Home > North America > Bermuda > How To Get Resdency In Bermuda | A Complete Guide

How To Get Residency in Bermuda | A Complete Guide

Capital: Hamilton

Population: 63,913 (2019, 205th)

Ethic Group: 52% Black, 31% White, 9% Multiracial, 4% Asian

Area: 53.2 km2

Offical Language: English

Currency: Bermudian dollar (equal to the US Dollar, not used as an international currency)

GDP per Captial: US$117,097 (2019, 4th)

Human Development Index: 0.981 (2013)

Region Profile:

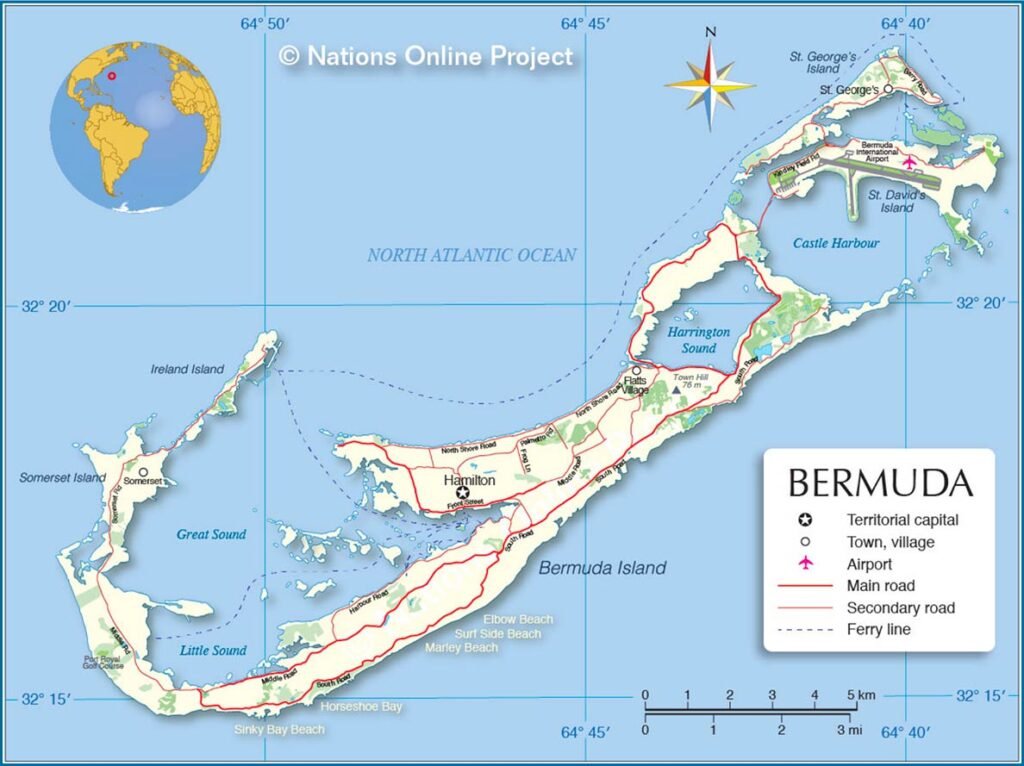

Bermuda is one of the British Overseas Territories in the Caribbean, consisting of about 138 small islands, with seven main islands connected by bridges. The archipelago is a popular tourist destination, attracting visitors from around the world with its beautiful pink sand beaches, clear waters, and unique coral reefs.

Bermuda is only 1,035 nautical miles from Miami, Florida, on the east coast of the United States. Economically, it is supported by the financial and tourism industries and is a world-renowned offshore financial center.

Visa And Immigration System:

Bermuda is a world-renowned tax haven and offshore financial center. It offers global investors easy-to-apply global entrepreneur work visas, business visas, and residency by investment programs.

One of the most popular programs is the Economic Investment Residential Certificate (EIRC): this program grants foreign investors who invest 2.5 million Bermuda Dollars direct permanent residency in Bermuda.

From 2021 to May 2024, the EIRC program and its predecessor, the EIC program, brought in $464 million in overseas funds to the small Bermuda archipelago.

The most common EIRC option is to establish the headquarters of a company with the required assets in Bermuda. This allows the actual controller of the company to obtain residency status in Bermuda and enjoy various tax exemptions in this tax haven.

In addition to investment immigration, Bermuda also launched a digital nomad visa program called the Work from Bermuda Certificate on July 18, 2020. This program allows remote workers and online students with certain financial means to reside in Bermuda.

Unfortunately, in April 2025, the Bermuda government issued an announcement officially terminating the digital nomad visa program. It became the second digital nomad visa program in the world to be officially revoked, following the Cayman Islands.

Currently, for those wishing to reside in Bermuda without making an investment, the only option is to apply for the country’s short-term residence permit, known as the Permission to Reside on an Annual Basis.

This residence permit is valid for up to five years and requires applicants to be at least 18 years old, in good health, have a clean criminal record, and demonstrate a certain level of financial means.

The entire application process for this short-term residence permit can be completed online. However, the biggest uncertainty surrounding this program is the exact financial threshold applicants must meet.

We may gain some insight by looking at the financial requirements for Bermuda’s work visa: the government mandates that work visa applicants have a local sponsor and provide deposit guarantees that vary depending on the size of the applicant’s household — at least $60,000 for a two-person household, $100,000 for a three-person household, and $125,000 for a four-person household.

Dependents:

For all Bermuda immigration visas, the primary applicant’s spouse, children under 18, and children aged 18 to 25 who are still studying can jointly obtain the visa as secondary applicants.

BOTC:

Foreigners who have legally resided in Bermuda for more than five years, with a total absence of no more than 450 days during that period, and who have continuously lived in Bermuda for the 12 months prior to submitting their application, are eligible to apply for a British Overseas Territories Citizenship (BOTC) passport.

After meeting relevant residency, nationality test, and social integration requirements, BOTC citizens can register to become British citizens.

Taxation:

Bermuda is one of the world’s most renowned tax havens: there is no income tax, asset tax, inheritance tax, or most other types of taxes. The only tax that tax residents need to pay is a comprehensive payroll tax at a rate of 6% of personal annual income.

Useful Links:

Bermuda EIRC Program:https://www.gov.bm/economic-investment-certificate-and-residential-certificate

Bermuda EIRC Government PDF:https://www.gov.bm/sites/default/files/210219-Economic-Investment-and-New-Residential-Certificate-Policy-Minister-v16-published_1.pdf

Work From Bermuda Certificate:https://forms.gov.bm/WFB

Home > North America > Bermuda > How To Get Resdency In Bermuda | A Complete Guide