hispanic, 3.8% Mixed, 3.2% White, 1.0% Indian

Area: 91 km2

Offical Language: English

Currency: East Caribbean dollar( pegged to the United States dollar, at the exchange rate of US$1 = EC$2.70)

GDP per Captial: $29,493 (2014)

Region Profile:

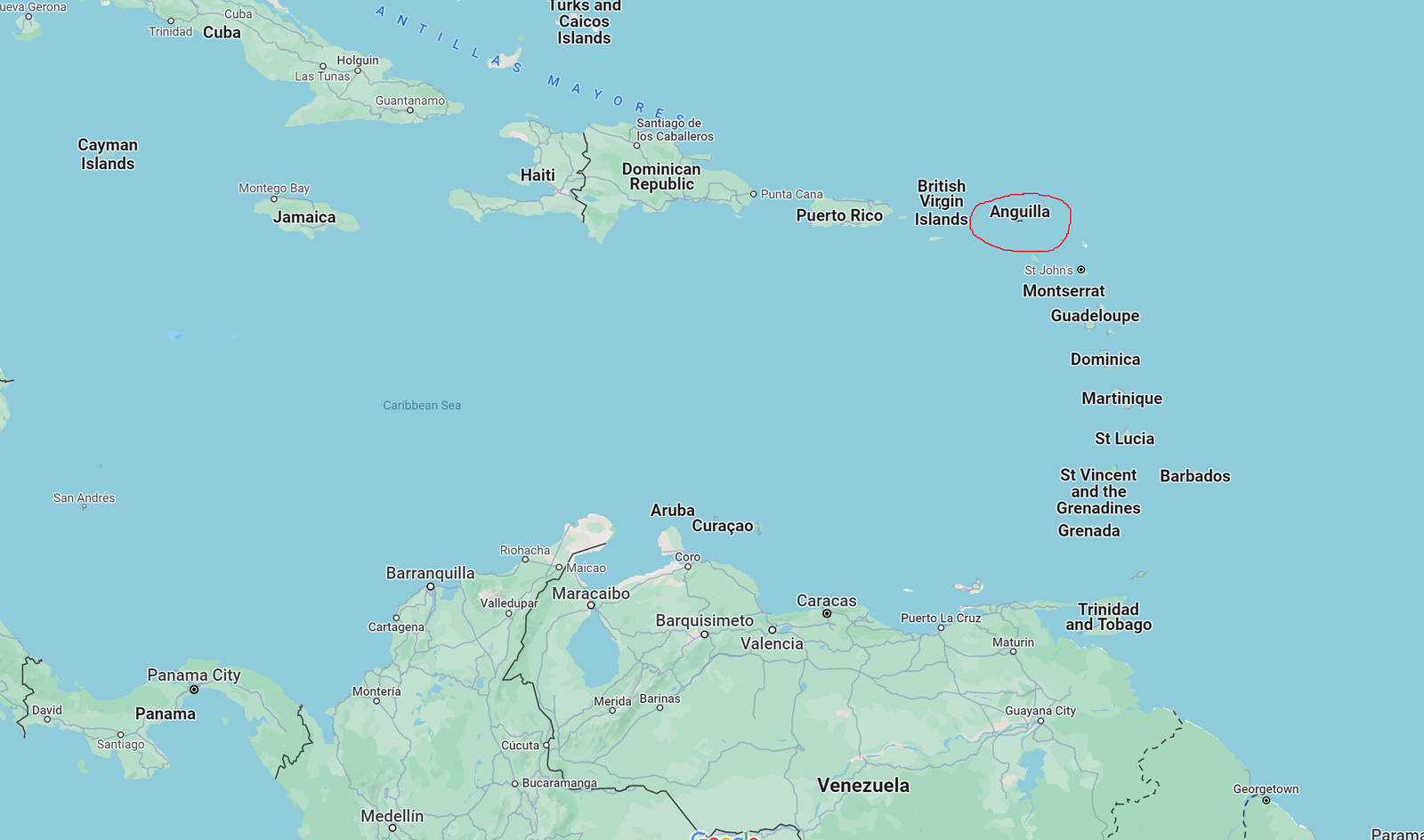

Anguilla is a British Overseas Territory located in the northeastern Caribbean Sea. It consists of the main island of Anguilla along with several smaller surrounding islands and coral reefs. The island is relatively flat and low-lying, formed primarily of coral and limestone, and is fringed by pristine white sand beaches that contribute to its natural beauty.

Tourism serves as the backbone of Anguilla’s economy. Renowned for its stunning beaches, crystal-clear turquoise waters, and upscale resorts, Anguilla has established itself as a premier vacation destination in the Caribbean. Visitors are drawn to its tranquil atmosphere, luxury accommodations, and vibrant marine life, including ecologically significant coral reefs.

In addition to tourism, Anguilla’s financial services sector has experienced rapid growth in recent years. This expansion has enhanced the island’s reputation as an emerging offshore financial center, diversifying its economic base beyond tourism.

Visa and Immigration System:

Why Select Anguilla?

In the Caribbean Sea, Anguilla is a small, unassuming island with a population of less than 20,000. Those who choose to relocate to Anguilla, apart from some workers from nearby Caribbean nations, are mainly overseas investors. Their primary considerations are:

1. To obtain a UK passport through indirect means: As one of the British Overseas Territories, Anguilla allows foreigners who legally reside there for five years to be eligible to apply for a British Overseas Territories Citizenship (BOTC) passport, thus indirectly obtaining UK citizenship.

2. Tax benefits: Anguilla is a true tax haven, with no income tax, property tax, trade tax, inheritance tax, corporate tax, or almost any other taxes. The local government sustains this nearly zero-tax system through minimal customs revenues, social security fees, and property taxes.

Permanent Residency By Investment Programs:

Historically, Anguilla’s immigration options for foreigners were limited. While work and family reunion visas were available, obtaining permanent residency required at least ten years of lawful residence, with a minimum of six months spent on the island each year. This path to eventual British Overseas Territories Citizenship (BOTC) was lengthy.

In 2018, seeking to stimulate economy, the Anguillan government introduced two residency by investment programs:

The first program is Anguilla Residency By Investment Program (ARBI): Under this program, applicants can choose to either make a donation of $150,000 USD or purchase Anguilla real estate valued at $750,000 USD or more in exchange for permanent residency in Anguilla.

ARBI operates similarly to other Caribbean passport programs. Prospective investors must first contact an official authorized agent, who submits application on their behalf. After the government completes a background check and issues a Principal Approval letter, applicant proceeds with investment. Once investment is completed, applicant receives their permanent residency card.

ARBI has no minimum residency requirement. Investors can maintain permanent residency without ever visiting Anguilla. However, becoming an Anguillan tax resident requires at least 45 days of annual residence. BOTC applicants need to spend over nine months per year in Anguilla.

The second program is Anguilla High Value Resident (HVR) Program: This program, in short, allows qualified investors to become tax residents of Anguilla: you need to purchase a property valued at $400,000 or more, and pay an annual fixed tax of $75,000.

Unlike other tax residency programs around the world, the Anguilla HVR program does not require you to make the country your primary residence, but you must still spend at least 45 days per year in Anguilla.

Also, becoming an Anguillan tax resident means that you cannot be a tax resident of any other country. In other words, you cannot spend more than 183 days per calendar year in any single country or region other than Anguilla.

Digital Nomad Visa:

Beyond its residency by investment programs, Anguilla offers a visa specifically for remote workers and online students: the Digital Nomad Visa. This visa grants temporary residence for one year. Unlike similar visas, it cannot be directly extended, requiring departure and reapplication upon expiry.

Besides remote workers, full-time online students are also eligible to apply for Anguilla’s digital nomad visa..

While Anguilla doesn’t have a set minimum income requirement for the Digital Nomad Visa, applicants typically need to prove an annual income of at least $50,000 USD. This demonstrates your ability to financially support yourself during your stay.

Dependents:

Most Anguillan immigration visas allow the principal applicant’s spouse and financially dependent children under 26 to obtain residency as dependents..

BOTC:

After five years of legal residence in Anguilla, foreign nationals can apply for British Overseas Territory Citizenship (BOTC), granting them a passport that opens doors to global opportunities.

BOTC holders who wish to become British citizens must:

1. Reside in the UK: Live in the UK for a minimum of six months in each of the five years preceding their application.

2. Meet Other Requirements: Fulfill additional requirements, such as passing a citizenship test and demonstrating integration into British society.

Useful Links:

Select Anguilla:https://www.selectanguilla.com/

Anguilla Tourist Board:https://ivisitanguilla.com/

Anguilla E-visa: https://evisa.gov.ai/

Anguilla ARBI: http://www.gov.ai/documents/finance/Anguilla%20Residency%20by%20Investment%20(ARBI)%20Presentation-%20General%20Public.pdf

Home > North America > Anguilla > A Comprehensive Guide To Long-Term Residency In Anguilla