Home > North America > Dominican Republic > How To Get Residency in The Dominican Republic: A Comprehensive Guide

How To Get Residency in The Dominican Republic: A Comprehensive Guide

Capital: Santo Domingo

Population: 11,532,151 (2025, 88th)

Ethnic Group: 71.72% Mixed, 18.7% White, 7.45% Black

Area: 48,671 km2 (128th)

Offical Language: Spanish

Currency: Dominican peso (as of June 12nd, 2025, 1 Dominican Peso = 0.017 USD)

GDP per Captial: $27,231 (2024, 64th)

Human Development Index: 0.776 (2023, 89st)

Country Profile:

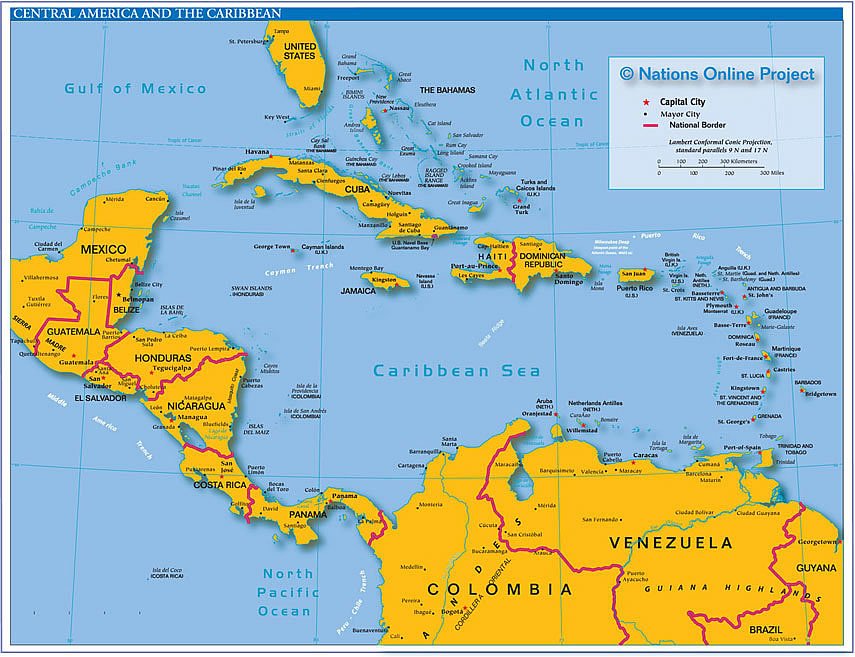

Nestled in the heart of the Caribbean, the Dominican Republic occupies the eastern five-eighths of Hispaniola. As the Caribbean’s second-largest nation, it offers a blend of culture and landscapes as vast as it is diverse.

As of early 2026, the DR is home to over 600,000 foreign-born residents—that’s nearly 6% of the entire population. While the majority of expats come from neighboring Haiti and Venezuela, there’s a massive and growing community of around 250,000 Americans and 20,000 Europeans now living here long-term.

So, what’s the draw? For Westerns, it really boils down to three core pillars: Residency, Lifestyle, and Economic Opportunity.

The Dominican Republic offers, quite literally, one of the easiest permanent residencies to obtain and keep in the entire world.

In most countries, you have to jump through hoops for years just to get a temporary permit. But in the DR, if you’re an investor or a passive income holder and meet a few straightforward requirements, you can skip the line and secure Permanent Status on your very first application.

What’s even more impressive is the freedom you have with your PR. There is no mandatory physical stay required to keep your status active. You can secure your permanent residency, go back home, and you don’t actually have to live in the DR full-time. You only need to fly in when it’s time to renew your card.

Then, there’s the lifestyle. While prices are climbing, your dollar still goes incredibly far here. You can enjoy a luxury lifestyle—often complete with private chefs or gardeners—for a fraction of the cost in the US or Europe.

This is bolstered by a semi-territorial tax system. For your first three years as a resident, your foreign-sourced income—including remote work, dividends, and pensions—is typically 100% tax-free. Even after that grace period, the tax environment remains significantly friendlier than most Western nations.

Lastly, the DR isn’t just a sleepy island; it’s a financial engine. As of 2026, it remains the largest economy in the Caribbean and the ninth-largest in Latin America. With the IMF projecting a robust 4.5% growth this year, the country is on an ambitious path to reach “high-income status” by 2030. This economic boom creates a fertile ground for development and long-term investment.

When you combine this economic momentum with world-class landscapes and a welcoming culture, it’s easy to see why so many are choosing the Dominican Republic for a new adventure.

Visa and Immigration System:

If you just want to test the waters, for citizens of the US, Canada, and Europe, entering the DR is incredibly simple. You don’t even need to apply for a visa beforehand; simply arrive with your passport and a Tourist Card, which is almost always included in your airfare.

As of 2026, the government remains flexible with stay limits. While the standard entry is 30 days, tourists can often extend their stay up to 120 days by simply paying a small “prolongation fee” at the airport when you depart. However, you can’t live on a tourist card forever. If you’re here for the long haul, you need legal residency.

There are two ways to get your foot in the door: the Fast-Track and the Standard Path.

The Fast Track:

You can apply for Immediate Permanent Residency in the DR if you qualify under one of these categories:

1. Pensionado (Retiree): Proof of a lifetime pension of at least $1,500 USD/month (+$250 per dependent).

2. Rentista (Passive Income): Proof of $2,000 USD/month from rental income, stocks, or other non-salary sources.

3. Investor: A minimum investment of $200,000 USD in a local business, financial instrument, or real estate (usually through a registered company).

You can get the card, leave, and come back whenever you want. It is, quite literally, one of the most flexible ‘Plan B’ residencies on the planet.

The Standard Route:

But if you don’t fit those categories, you’ll follow the Standard Path, starting with Temporary Residency.

There are five main ways to qualify for a Temporary Permit:

First up, Ordinary Temporary Residency:This is the most common path for people who don’t qualify for the ‘fast-track’—including retirees who don’t hit that $1,500 threshold, digital nomads, or those living off their savings. The requirements are lower, but you’ll still need a clean record and proof of financial solvency, like bank statements or property titles. This permit is valid for one year, and you’ll renew it annually for five years before you can upgrade to Permanent status.

Second, Temporary Worker Residency:This is for those with a valid job offer from a registered Dominican company. You’ll need a certified employment contract and approval from the Ministry of Labor. Just keep in mind: this permit is tied to your job. If you lose the position, your residency may become void.

Thirdly, Religious Residency:This is for missionaries or members of religious organizations who are coming to the DR to perform specific religious work.

You’ll need an official letter from a DR-registered institution confirming your mission and financial support.

The forth one is Student Visas: For foreigners enrolled in a primary, secondary, or university-level institution recognized by the Dominican state.

Lastly, Family Reunification: This is granted to the spouse or minor children of a person who already holds a Residency Permit.

Unlike other countries that demand you stay 183 days a year to keep your status, the DR is remarkably “hands-off.” You can hold your temporary or permanent permit without actually living here full-time. You only need to be in the country for your renewal process—to handle your medical exams, fingerprints, and card pickup.

Even if your residency expires while you’re abroad, the government usually won’t revoke it immediately. You can often return, pay a late renewal fine—which is proportional to how long you’ve been gone—and get back on track.

Permanent Residency & Citizenship:

If you’re on the Standard Path, after 5 years of temporary status, you can apply for an “Adjustment of Status” with the Dirección General de Migración to become a Permanent Resident.

You’ll need to provide a fresh police record, pass a new medical exam, and show proof of financial solvency. Once approved, your first Permanent Residency card is valid for one year, with subsequent renewals every four years. After ten years of permanent status, you are issued a “Definitive Residency Card,” which is no longer subject to renewal! And just like temporary residency, you technically only need to fly back once every few years to keep it active.

If you do decide to go for the passport, you can usually apply after holding Permanent Residency for two consecutive years. There are ways to speed this up: Investors can technically apply after just six months, though most lawyers recommend waiting two years for a higher success rate.

If you marry a Dominican citizen, the wait is also shortened to between six months and two years.

While residency is flexible, citizenship is more rigorous. The Ministry of Interior and Police will check your entry and exit stamps. If you’ve spent 95% of your time outside the country, they may deny your application on the grounds that you haven’t truly “integrated” or established a “domicile.”

Furthermore, the citizenship process requires a personal interview entirely in Spanish. You’ll need to prove your fluency, show your knowledge of Dominican history and values, and explain why you want to become a citizen. If you pass, the process ends with a formal oath of allegiance, usually administered by the Ministry of Interior and Police.

Tax Impliction:

The Dominican Republic is often described as a ‘tax-friendly’ jurisdiction, but you need to understand the nuances to make it work for you. The system here is primarily territorial. In simple terms: the government generally only cares about the money you earn inside the Dominican borders.

If you don’t actually live in the DR and only visit occasionally, you are generally only taxed on your Dominican-source income at a flat withholding rate of 27%.

However, if you spend more than 182 days in the country—whether those days are consecutive or not—you are officially a Tax Resident. At that point, you are technically taxed on your local income and certain foreign-source investment income. But wait—there’s a massive exception.

This is one of the biggest perks for new residents: The Grace Period. For your first three years, you get a temporary exemption on almost all foreign income. During this window, your foreign pensions, rental income from abroad, and dividends are 100% tax-free in the DR. You only pay tax on money you earn locally, like a DR salary or rent from a property you own on the island.

And even after that three-year mark, the rules are still very fair.

If you work remotely for a US or European company, that income is technically considered ‘work performed abroad,’ meaning it’s generally not subject to Dominican income tax, even after you’ve lived here for a decade!

If you earn income within the DR (or foreign investment income after 3 years), you are subject to progressive tax brackets. In 2026, the estimated brackets are up to 25%.

Another good news is that, If you enter through the Pensionado, Rentista, or Investor routes we just discussed, Law 171-07 gives you ‘Super-Benefits‘ that last forever:

For pensioners, Your Social Security or retirement pension is permanently exempt from Dominican income tax.

For investors, You often get a 0% tax rate on dividends and interest earned from that registered $200,000 investment.

And if you buy real estate, you get major breaks on property transfer taxes and a permanent fifty-percent reduction on your annual property tax.

However, it’s important to remember that the DR does not have double-taxation treaties with the United States or any EU nations besides Spain. If you’re from the US, for example, Uncle Sam still wants his cut. You must still report your worldwide income to the IRS. While you can use tools like the Foreign Earned Income Exclusion or Foreign Tax Credits to offset what you owe, you’ll still need to stay compliant with your home country’s tax office. So, Always consult with a cross-border tax specialist before you pack your bags!

Passport Power:

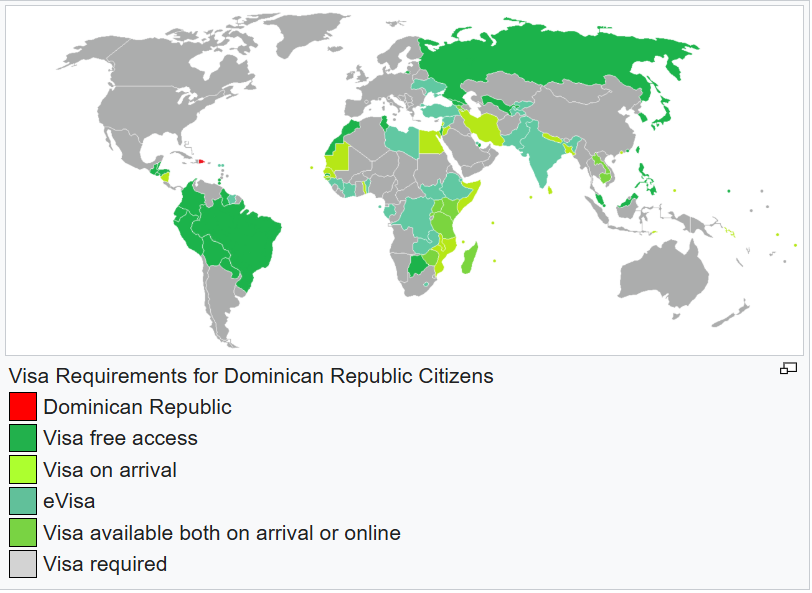

The Dominican Republic recognizes dual citizenship. Its passport ranks tied for 63rd globally. Passport holders can travel freely (visa-free, visa on arrival and e-visa) to 74 countries and regions around the world. (June 12nd, 2025)

Useful Links:

The Dominican Republic Visa Online Platform:https://drembassyusa.org/visas/visa-de-residencia-rs/

Ministry of Immigration of The Dominican Republic:https://migracion.gob.do/en/servicios/residence/

Home > North America > Dominican Republic > How To Get Residency in The Dominican Republic: A Comprehensive Guide