Home >> North America >> Aruba

A Comprehensive Guide to Long-term Residency in Aruba

Capital: Oranjestad

Population: 108,027 (2024 estimated, 180th)

Ethnic groups: 78.7% Dutch, 6.6% Colombian, 5.5% Venezuelan, 2.8% Dominican, 1.3% Haitian

Area: 180 km2

Offical Language: Dutch & Papiamento

Currency: Aruban florin (1 Afl =0.55 USD on May 6th 2025)

GDP per Captial: $51,352 (2022)

Regional Profile:

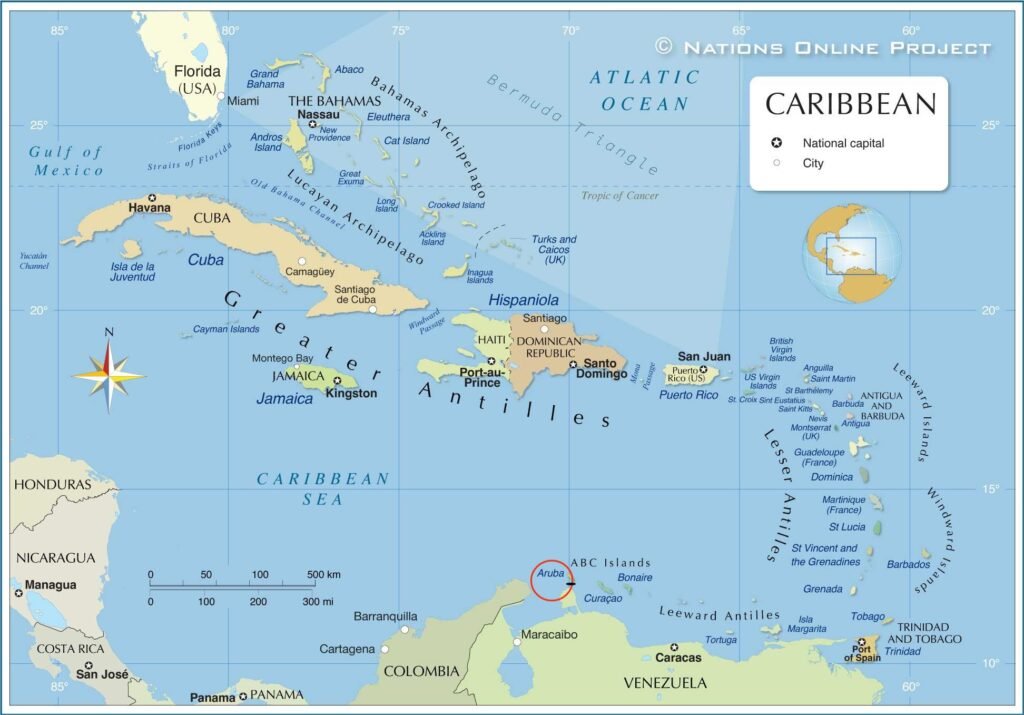

Aruba is one of the four constituent countries of the Kingdom of the Netherlands in the Caribbean, located off the coast of Venezuela to the north of the South American country. Although it is an overseas territory belonging to the Netherlands, Aruba has its own independent government and constitution, as well as extensive autonomy.

Economically, Aruba mainly relies on tourism. The island’s white sandy beaches and warm climate attract visitors from around the world. In addition, the region has developed a certain level of refining industry and offshore financial services, which serve as supplementary pillars of its economy.

Visa and Immigration System:

Aruba offers two accessible pathways for foreigners to obtain residency through income visas: : the Residence Permit for Retirees with Guaranteed Income and the Residence Permit for Retirees or Interest-Earners without Guaranteed Income.

Aruba Residency Permit:

Aruba government offers two types of income-based visas for financially qualified overseas individuals: a retirement visa (the Residence Permit for Retirees with Guaranteed Income) and an income visa (the Residence Permit for Retirees or Interest-Earners without Guaranteed Income.).

Retirement Visa Basic Requirements:

1. Must be at least 55 years old.

2. Have a pension income of no less than 50,000 Aruban florins per year (approximately USD 27,700); or possess long-term savings/financial product income with annual returns exceeding 50,000 florins.

Income Visa Basic Requirements:

1. Must be at least 18 years old.

2. Prove a stable passive income of 100,000 Aruban florins per year (approximately USD 55,500).

For both visa types, the source of income must meet conditions: it must come from a bank system in an OECD country, a member of Mercosur, or a member of the Caribbean Community.

Holders of either the retirement or income visa are not allowed to work locally during the visa validity period.

Application Process:

Currently, Aruba offers a fully online application process for all of its visas. To apply, simply log in to the region’s DIMAS system, create an account, complete the application form, upload the required documents, and submit your application.

Required Documents include:

Identification Documents: Passports of all primary and secondary applicants, passport-sized photos, and proof of relationship documents such as birth certificates and marriage certificates for all applicants.

Proof of Income: A bank-certified transaction statement verifying your income.

Application Forms: A completed application form along with a declaration supporting the secondary applicant’s ability to live locally.

The processing time for Aruba’s income visa typically takes about 4 to 6 weeks.

Dependents:

Most Aruba long-term visas allow the primary applicant’s spouse and financially dependent children to obtain the visa as accompanying dependents.

Visa Duration:

The validity period of both Aruba’s retirement visa and income visa varies according to the applicant’s financial capacity, generally lasting one year, and can be renewed continuously as long as the original conditions are maintained.

Foreigners who have legally resided in Aruba for 10 years or more can apply for permanent residence.

Foreigners who have continuously lived in Aruba for at least five years can apply for Dutch nationality locally.

Taxation:

Aruba’s taxation system includes various taxes on individuals, corporations, and consumption, with a progressive personal income tax and multiple indirect taxes.

Personal Income Tax:

Aruba taxes its residents on their worldwide income, while nonresidents are taxed only on Aruba-source income.

The personal income tax rates are progressive, ranging from 0% (as of 2025 for the lowest bracket) up to 52% for high earners.

As of January 1, 2025, the lowest income bracket up to Afl. 64,930 (about USD 36,000) is tax-exempt.

The tax brackets above this threshold remain progressive, with rates up to 52%.

Capital gains tax generally applies at 0% or 25%, depending on the situation1.

A fictitious minimum wage applies to substantial shareholders (holding 25% or more of company shares), subject to tax based on certain wage comparisons.

Corporate and Business Taxes:

Corporate profits are taxed, with a corporate tax rate around 22%.

Aruba levies a turnover tax (similar to VAT) on goods and services, currently at 2.5%, raised from 1.5% to replace a postponed VAT regime.

Additional indirect taxes include a 2% health levy and a 3% destination tax for general sickness insurance, combining to a total indirect tax rate of about 7% on turnover.

Free zone companies benefit from a reduced profit tax rate of 2%, provided they meet certain conditions.

Property and Other Taxes:

Property transfer tax is 3% for real estate valued at Afl. 250,000 or less, and 6% for properties above that value.

Annual real estate property tax is 0.4% of the property value, paid by the owner.

Inheritance tax ranges from 2% to 6% depending on the estate’s value.

Foreigners can freely purchase property but must pay an 8% property transfer tax (note: this may vary slightly depending on sources).

Social Security and Other Levies:

Aruba has mandatory social insurance contributions, including old-age pension (AOV), widows and orphans insurance (AWW), and general health insurance (AZV), with contributions from both employers and employees.

Excise duties apply to gasoline, cigarettes, alcoholic beverages, and mineral oils.

Taxation of Foreigners:

Foreign residents are generally subject to the same tax rules as locals on income and assets.

Certain exemptions may apply under international tax treaties, for example, for non-resident workers or digital nomads.

In summary, Aruba’s tax system features a progressive personal income tax with a top rate of 52%, corporate tax around 22%, and a turnover tax replacing VAT at 2.5%. Property taxes, inheritance tax, and social security contributions are also significant components. Foreign investors and residents are subject to similar tax rules, with some treaty-based exemptions available.

Useful Links:

Aruba DIMAS: https://www.dimasaruba.aw/en/

Home >> North America >> Aruba