Home > North America > Antigua And Barbuda > Antigua and Barbuda Tax Residency Program: A Comprehensive Guide

Antigua And Barbuda Tax Residency Program: A Comprehensive Guide

Antigua and Barbuda Tax Residency Program: An Overview

Since 1995, the government of Antigua and Barbuda has offered a Tax Residency Program designed to attract wealthy individuals from around the globe. The program offers permanent residency in Antigua to applicants who meet the following requirements:

Legal Residence: You must have a place to live in Antigua, either by renting or purchasing a property.

Income: You must prove an annual income of at least $100,000 USD.

Taxes: You must commit to becoming an Antiguan tax resident and pay a fixed annual tax of $20,000 USD.

Residency: You are required to live in Antigua for at least 30 days each year. As an Antiguan resident, you cannot be a tax resident of any other country. This means you cannot spend more than 183 days in any single calendar year outside of Antigua.

Tax Implication:

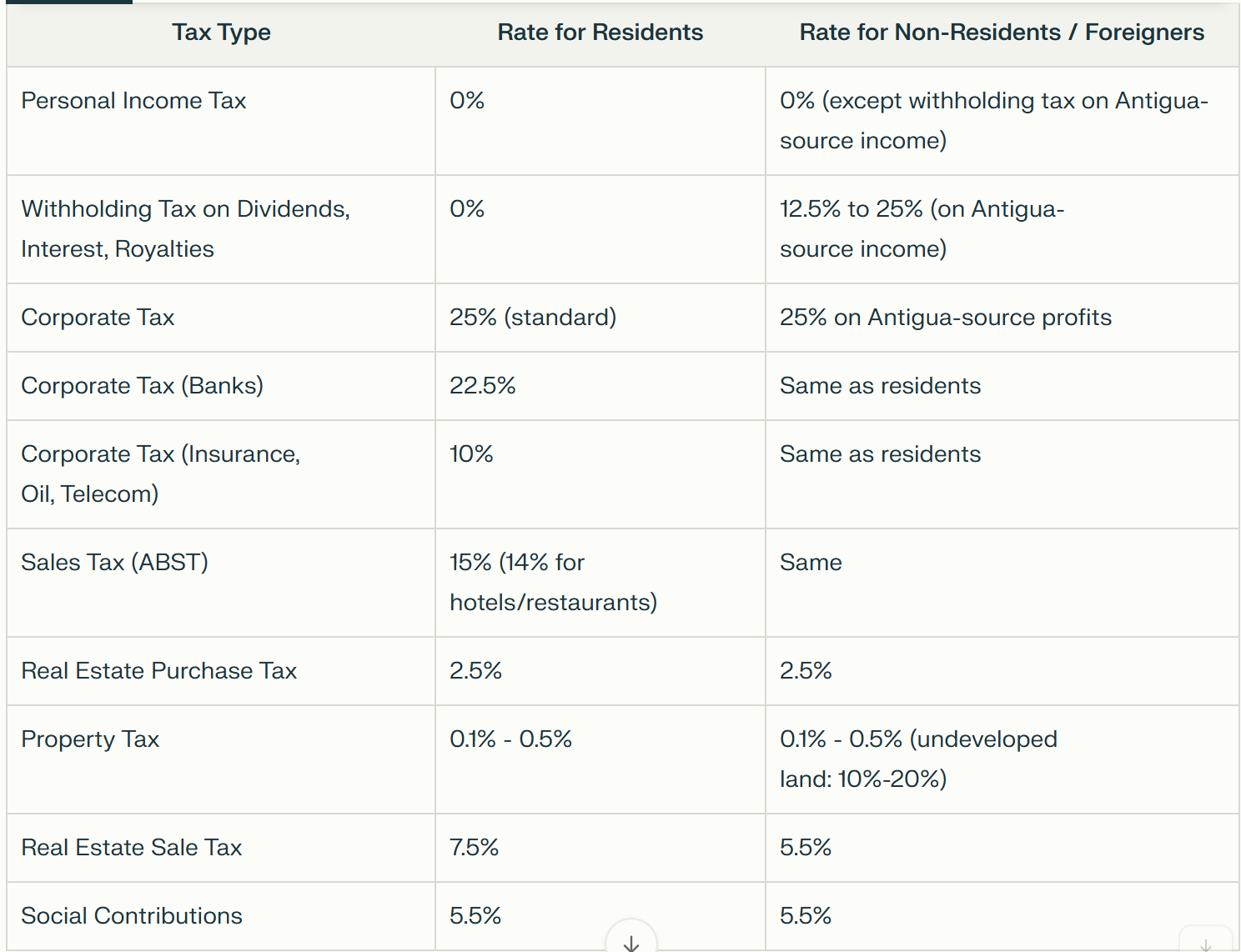

Antigua and Barbuda abolished personal income tax in 2016. Residents are not required to pay personal income tax on either local income or global income, including dividends, royalties, interest, inheritance, wealth, or capital gains.

Some of the main types of taxes in Antigua are shown in the following chart:

Application Process:

To apply for the Antigua Tax Residency Program, you must gather all the necessary documents and submit your application directly to the Antigua and Barbuda Inland Revenue Department (IRD).

The required documents for the application include:

Proof of Identity: You’ll need valid passports for yourself and any other applicants, along with passport-sized photos and relationship certificates (like birth or marriage certificates).

Proof of Income: You must provide evidence of a stable, annual income of at least $100,000 USD.

Criminal Record Check: A certificate of no criminal record is required for all applicants.

Application Form: A completed tax residency application form.

Proof of Residence: Documents showing you have a local address in Antigua.

After you submit your application, the government will conduct a thorough review of your financial background and security history. If your application is approved, you will immediately receive your Antiguan Permanent Residency Card and a Tax Identification Number (TIN). The TIN is a unique, six-digit number that is permanently assigned to you as an Antiguan tax resident.

Official Links:

Antigua and Barbuda Tax Residency Program: https://antiguabarbuda.com/dario-item-tax-residency-program/

Useful Links:

Antigua and Barbuda Travel Guide 2025: https://amzn.to/3KDiQx3

Antigua and the Antiguans: A Full Account of the Colony and Its Inhabitants from the Time of the Caribs to the Present Day: https://amzn.to/3KzMIKN

All About Antigua and Barbuda: Discover the history and heritage of this twin Island Nation, through some of its top sites and attractions: https://amzn.to/48mxLp3

Caribbean Islands eSIM: https://amzn.to/42ziWvL

World Seven Continents Antigua and Barbuda Coat of Arms National Emblem Stickers Different Sizes Sticker: https://amzn.to/4q74YLO

Home > North America > Antigua And Barbuda > Antigua and Barbuda Tax Residency Program: A Comprehensive Guide