Home > North America > The Bahamas > A Comprehensive Guide To Long-term Residency In The Bahamas

A Comprehensive Guide to Long-term Residency in The Bahamas

Capital: Nassau

Population: 412,628 (2023)

Ethic Group: 90.6% Black, 4.7% White, 2.1% mixed

Area: 13,943 km2 (155th)

Offical Language: English

Currency: Bahamian dollar (BSD) & USD

GDP per Captial: $46,524 (2024 estimated, 43rd)

Human Development Index: 0.820 (57th)

Country Profile:

The Bahamas is a Commonwealth country situated in the Caribbean Sea on the western side of the Atlantic Ocean. It comprises over 700 islands, with only 24 being inhabited.

The country is just 80 kilometers from the state of Florida in the United States, making it the closest country to the U.S. in the Caribbean region.

The Bahamian economy is predominantly driven by tourism, which contributes approximately 60% of the nation’s gross domestic product. Other significant economic sectors include financial services, fishing, and manufacturing.

Bahamas Immigration System:

Residence permits:

In tradition, the Bahamas is not an immigration country. It only offers some annual residence permit options to local relatives or overseas individuals with economic ties. Currently, the main annual residence permits in the Bahamas are as follows:

1. Annual Residency Card: This permit is issued to foreign nationals who want to frequently visit the Bahamas but do not intend to work locally. For example, if you are a relative of a Bahamian citizen or legal resident, or an economically independent individual who does not need to work locally, you can apply for this visa.

Regarding the option for financially independent individuals, the Bahamian government has not specified a specific financial requirement; the assessment criteria vary from person to person.

The annual residency card is generally valid for one year and can be renewed indefinitely. You can apply for this visa directly through the Bahamian Department of Immigration, and each application requires a $200 visa fee.

2. Homeowner’s ID Card (Real Estate Owner Visa): This visa is issued to individuals who own property in the Bahamas.

Similar to the short-term residency permit, the Bahamian homeowner’s ID card is renewed annually, as long as you maintain ownership of property in the Bahamas. The visa renewal fee is $200.

However, like short-term residency permit holders, homeowners with this visa are also not allowed to work locally.

Economic Permanent Residence:

During pandemic, the Bahamian government introduced several long-term residence permit programs aimed at attracting new immigrants. Among these, the most well-known is the Economic Permanent Residence program.

This program grants permanent residency rights to foreign individuals who invest over $500,000 in local economy.

Economic Permanent Residence holders can maintain their visa for life, provided they meet two key conditions:

1. PR holders must maintain their investment for at least 10 years.

2. PR holders must spend at least 90 days per year residing in the Bahamas.

Digital Nomad Visa:

The Bahamian government has been offering a digital nomad visa program called “BEATS” (Bahamas Extended Access Travel Stay) since October 2020. This program is available to remote workers who can demonstrate stable income and students engaged in fully online courses.

Currently, the BEATS visa does not specify a minimum income requirement, so any remote worker can apply. However, it is a non-immigrant visa with a validity of one year, which can be renewed twice, allowing a maximum stay of three years in the Bahamas.

After three years, visa holders must leave the Bahamas.

Dependents:

Most Bahamian residence permits allow the spouse of the main applicant and financially dependent children to obtain residency as dependents.

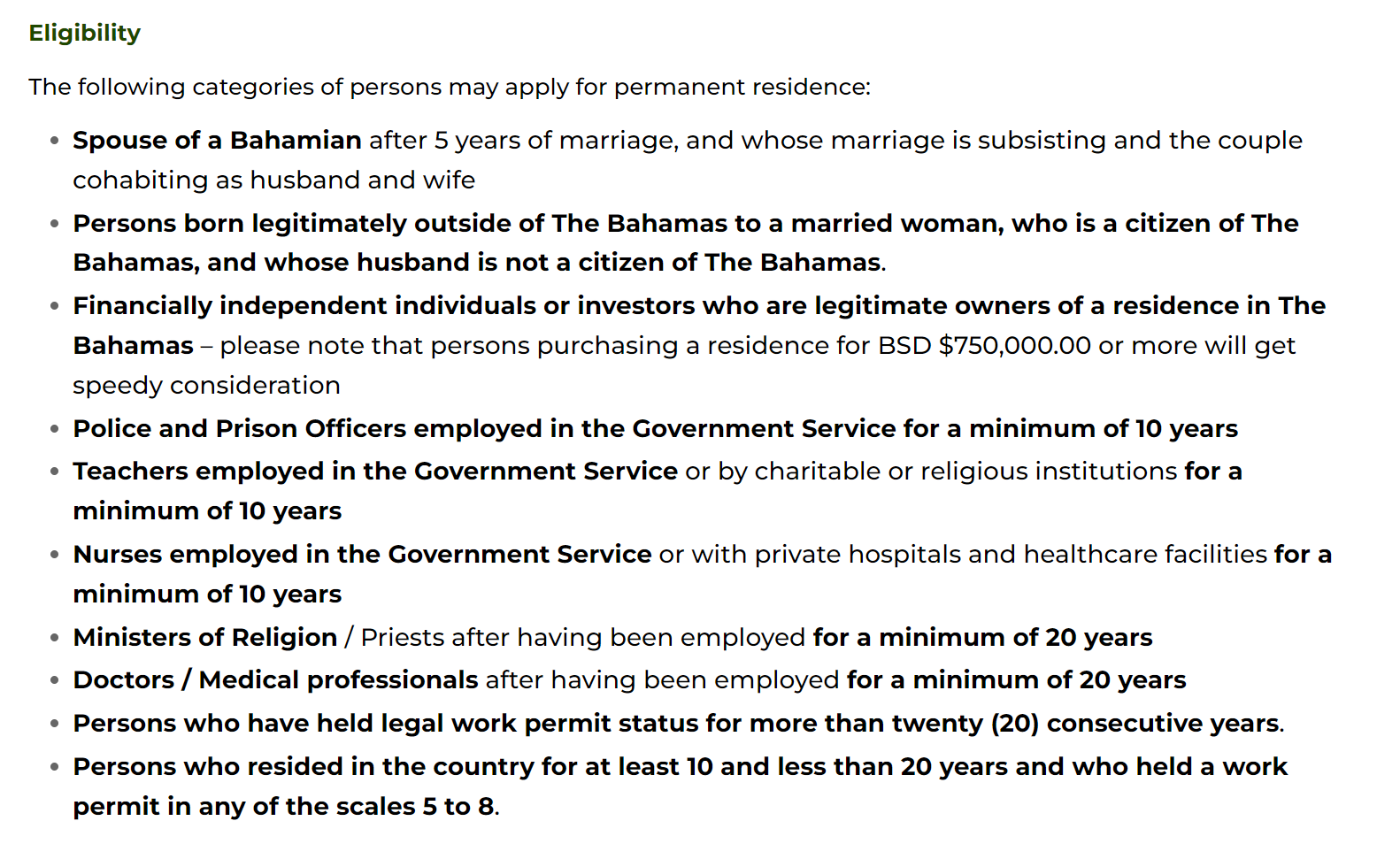

Permanent Residency:

Currently, apart from family immigration and investment channels, it is almost impossible for foreigners to obtain permanent residency in the Bahamas:

Special professions such as teachers and nurses need to work in the Bahamas for 10 years to apply for permanent residency; other professionals need to work in the Bahamas for more than 20 years to be eligible to apply for permanent residency.

Citizenship:

Foreign nationals in the Bahamas can apply for naturalization only after holding permanent residency locally for 10 years. They must also meet the requirement of residing in the Bahamas for at least 6 months each year and fulfill conditions such as renouncing their original nationality.

Taxation:

The Bahamas is renowned as one of the tax havens in the Caribbean region. The local government does not impose income tax, capital gains tax, inheritance tax, or gift tax on residents. Instead, their main sources of revenue include value-added tax (VAT), stamp duty, import taxes, and various licensing fees.

As a Bahamian tax resident, you’ll encounter the following key taxes:

1. Value-Added Tax (VAT): The Bahamas has two VAT rates—either 0% or 10%.

2. Stamp Duty: Ranging from 2.5% to 10%.

3. Property Tax: For properties valued below $500,000, the tax rate is 1%. For properties valued above $500,000, it’s 2%, with a maximum limit of $60,000.

Passport Utility:

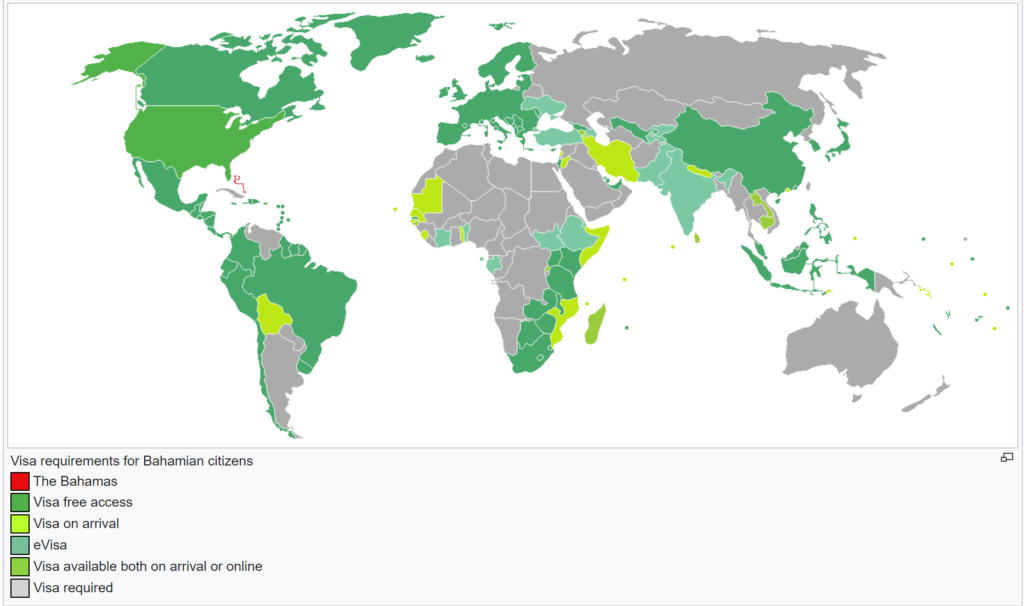

The Bahamas does not recognize dual citizenship. Its passport ranks 27th globally. Passport holders can freely travel (visa-free or obtain a visa upon arrival) to 156 countries and regions around the world, including North America, Europe, China, Japan, South Korea, and Southeast Asia (July 17th, 2024).

Useful Links:

Bahamas Immigration:https://www.immigration.gov.bs/

Bahamas BEATS:https://www.bahamasbeats.com/

Home > North America > The Bahamas > A Comprehensive Guide To Long-term Residency In The Bahamas