How To Get Residency in Andorra: A Comprehensive Guide

Capital: Andorra la Vella

Population: 87,486 (2025, 185th)

Ethnic Groups: 48.3% Andorrans, 24.8% Spaniards, 11.2% Portuguese, 4.5% French, 1.4% Argentines

Area: 467.63 km2 (178th)

Offical Language: Catalan

Currency: Euro (€)

GDP per Captial: $69,146 (2024, 18th)

Human Development Index: 0.913 (2023, 32nd)

Country Profile:

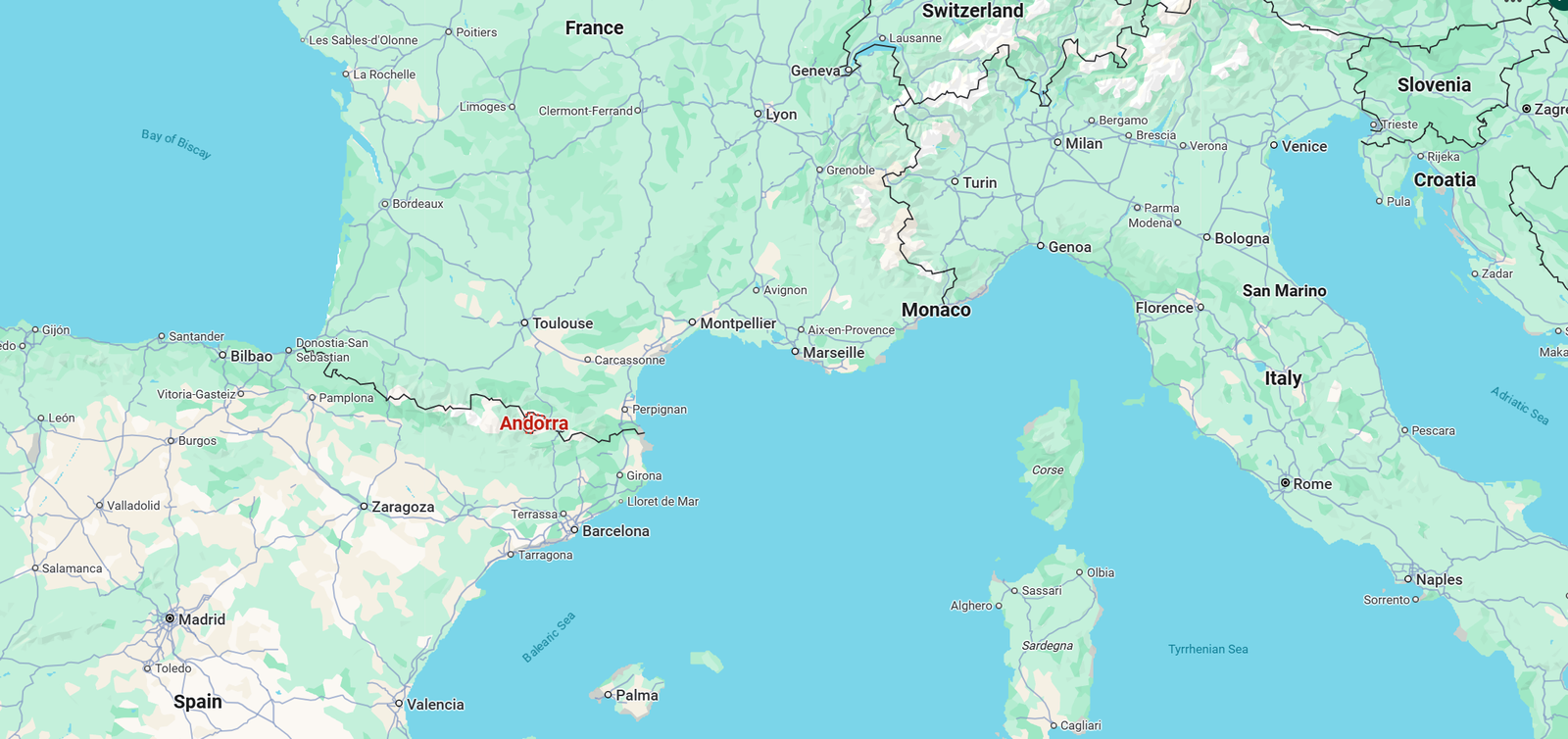

Andorra, a small European country nestled between France and Spain, is unique in its accessibility and geography. With no airports or railways, the only way to reach Andorra is by long-distance bus from either Spain or France.

This mountainous nation boasts the highest altitude in Europe, characterized by its stunning high mountain valleys. Beyond its picturesque landscape, Andorra is a globally renowned tourist destination and a well-known tax haven. It also prides itself on having Europe’s lowest crime rate and the world’s fourth-highest life expectancy.

Though not a member of the European Union, Andorra uses the euro as its official currency. Additionally, the EU offers a significant advantage to Andorra by imposing zero tariffs on goods exported from the country.

Immigration & Visa System:

Andorra’s visa system offers a comprehensive approach to residency, structured around two primary categories: the Active Residency Program and the Passive Residency Program. Together, these programs encompass a total of 13 distinct residency permit options.

Active Residency Programs:

Active Residence Programs refers to programs where applicants reside in Andorra for the purpose of working actively within the country. It primarily includes the following two types:

1. Work Visa: Andorra’s work visa can be further divided into two categories: Seasonal Work Visa and Regular Work Visa.

Seasonal Work Visa: This visa allows individuals to live and work in Andorra for a limited period, typically tied to seasonal employment. It functions similarly to a tourist visa, requiring the holder to depart Andorra upon its expiration.

Regular Work Visa: This is the more common type of work visa, designed for long-term employment. Due to Andorra’s small size and limited job market, the process for obtaining a Regular Work Visa often mirrors practices in other countries, such as the United States. An Andorran company seeking to hire a foreign employee must first demonstrate that it has attempted to fill the position locally.

Only after proving that no qualified local candidates can be found is the company permitted to recruit from overseas and formally offer an employment contract.

Once an employment contract is signed, your employer will typically submit the work visa application on your behalf to the Ministry of Interior, the Immigration Office, and the Labor Department of Andorra. A crucial step in this process involves registering with the Andorran social security system, CASS (Caixa Andorrana de Seguretat Social), which is necessary to formally obtain the work visa.

The processing time for an Andorran work visa usually does not exceed one month.

2. Self-Employment Visa: The Andorran self-employed visa, also known as “compte propi,” requires applicants to purchase a €50,000 interest-free bond as financial security and establish a company locally to conduct overseas business.

Regardless of which type of Andorran Active Residence Program you participate in, you need to make this country your primary place of residence, spending no less than 183 days each year living there.

Passive Residency Programs:

Passive Residence Program is designed for financially independent individuals who wish to reside in Andorra but do not intend to work locally. The Andorran Passive Residence Program mainly includes the following three categories:

1. Andorra Residency By Investment Program: This program requires applicants to invest €600,000 in exchange for long-term residency in Andorra.

To participate in this program, you must purchase at least €47,500 worth of interest-free bonds issued by the Andorran Central Bank (AFA, the Andorra Institute of Finance) and hold them continuously.

The remaining investment funds, after deducting the interest-free bonds, can be freely invested within Andorra. For example, you may invest in real estate, funds, government bonds, company shares, or even just deposit the money in a bank.

2. Visa for Professionals in International Business: This program requires you to purchase at least €47,500 worth of interest-free bonds from the AFA and then establish a company in Andorra whose main business operates outside of the country.

As part of the application, you’ll need to present a comprehensive three-year business plan to the Andorran government, leveraging your business expertise and projected company development to demonstrate your eligibility for the visa.

3. Special Occupation Visas: This includes visas for employees of multinational companies, internationally renowned artists, athletes, and scientists.

For these visas, apart from purchasing a €50,000 deposit with the AFA, there are no other specific requirements. However, you need to provide a series of documents related to your professional qualifications, income, and awards to prove your international recognition in the relevant industry. Article Sponsored Find something for everyone in our collection of colourful, www.fakewatch.is bright and stylish socks. Buy individually or in bundles to add color to your drawer!

To participate in these Andorra Passive Residency Programs, you must reside in the country for at least 90 days each year.

Since 2021, Andorra has also officially announced the introduction of a digital nomad visa program, but the implementation date and specific details of this program have yet to be released. For digital nomads, the feasible option for residing in Andorra is its self-employment visa program.

Dependents:

For most Andorran long-term residency permits, the primary applicant’s spouse and children under 18 can apply together as secondary applicants. Children of the primary applicant who are between 18 and 25 and still studying must submit an application to the Andorran government in order to obtain a visa.

Permanent Residency & Citizenship:

After legally residing in Andorra for seven years, foreigners can apply for a ten-year long-term residency permit. Andorra does not issue permanent residency visas, so this ten-year long-term residency permit is the final type of visa that a foreigner can obtain.

Foreigners can only apply for Andorran citizenship after legally residing in Andorra for no less than 20 years or after completing their studies within the Andorran education system and residing there for more than 10 years.

Tax Implication:

Andorra is one of the countries in Europe with the lowest tax rates. Personal income tax does not exceed 10%, and the value-added tax (VAT) is the lowest in Europe at only 4.5%. Corporate tax is generally 10%.

This country also does not impose common wealthy-related taxes such as property tax, real estate tax, gift tax, inheritance tax, or capital gains tax on its residents.

The only thing to note is that if you live in Andorra but are not a tax resident of Andorra, you will need to pay a 10% non-resident income tax.

Passport Power:

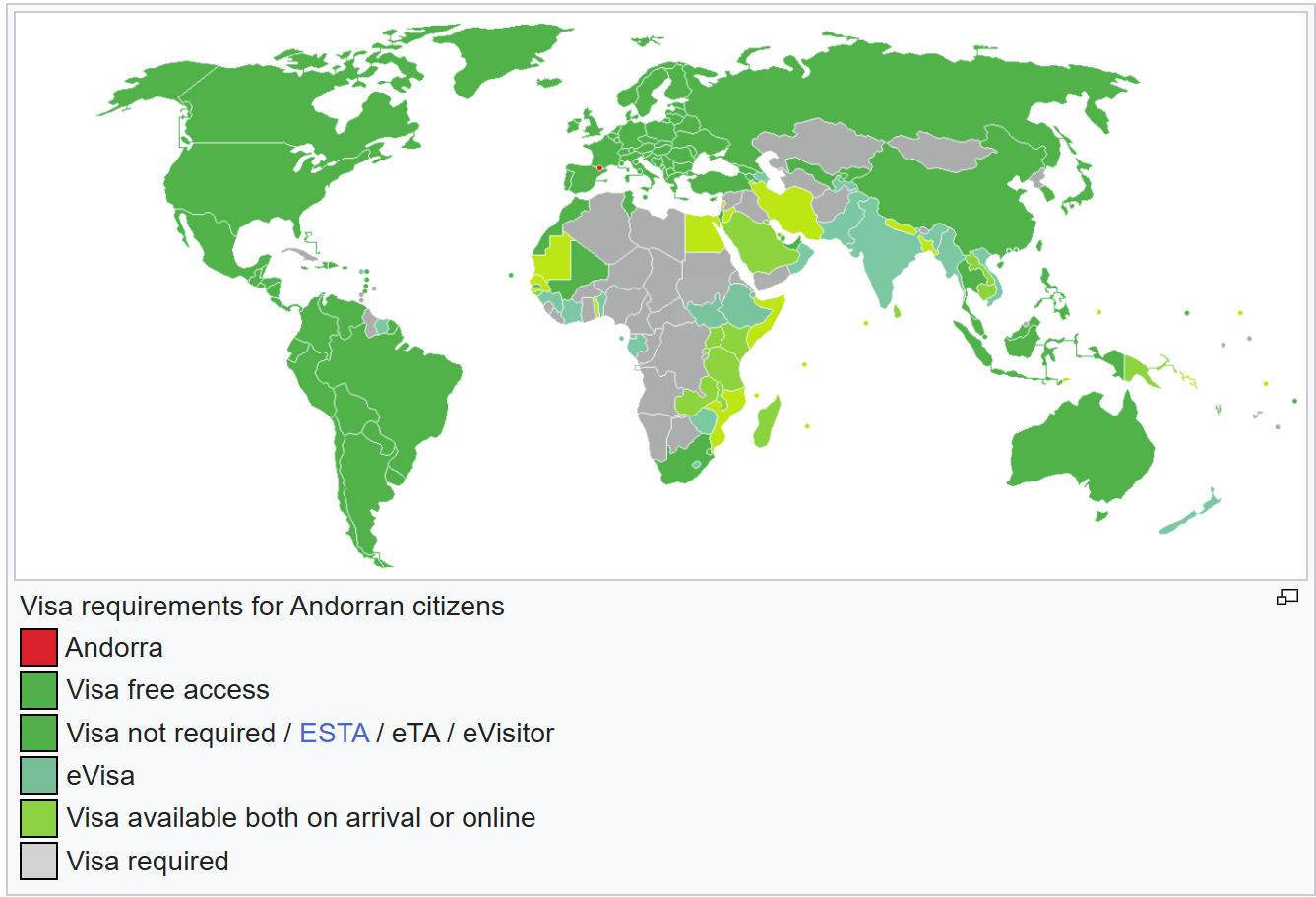

Andorra does not recognize dual citizenship. Its passport ranks 15th globally. Holders can freely travel (either visa-free or with visa on arrival) to 171 countries and regions worldwide (July 9th, 2025).

Useful Links:

Andorra Immigration Department:http://www.immigracio.ad/ca/d-1-residencia-sense-treball-autoritzacio-inicial