Cyprus Digital Nomad Visa: A Comprehensive Guide

What is digital nomad visa?

“Digital nomads” represent a lifestyle trend that has gained prominence in the 21st century. With the advancement of information technology, an increasing number of professionals—such as IT workers, media personnel, language teachers, and freelancers—have broken free from traditional office settings. They now have the ability to work remotely from any location worldwide with internet access. This concept of remote work gained significant traction, especially before and during the pandemic.

Once liberated from office constraints, some remote workers choose to embrace a unique lifestyle: they carry their bags and travel to various destinations while continuing to work remotely. These individuals, known as “digital nomads,” experience a blend of exploring new cultures and working from different corners of the world.

To attract digital nomads and promote tourism and emerging industries, governments in at least 65 countries and regions worldwide have introduced specialized digital nomad visas. These visas typically have the following characteristics:

1. Applicants must be remote workers with stable monthly income and cannot be employed locally.

2. Digital nomad visas are essentially extended travel visas, often valid for one year and allowing residence for up to two to four years in the destination country without the option for permanent immigration.

However, in some Latin American and Southern European countries—such as Portugal, Spain, Uruguay, and Ecuador—digital nomads can eventually obtain local permanent residency or even naturalization after accumulating a certain length of stay.

For more information on digital nomad visa programs, explore the details in our “Global Digital Nomad Visas | An Incomplete Handbook” on this websites.

Cyprus Digital Nomad Visa: An Overview

The Cyprus Digital Nomad Visa was launched during the COVID-19 pandemic in 2021. It allows remote workers and digital nomads who meet the income requirements to reside in the country for a period of one to three years.

Eligibility and Requirements:

Currently, to apply for the Cyprus Digital Nomad Visa, applicants must satisfy the following conditions:

1. You must be a non-EU citizen, at least 18 years old, in good health, and pose no threat to the public safety of Cyprus.

2. You must be a remote worker, either employed by a company registered outside of Cyprus or self-employed with clients also outside of Cyprus.

3. Your after-tax monthly income must be no less than €3,500 (after-tax).

The Cyprus Digital Nomad Visa permits a spouse and minor children to accompany the principal applicant. If a spouse accompanies the applicant, the income requirement for the principal applicant increases to €4,200.

If a family of three (applicant, spouse, and one minor child) applies for the Cyprus Digital Nomad Visa, the principal applicant’s monthly income requirement increases to €4,830.

Thereafter, the income requirement for the principal applicant increases by 15% for each additional minor child.

4.You must purchase adequate annual health insurance for all applicants, both principal and accompanying dependents.

5. You must have suitable accommodation within Cyprus.

Annual Quota:

Unlike digital nomad visa programs in other countries, the Cyprus Digital Nomad Visa has an annual quota limit, and this quota is often filled quickly. When the Cyprus government first set the limit for the Digital Nomad Visa in 2021, the ceiling was 100 people. It was later increased to 500 people in 2022, and as of March 2025, the annual quota has been raised to 1,000 people.

Cyprus Digital Nomad Visa: Application Process

The application process for the Cyprus Digital Nomad Visa involves the following steps:

Step One: Entry

You must first apply for a visa to enter Cyprus and then apply for the Digital Nomad Visa while inside the country.

Step Two: Preparation

The applicant must prepare all necessary documents, secure a confirmed address in Cyprus, and complete the application letter.

The required documents for this program include:

Applicant Identification Documents: These include the principal applicant’s CV, passports valid for more than three months (plus copies) for all principal and accompanying dependents, two passport-sized photos, and documents proving the relationship between the principal applicant and dependents, such as a marriage certificate or birth certificates.

Completed Application Forms: All principal and dependent applicants must complete a personal information application form. You must also prepare an application letter explaining your reason for seeking the Digital Nomad Visa and outlining your work process in Cyprus, as well as a commitment letter pledging not to take up salaried employment with a Cypriot entity.

Proof of Remote Work:

If you are self-employed or a freelancer, you need to provide service agreements or contracts for your current projects, demonstrating that you can perform your work while in Cyprus and that the work is not related to the country.

If you are an employed worker, you need to provide your employment contract, a confirmation letter from your company stating you are permitted to work remotely, and a copy of the company’s registration details, among other relevant documents.

Proof of Health Insurance: Generally, all principal and dependent applicants must purchase health insurance that is valid across the EU, with a minimum coverage of €30,000, for the entire duration of the visa’s validity.

Medical Examination Certificates: This includes blood tests and X-ray examinations for all principal and dependent applicants over the age of six.

Clean Criminal Record Certificate: The police clearance certificates for all principal and dependent applicants must be issued within six months prior to the date of application.

Proof of Income: Typically, you need to provide the bank statements from your primary account for the last six months to prove that your income meets the required minimum of €3,500 per month.

Proof of Accommodation in Cyprus: This can be a purchase contract, a rental agreement, or a hotel reservation record for the principal applicant’s residence in Cyprus.

Notarization Requirements: All documents not in English must be translated into English. Furthermore, all documents must be Apostilled (Hague Convention certification) or certified by a Cypriot embassy or consulate.

Step Three: Submission of Application

Applicants must submit their application in person at the Cypriot Civil Registry and Migration Department in Nicosia. You will be required to pay a visa fee ranging from €70 to €140, with the exact amount varying based on the applicant’s specific circumstances.

You can book an appointment for submission at here.

Step Four: Visa Issuance

The processing time for the Cyprus Digital Nomad Visa is generally 5 to 7 weeks. Once the visa is approved, you are granted the right to work remotely freely while residing in Cyprus.

Dependents:

For the Cyprus Digital Nomad Visa, the principal applicant’s spouse or partner and their minor children can obtain a temporary residency permit as accompanying dependents.

Visa Validity:

The Cyprus Digital Nomad Visa is initially valid for one year. It can be extended for up to a maximum of two additional years.

Even for an extension, you still need to secure a spot within the annual quota. This means if the quota is full, you will not be able to renew your Cyprus Digital Nomad Visa.

Tax Implication:

Whether you are required to pay local taxes as a digital nomad in Cyprus depends on the duration of your stay within the country each year. A foreign individual automatically becomes a Cypriot tax resident if they reside in the country for more than 183 days in a single calendar year.

The “60-Day Rule”:

Cyprus also offers a “60-Day Rule,” which allows you to establish tax residency without meeting the 183-day threshold, provided you satisfy the following criteria:

1. You reside in Cyprus for a minimum of 60 days during the calendar year.

2. You do not reside in any other single country for more than 183 days within the same calendar year, and you are not a tax resident of any other country.

3. You demonstrate a strong tie to Cyprus, for example, by engaging in work or business activities substantially connected to the country, or by purchasing residential property in Cyprus.

Tax Benefits for Digital Nomads:

Digital nomads who establish Cypriot tax residency can take advantage of significant tax benefits:

Exemption on income derived from financial assets, such as dividends and gains from securities trading.

A 50% tax reduction on all applicable tax liabilities if their annual income exceeds €55,000.

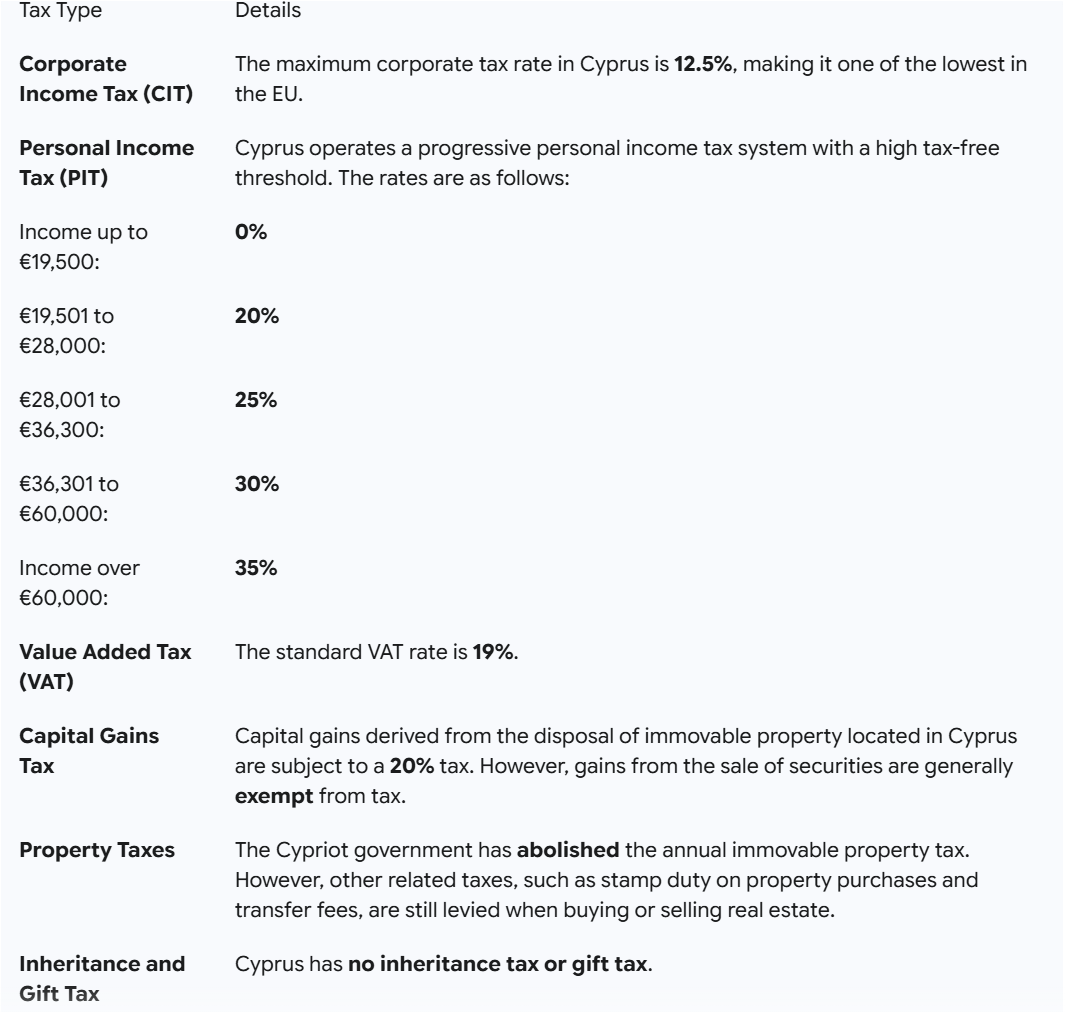

Overview of the Cypriot Tax System:

Cyprus maintains a tax regime that is highly competitive across the European Union for both residents and non-residents. Key taxes levied in the country include:

Official Links:

Cyprus Civil Registry and Migration department:http://www.moi.gov.cy/moi/crmd/crmd.nsf/home_en/home_en?openform

Cyprus Digital Nomad Visa: https://www.mip.gov.cy/dmmip/md.nsf/All/BF9908B541BFF7D3C22587EA003CD306?OpenDocument

Useful Links:

Cyprus – Culture Smart!: The Essential Guide to Customs & Culture: https://amzn.to/48q8URf

The Cyprus Problem: What Everyone Needs to Know: https://amzn.to/4q5s0T9

Europe eSIM 15 Days 10GB 5G/4G LTE Support Hotspot Sharing: https://amzn.to/477id6l

Cyprus flag tshirt: https://amzn.to/48UjAry