Home > Africa > Seychelles > How To Get Residency in Seychelles: A Comprehensive Guide

How To Get Residency in Seychelles: A Comprehensive Guide

Capital: Victoria

Population: 121,355(2024, 200th)

Ethic Groups: mostly Seychellois Creoles

Area: 457 km2 (181th)

Offical Language: English, French and Seychellois Creole

Currency: Seychellois rupee (As of June 16th, 2025, 1 SCR = 0.071 USD)

GDP per Captial (PPP): $41,828 (2023, 49th)

Human Development Index:0.848 (54th)

Country Profile:

Seychelles is an archipelago nation located in the Indian Ocean, off the coast of East Africa. It’s composed of 115 small islands and has a population of fewer than 130,000 people.

The residents of Seychelles are primarily descendants of immigrants from Africa, India, Europe, and China, contributing to a diverse multicultural and multi-ethnic background.

Since the 21st century began, Seychelles has consistently maintained Africa’s highest GDP per capita and the second-highest Human Development Index (surpassed only by Mauritius).

Visa & Immigration System:

Seychelles, a stunning island nation in the Indian Ocean with a population just over 100,000, has historically maintained a very closed-door policy regarding immigration and residence permits.

For foreigners to even be considered for a long-term residence card here, they must meet all four of these stringent conditions:

- Financial Solvency & Legal Status: You must not be an illegal immigrant and need to prove you have ample financial resources to support yourself. This means having a bank deposit of at least 2 million Seychellois Rupees (roughly $141,100 USD). You also have to agree that the Immigration Department can use these funds if essential for medical care or other vital assistance for you or your dependents.

- Ties to Seychelles: You’ll need to demonstrate a connection, either through relatives in Seychelles or by showing you’ve made, or will make, a sustained contribution to the local economy, culture, or community.

- No Social Benefits: It’s crucial to understand that holding this residence card does not grant access to free healthcare or other social security benefits in Seychelles.

- Annual Residency: To keep your long-term residence visa valid, you’re required to reside in Seychelles for a minimum of five days each year.

Even with a long-term residence card, it’s exceptionally difficult for foreigners to gain permanent residency without making significant contributions. And becoming a citizen is almost impossible unless you marry a local.

This rigid stance began to soften in 2021 with the introduction of the “Encouraging Economic Activities Act” (the Reserved Economic Activities Policy). This act created a limited opportunity for Residency by Investment. Now, foreigners who invest over $1 million USD in Seychelles and meet specific residency requirements can apply for permanent residency or even citizenship. The residency criteria are over one year for permanent residency and 11 years for citizenship.

However, this investment program does come with notable government fees, ranging from $10,400 USD to $24,500 USD, making it a considerable financial commitment.

Beyond traditional immigration paths, Seychelles also offers the Workcation Retreat Program, a digital nomad visa. This program is appealing because it has no specific income requirements; if you’re a remote worker, you’re generally eligible to apply. The key limitation is its validity: it’s good for one year and can only be renewed for an additional six months. This means your stay in Seychelles under this visa is capped at a maximum of one and a half years.

Tax Implication:

In Seychelles, digital nomads don’t have to pay taxes.

Seychelles generally has a simple and relaxed tax system, operating on a territorial basis. The main types of taxes include corporate income tax, Value Added Tax (VAT), business tax, trades tax, excise tax, and social security contributions.

-

Corporate Income Tax: The standard rate is 33%, but for foreign companies, it’s typically 15%. Offshore companies registered in Seychelles can even enjoy a 0% corporate income tax rate, benefiting from significant tax incentives. Business tax is also considered corporate income tax, with a 25% rate on income below 1 million SCR and 33% on income exceeding that threshold.

-

Value Added Tax (VAT): Implemented in 2013 with a rate of 15%, VAT is a primary source of tax revenue for Seychelles, accounting for about 38% of total tax income. Some goods and services are exempt or zero-rated, and the tourism and export sectors can benefit from relief policies.

-

Excise Tax: This tax is primarily levied on specific goods like cigarettes, alcohol, vehicles, and petroleum products. Since 2015, the excise tax on alcoholic beverages over 16% ABV increased by 20%, and on tobacco products by 50%.

-

Trades Tax: This is calculated based on the CIF (Cost, Insurance, and Freight) value of imported goods. For export-oriented businesses, the rate is 15%, and they may apply for a 5-15% reduction in trades tax.

-

Personal Income Tax: Seychelles uses a progressive tax rate, with a standard rate of 15%. Foreign employees benefit from a lower 5% tax rate. Non-monetary benefits are paid by the employer at a rate of 20%.

-

Social Responsibility Tax: Companies with a turnover of 100 SCR or more are subject to a 0.5% tax on their monthly turnover. Small businesses pay a fixed rate of 1.5% of their monthly turnover.

-

Property Tax: Introduced in 2018, this tax applies to foreign-owned residential and office properties, as well as properties with lease terms exceeding 25 years. The rate is 0.25% of the total property value.

-

Tourism Marketing Tax: Since 2013, tourism-related companies have been subject to a 0.5% tax rate, which was extended to include construction companies and clubs in 2016.

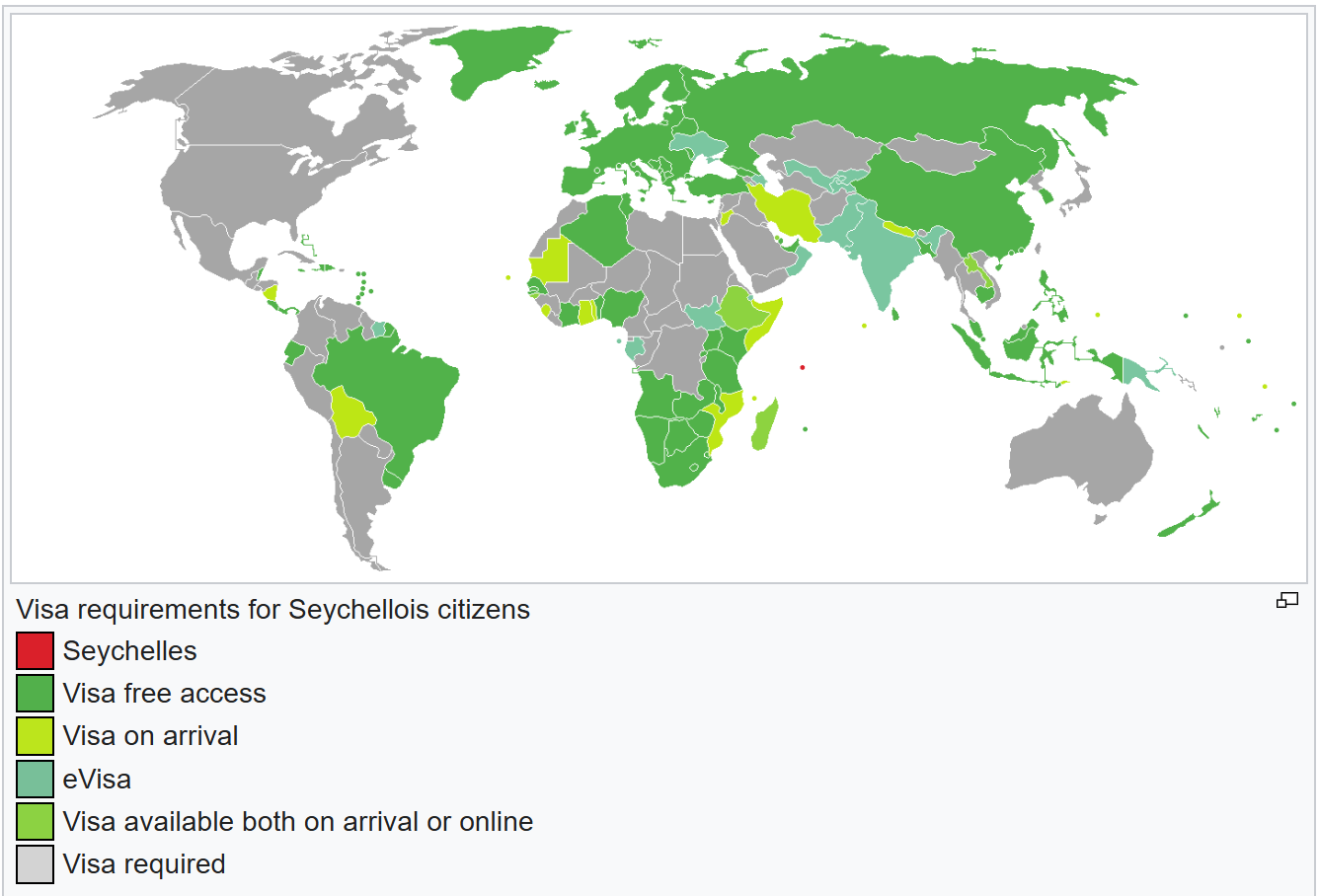

Passport Power:

Seychelles recognizes dual citizenship. Its passport ranks 22nd globally, allowing its holders visa-free or visa-on-arrival access to 156 countries and regions around the world. (As of June 16th, 2025)

As of April 2019, Brunei, Grenada, Mauritius and Seychelles are the only countries whose citizens may travel without a visa to China, Russia, Schengen Area and the United Kingdom.

Useful Links:

Seychelles Electronic Border System:https://seychelles.govtas.com/

Immigration and Civil Status Seychelles:http://www.ics.gov.sc/permits/residence-permit

Home > Africa > Seychelles > How To Get Residency in Seychelles: A Comprehensive Guide