Home > North America > Honduras > How To Get Residency in Honduras | A Complete Guide

How To Get Residency in Honduras | A Complete Guide

Capital: Tegucigalpa

Population: 9,571,352 (2023 95th)

Ethnic Group: Mestzo(90%), Indian(7%), Black(2%), White(1%)

Area: 112,492 km2 (101st)

Offical Language: Spanish

Currency: Lempira (as of June 20th, 2025, 1 Honduras Lempira = 0.038 USD)

GDP per Captial: $7,162 (2023, 134th)

Human Development Index: 0.624 (2021, 138th)

Country Profile:

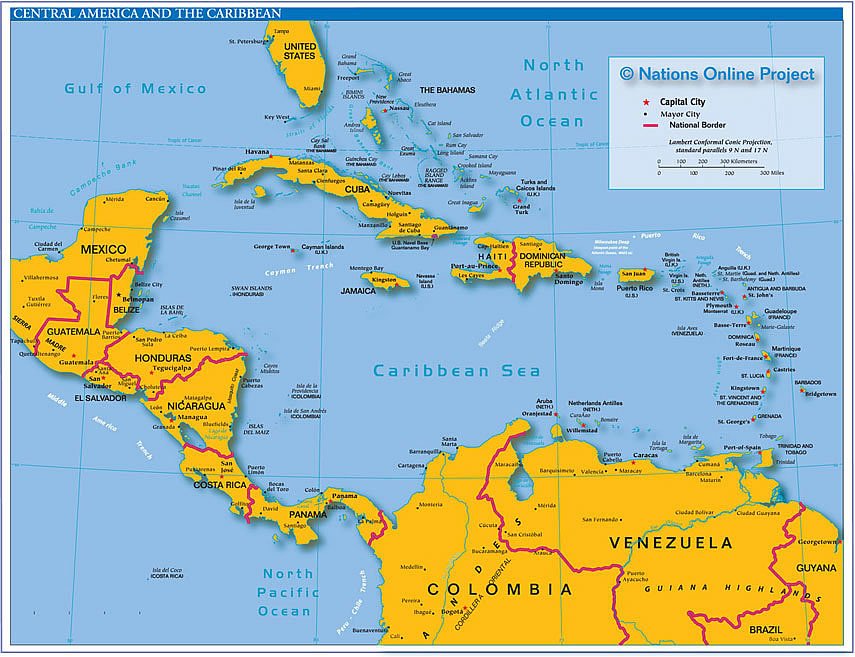

Honduras is located in the central part of Central America, bordered by the Caribbean Sea to the north and the Pacific Ocean to the south. It’s the second-largest country by land area in Central America but is also one of the poorest in the region, with its economy primarily based on agriculture.

Politically, Honduras is a democratic republic, though it has a history of political instability, including military coups and political violence. Socially, Honduras faces high rates of poverty and crime, a situation that is particularly severe in urban areas.

Visa & Immigration System:

The Honduran government offers five types of immigration visas to foreign applicants: Investor Visa, Pensioner Visa(Retirement Visa), Rentista Visa (Non-Profit Visa), Work Visa, and Family Visa (Marriage, family bond, de facto union).

1. Investor Visa:

This visa is for foreign investors who deposit $50,000 USD in Honduras or invest $50,000 USD in a business sector.

In addition to the investment, applicants must also deposit between $5,000 and $8,000 USD in the Central Bank of Honduras to prove they can support themselves and their families locally.

2. Pensioner Visa:

This visa is issued to individuals with sufficient pension or retirement income who can guarantee a monthly transfer of $1,500 USD into Honduras.

As one of the Central American regions with the lowest cost of living, Honduras attracts a large number of North American retirees.

3. Rentista Visa:

This visa is for foreign individuals with sufficient income from non-Honduran sources who can guarantee a monthly transfer of $2,500 USD into a local account.

This income can be non-salary earnings like rental income, dividends, or investment returns, or even income from self-employment or remote work. The local government only requires that you guarantee a monthly transfer of $2,500 USD in foreign funds.

Another advantage of the Honduras Rentista Visa is that its holders can apply for a local work permit, effectively allowing them to work freely in Honduras.

4. Work Visa:

Honduras Work Visa includes two types: Employer-Sponsored Visas and Entrepreneur Visas.

- Employer-Sponsored Visas are issued to foreign employees who are hired and sponsored by a local company.

- Entrepreneur Visas are for foreign individuals who operate a business in Honduras, create jobs, and provide tax revenue.

5. Family Visa:

This visa is issued to the spouse, de facto partner, children, parents, and other direct relatives of Honduran citizens or permanent residents.

Dependents:

For all types of Honduran immigration visas, the main applicant’s spouse and financially dependent children can obtain visas as dependent applicants.

Permanent Residency & Citizenship:

After legally residing in Honduras for five years, foreign nationals can apply for permanent residency.

Foreign nationals are eligible to apply for naturalization after legally residing in Honduras for three years (Central American citizens only need 1 year, and Latin American citizens only need 2 years).

Honduras doesn’t have a minimum residency duration requirement for passport applications. Therefore, even if an applicant doesn’t reside in the country for a full six months each year, they may still be eligible to apply for naturalization. However, you’ll always need to demonstrate a deep connection to the country.

Taxation:

Honduras operates on a territorial tax system, meaning that residents and companies are generally only taxed on income earned within Honduras. Foreign-sourced income is typically exempt.

Personal income tax rates are progressive, ranging from 0% for lower incomes up to 25% for higher earners. Corporate income tax is generally 25%, with an additional 5% solidarity tax on net taxable income exceeding HNL 1 million for companies.

Capital gains are usually taxed at a flat rate of 10%. Honduras also imposes a sales tax (VAT) of 15% on most goods and services, with an 18% rate for certain items like alcoholic beverages.

It’s important to note that Honduras does not have a comprehensive network of double-taxation treaties, which could lead to certain income being taxed in both Honduras and your home country. While there are generally no wealth, gift, or inheritance taxes, navigating the Honduran tax system often requires assistance from a local registered lawyer due to its complexities and specific requirements for filing and compliance.

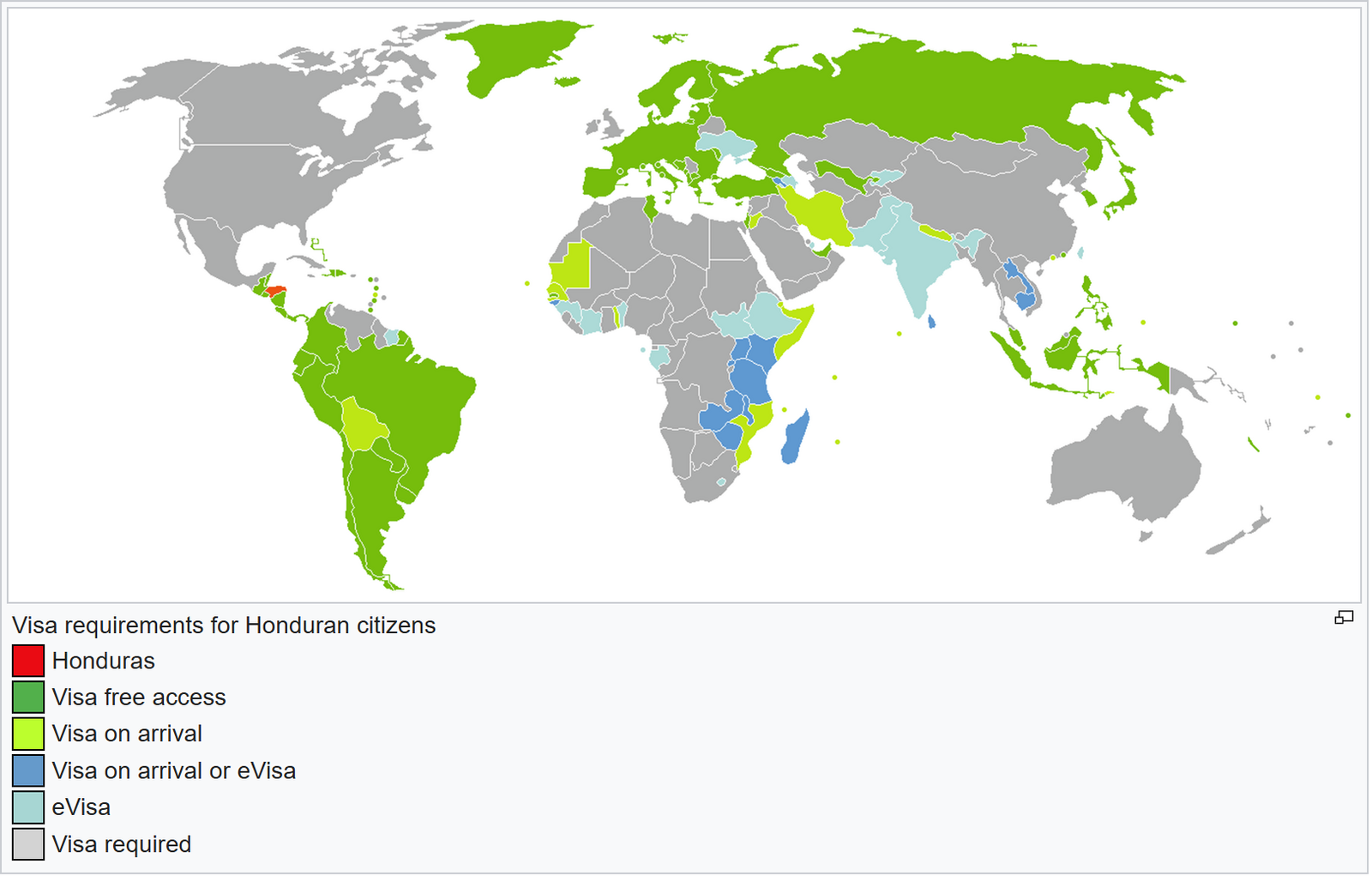

Passport Power:

Except in special circumstances, Honduras does not recognize dual citizenship. The Honduran passport is ranked 38th in the world, tied with others. Passport holders can travel freely (either visa-free or with a visa upon arrival) to 132 countries and regions worldwide (as of June 20th, 2025).

Home > North America > Honduras > How To Get Residency in Honduras | A Complete Guide