Home > North America > Barbados > How To Get Residency in Barbados | An Incomplete Guide

How To Get Residency in Barbados | An Incomplete Guide

Capital: Bridgetown

Population: 281,998 (2023,174th)

Ethic Group: 92.4% Black, 3.1% Multiracial, 2.7% White, 1.3% Indian

Area: 439 km2 (183rd)

Offical Language: English

Currency: Barbadian dollar(as of May 15, 2025, 1 Barbadian dollar = 0.49 USD)

GDP per Captial: $18,738 (2023, 90th)

Human Development Index: 0.809 (62nd)

Country Profile:

Barbados is situated at the crossroads of the Caribbean Sea and the North Atlantic Ocean. It gained independence from the United Kingdom in 1966, yet it remains a proud member of the Commonwealth.

Historically, sugarcane cultivation and the sugar industry were cornerstones of Barbados’s economy. Today, however, the nation’s primary sources of revenue have shifted to tourism and financial services.

Barbadian culture is richly influenced by African, British, and West Indian heritage. Music, dance, and vibrant festivals play a central role in the country’s cultural life, reflecting its diverse and dynamic identity.

Visa & Immigration System:

As a small island nation with a population of less than 300,000, there are generally limited options for long-term residence in Barbados. Apart from work visas and family reunification visas, there are only two notable pathways for long-term residency in Barbados.:

1. Special Entry and Residence Permit (SERP): A Multi-faceted Program

The SERP visa caters to four distinct categories: individuals of significant interest to Barbados, parents and grandparents of Barbadian citizens over 60 years of age, high-net-worth individuals, and financially independent retirees.

Initially conceived as a haven for financially independent retirees, the SERP program gradually relaxed its age restrictions. However, only applicants aged 60 and above are eligible to directly apply for permanent residency in Barbados. If the applicant is under 60 years old, they can only apply for a SERP visa with a validity period of five to ten years.

Investors seeking SERP status in Barbados can pursue two primary routes:

Real Estate Investment: Invest USD 300,000 in local real estate. This path grants a five-year residency visa, precluding employment in Barbados.

High-Net-Worth Investor: Demonstrate a net worth exceeding USD 5 million and invest USD 2 million. Upon meeting the age requirement, individuals may qualify for direct permanent residency in Barbados, granting almost all citizen rights, including employment opportunities.

Complementing the SERP program, Barbados offers a digital nomad visa option, the “Work Stamp“. This visa caters to remote workers and freelancers, granting a short-term residency permit to those earning an annual income of at least USD 50,000.

Barbados Digital Nomad Visa is a one-year non-immigrant visa that cannot be converted into permanent residency or citizenship. However, visa holders can infinitely renew the Work Stamp under the same conditions.

Dependents:

Both the Barbados SERP and Work Stamp visas allow the main applicant’s spouse, minor children (under 18 years old), and any financially dependent children over 18 to reside in Barbados as dependents.

Citizenship:

Foreign nationals who have legally resided in Barbados for five years are eligible to apply for permanent residency.

Foreign nationals who have legally resided in Barbados for seven years, with at least five years of physical presence within the preceding seven years and continuous residency in the 12 months immediately preceding the application, and who are proficient in English, are eligible to apply for naturalization.

Taxation:

Barbados features a relatively low and tiered corporate tax system, with dividends between companies exempt from tax and no capital gains tax. Personal income tax is structured with two brackets and includes a tax-free allowance. The tax framework is designed to encourage business development while ensuring revenue for social security and sales tax.

Some of the main taxes in Barbados include:

Tiered Personal Income Tax: Residents pay 12.5% on the first BBD 50,000 of taxable income; income exceeding BBD 50,000 is taxed at 28.5%.

Tiered Corporate Income Tax: 5.5% on the first BBD 1 million of corporate income, 3% on income between BBD 1 million and BBD 20 million, 2.5% on income between BBD 20 million and BBD 30 million, 1% on income exceeding BBD 30 million.

Sales Tax (VAT): The rate is 17.5%.

Social Security Contributions: The total contribution rate is 23.85%, with employers contributing 12.75%.

Passport Utility:

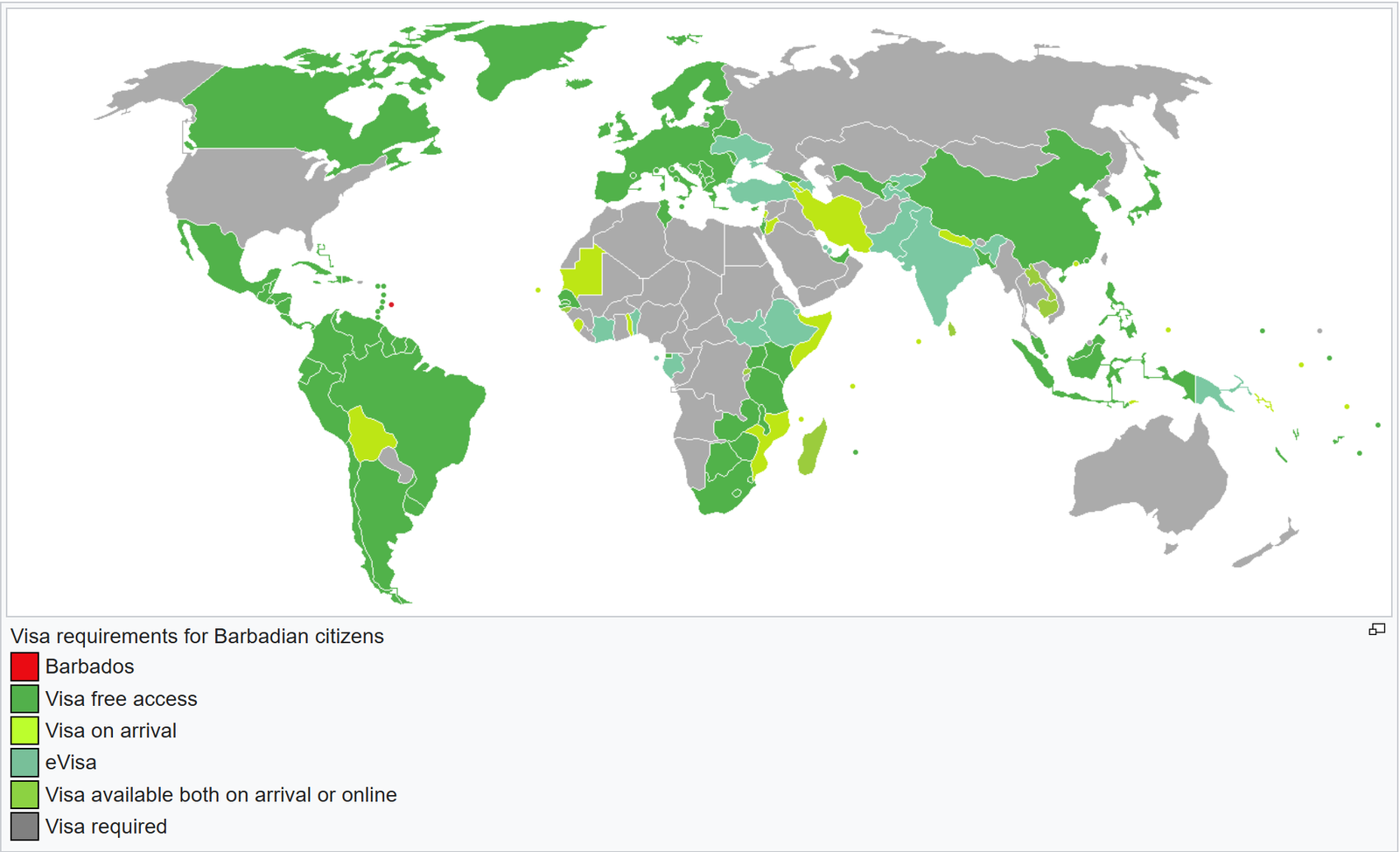

Barbados recognizes dual citizenship. Its passport ranks 21st globally and holds the top position in the Caribbean region. Passport holders enjoy freedom to travel (either visa-free or with visa on arrival) to 165 countries and regions worldwide. (May 15, 2024)

Useful Links:

Barbados Immigration Office:https://immigration.gov.bb/

Barbados Welcome Stamp:https://www.visitbarbados.org/barbados-welcome-stamp

Home > North America > Barbados > How To Get Residency in Barbados | An Incomplete Guide