Home >> North America >> How To Get Residency In Turks and Caicos | A Complete Guide

How To Get Residency in Turks And Caicos | A Complete Guide

Capital: Grand Turk (Cockburn Town)

Population: 49,309 (2023, 215th)

Ethnic groups: 88% Afro-Caribbean, 8% Euro-Caribbean, 4% Mixed or Indo-Caribbeans

Area: 948 km2

Offical Language: English

Currency: USD

GDP per Captial: USD20,908.58 (2021)

Region Profile:

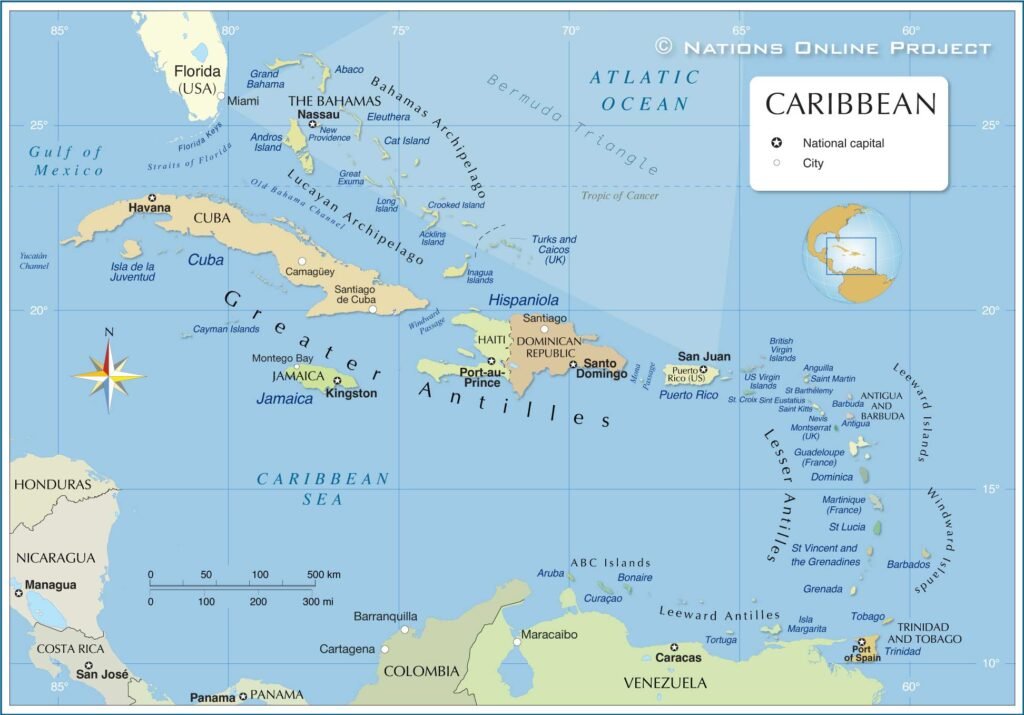

The Turks and Caicos Islands are British Overseas Territories located southeast of the Bahamas in Central America, consisting of over 30 islands, of which 8 are inhabited year-round.

The main industries in the Turks and Caicos Islands are tourism and offshore finance, with most tourists coming from the United State and Canada. Canada has a significant influence on it, and in recent years, there have even been calls within the islands for joining Canada as its eleventh province.

Visa and Immigration System:

Investment immigration is the most direct way for foreigners to obtain status in the Turks and Caicos Islands.

The simplest method is to directly spend $500,000 USD, to purchase property in Providenciales or West Caicos, or spend $250,000 USD to buy property in other developing areas of the Turks and Caicos Islands, in exchange for a one-year residence permit.

As long as the buyer maintains his/her investment, this investment residence permit can be renewed unlimited times annually, allowing long-term residence locally.

Foreigners who have legally resided in the Turks and Caicos Islands for ten years and have reached a basic level of English proficiency can apply for permanent residence locally;

After obtaining permanent residence, in the second year, if you meet other residence duration conditions, you are eligible to apply for the British Overseas Territories Citizen (BOTC) passport.

Another way to move to the Turks and Caicos Islands is through its permanent residency by investment program.

Permanent Residency By Investment:

Program Profile:

Every year, Turks and Caicos government opens 200 permanent residency slots for overseas investors who invest locally through one of the following three options:

1. Invest at least $750,000 in companies or business entities on the five islands of Grand Turk, Salt Cay, South Caicos, Middle Caicos, or North Caicos, or invest $1,500,000 in companies operating on other islands;

2.Invest $1,000,000 in government-supported public utility projects locally;

3.Invest $300,000 in building new homes or renovating old homes on the five islands of Grand Turk, Salt Cay, South Caicos, Middle Caicos, or North Caicos, or invest $1,000,000 USD in real estate on other islands.

Application Process:

The application process for the Turks and Caicos Islands permanent residency by investment program can be divided into the following three steps:

1. Complete Investment: First, you need to choose your investment route and complete the investment locally.

After completing the investment and preparing all required documents, you must download and fill out an application form to submit to the local Invest Turks and Caicos Agency, and pay a one-time application fee of $1,500 USD plus a $25,000 USD PRC (Permanent Residency Certificate) review fee.

Required documents for this program include:

Personal information documents: including all main and secondary applicants’ passports, passport-sized photos, birth certificates, marriage certificates, and other documents proving relationships between main and secondary applicants.

Personal resume: the main applicant must provide a resume covering educational background and work experience.

Proof of completed investment: you need to provide evidence of completed investment, including bank statements.

Police clearance certificate: all adult applicants must provide a police clearance certificate issued within the last six months from their place of residence.

Medical examination certificate.

All documents from outside the Turks and Caicos Islands must be notarized; all non-English documents must be translated into English.

2.Submit Application to the Ministry of Border Control and Employment: Once the Invest Turks and Caicos Agency confirms your investment is complete, you must submit the application form, all required documents, and payment proof to the Ministry of Border Control and Employment for background checks.

3. Approval and Fingerprinting:The entire review process for the permanent residency by investment program can take up to three months. Once your application is approved, you can go to the Invest Turks and Caicos Agency to provide your biometric information and receive your permanent residency card.

Depentdents:

In the Turks and Caicos permanent residency by investment program, the main applicant’s spouse and children under 18 years old can apply together as dependents to obtain permanent residency cards.

BOTC:

Turks and Caicos permanent residents who have continuously resided there for five years, and whose total absence from the islands does not exceed 450 days within those five years, and who have resided locally for the 12 months immediately prior to the application, are eligible to apply for the British Overseas Territories Citizen (BOTC) passport.

Taxation:

Turks and Caicos is effectively a tax haven with zero direct taxes on income, capital gains, inheritance, and corporate profits. Instead, the government relies on indirect taxes such as customs duties, accommodation taxes, and business-related fees. This tax structure makes the islands attractive for individuals and businesses seeking a low-tax jurisdiction, especially in tourism, real estate, and financial services sectors

Primary taxes are as follows:

1. Customs Import Duties: Most imported goods incur a 30% tariff plus a 5% Customs Processing Fee, with exceptions such as food (0%) and building materials (10% plus CPF).

2. Business License Fees: All businesses require a license with fees ranging from $150 to $7,500 depending on the nature of the business.

3. Financial Services Tax: A 12% tax applies on commissions and service fees related to transferring money abroad.

4. Retention Tax: A 35% retention tax applies to interest payments made by a paying agent in Turks and Caicos to beneficial owners resident in an EU Member State, with part of the tax revenue shared with the EU state.

5. Accommodation Tax: A 12% tax on hotel stays and short-term rentals, which is a significant revenue source,

6. Stamp Duty on Land Transfers: Ranges from 0-10% depending on sale value, with exemptions for transfers to close family members.

7. Restaurant Tax, Insurance Premium Sales Tax, Fuel Tax, Communications and Telecom Taxes also contribute to government revenue.

Useful Links:

Visit Turks And Caicos:https://www.visittci.com/

The Turks And Caicos Islands Permanent Residence Permit Page:https://www.gov.tc/bordercontrol/services

The Turks And Caicos Islands Residence Permit Page:https://www.gov.tc/bordercontrol/component/content/article/9-products-and-services/3-residence-permit

Home >> North America >> How To Get Residency In Turks and Caicos | A Complete Guide