Home > North America > Montserrat > How To Get Residency in Montserrat | A Complete Guide

How To Get Residency in Montserrat | A Complete Guide

Capital: Plymouth

Population: 4390(194th)

Area: 102 km2(116th)

Offical Language: English

Currency: East Caribbean dollar( pegged to the United States dollar, at the exchange rate of US$1 = EC$2.70)

GDP per Captial: US$12,384

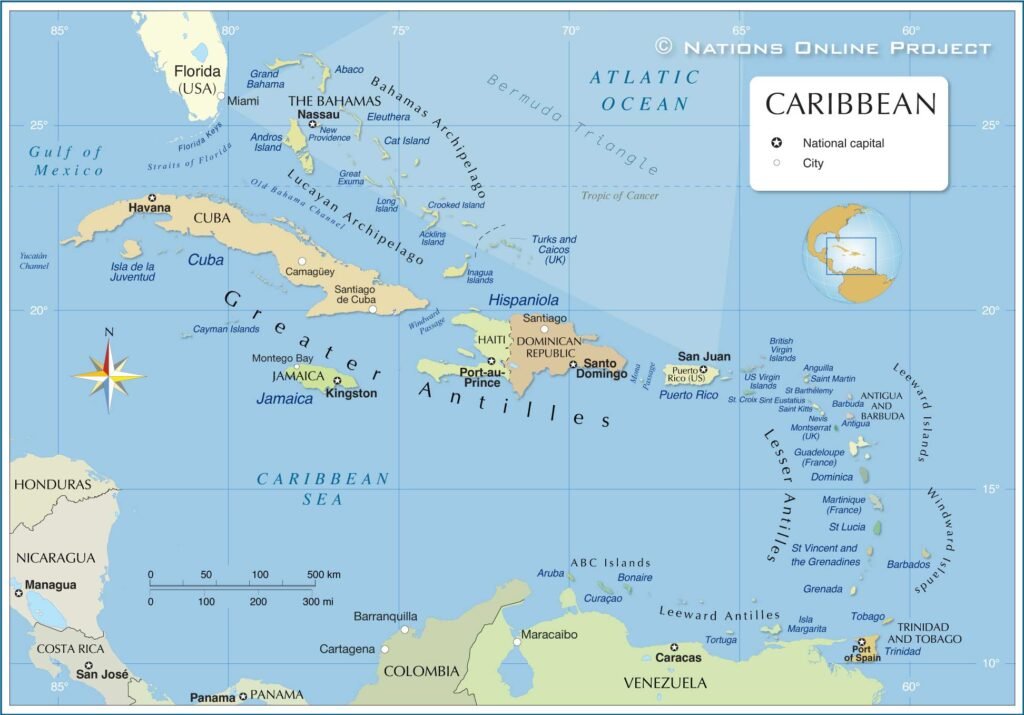

(This map is sourced from Nations Online Project)

Region Profile:

Montserrat is a British Overseas Territory located in the West Indies, Caribbean Sea. The island was once known for its sea island cotton, bananas, sugar, and vegetables. However, starting July 18, 1995, the Soufrière Hills volcano began a series of eruptions that destroyed areas like Plymouth, the island’s capital, and led to two-thirds of the population being evacuated or migrating abroad.

Today, fewer than 5,000 long-term residents remain in Montserrat.

Fortunately, the volcanic eruptions also created a unique and magnificent landscape on this 102-square-kilometer island. Every year, a large number of international tourists travel specifically to Montserrat to admire its distinct scenery. Tourism has now become a pillar industry of Montserrat.

How to get residency In Montserrat:

In 2015, the Montserrat government attempted to launch a citizenship by investment program, requiring a $625,000 USD investment for direct acquisition of a British Overseas Territories passport. The aim was to issue 275 passports to pre-booked investors from Dubai and China.

However, this citizenship by investment initiative was ultimately rejected by the British government.

Currently, foreigners seeking long-term residence in Montserrat have only three avenues:

1. Short-Term Residence Card: This card is issued to foreign property owners on the island. The application process is remarkably straightforward: once you’ve purchased a property in Montserrat, you can submit an online application from within the territory, and the relevant government departments will approve your residence card within 24 hours.

2. Permit of Economic Residence: This visa is granted to foreign investors who invest 400,000 East Caribbean Dollars (approximately $148,000 USD) locally. Applicants can choose from three investment options: bank deposits, real estate purchases, or government bond acquisitions. The Montserrat Economic Residence permit functions as a de facto permanent residency visa; holders are not required to physically reside in Montserrat and can continuously maintain their economic resident status simply by sustaining their investment.

3. Digital Nomad Visa (Montserrat Remote Worker Stamp): This visa is issued to global remote workers with an annual income of at least $70,000 USD. While the Montserrat Digital Nomad Visa is a non-immigrant visa with an initial validity of only one year, it can be renewed indefinitely under the original conditions, thereby allowing for effective long-term residency.

Depenents:

For most Montserrat residence permits, the main applicant’s spouse and children under 18 can also obtain residence as dependents and settle in Montserrat.

Permanent Residency & Citizenship:

According to new regulations effective January 1, 2023, foreigners who have legally resided in Montserrat for eight years become eligible to apply for local permanent residency. To qualify, their monthly income in the six months prior to application must exceed $5,000 USD, or they must own local property valued at over $50,000 USD.

Once a Montserrat permanent resident has lived locally for one year, they can apply for a British Overseas Territories Citizen (BOTC) passport. After a specific process, BOTC holders can then directly apply for a British passport.

Taxation:

Montserrat operates a comprehensive tax system overseen by the Montserrat Customs & Revenue Service. Key taxes include Income Tax, applied progressively from 5% to 40% on earnings above an annual threshold of XCD 15,000 (approx. $5,556 USD).

Company Tax is also levied on corporate profits. Property Tax is an annual charge based on the market value of land (0.05%) and buildings (0.025% for residential). Additionally, Withholding Tax applies to certain payments to non-residents, and Customs Duties are collected on imported goods.

Montserrat aims to balance revenue generation with an attractive environment for residents and businesses. While there is a tax on income earned globally for residents, Montserrat does not tax offshore corporations.

Useful Links:

Montserrat Permit of Economic Residency Guide:https://www.gov.ms/wp-content/uploads/2020/08/Economic-Residence-Guidance-Notes-002.pdf

Montserrat Remote Worker Stamp: https://www.montserratremoteworker.com/

Montserrat Visa Online Platform:https://www.immigration.ms/residents/before_apply

Montserrat Permanent Residence Guide:https://www.gov.ms/wp-content/uploads/2020/08/Permanent-Residence-Leaflet-002.pdf

Home > North America > Montserrat > How To Get Residency in Montserrat | A Complete Guide