Home > North America > Antigua And Barbuda >How To Get Residency in Antigua and Barbuda: A Comprehensive Guide

How To Get Residency in Antigua and Barbuda: A Comprehensive Guide

Capital: St. John’s

Population: 100,772 (2022, 182nd)

Ethnic Group: 87.27% African (Black), 4.73% Multiracial, 1.65% European (White)

Area: 440 km2 (182nd)

Offical Language: English

Currency: East Caribbean dollar( pegged to the United States dollar, at the exchange rate of US$1 = EC$2.70)

GDP per Captial: $25,449 (2023, 59th)

Human Development Index: 0.851 (53rd)

Country Profile:

Antigua and Barbuda is a twin-island nation located in the Caribbean, comprising two main islands, Antigua and Barbuda, along with some smaller islands.

Tourism is the backbone of Antigua’s economy, and the country is renowned for its beautiful beaches, clear waters, and abundant water activities. Notable attractions include Paradise Bay, Nelson’s Dockyard, and the Pink Sand Beach in Barbuda.

Antigua and Barbuda were once colonies of Spain and the United Kingdom. Today, it is a member of the Commonwealth and the Caribbean Community (CARICOM). Culturally, the country is a melting pot of African, European, and Caribbean traditions.

Immigration & Visa System:

Citizenshi By Investment Program:

Saint Kitts and Nevis, Antigua and Barbuda, Dominica, Grenada, and Saint Lucia are five Caribbean countries that offer citizenship by investment programs, commonly known as passport programs.

Among these, the Antigua Citizenship by Investment program provides three avenues for obtaining citizenship through investment for overseas applicants: donations, real estate purchases, and business operations.

If you choose donation option, you can contribute to one of two public funds in Antigua: National Development Fund (NDF) or University of the West Indies Fund (UWI). The minimum cost required is $240,000.

For real estate option, you need to purchase property in Antigua valued at a minimum of $300,000.

For the business investment option, you need to make an individual investment of $1.5 million, or a joint investment where each participant contributes $400,000 to a business project worth at least $5 million.

For a family of three or four applicants, Antigua is the most affordable option among the five Caribbean countries offering citizenship by investment programs.

Tax Residency Program:

Beyond its well-known CBI programs, the Antiguan government also provides two primary immigration pathways that do not require a major financial investment:

1. Tax Residency Program: This program offers permanent residency to foreign nationals who have an annual income of at least $100,000 USD and agree to pay a flat yearly tax of $20,000 USD to the Antiguan government.

Antigua is widely recognized as a tax haven because it does not levy taxes on residents’ income, property, or inheritances. However, to qualify for this program, you must do more than just meet the financial criteria. You are required to live in Antigua for at least 30 days each year and, crucially, you cannot spend more than 183 days in any other country during a single year. This is to ensure you don’t become a tax resident elsewhere.

2. Residence Permit: This permit is typically granted to foreign nationals who are either employed in Antigua or are financially independent individuals who have already been living there for a minimum of two years.

Antiguan residence permits are generally valid for a period of three years and can be renewed.

Digital Nomad Program:

For those interested in a shorter stay, Antigua offers a digital nomad visa designed for remote workers. To be eligible, applicants must have an annual income of at least $50,000 USD.

Known as the Nomad Digital Residence (NDR) visa, this program grants a stay of up to two years and is non-renewable. If you wish to remain in Antigua after your NDR visa expires, you would need to apply for either a standard residence permit or the permanent tax residency program.

Tax Implication:

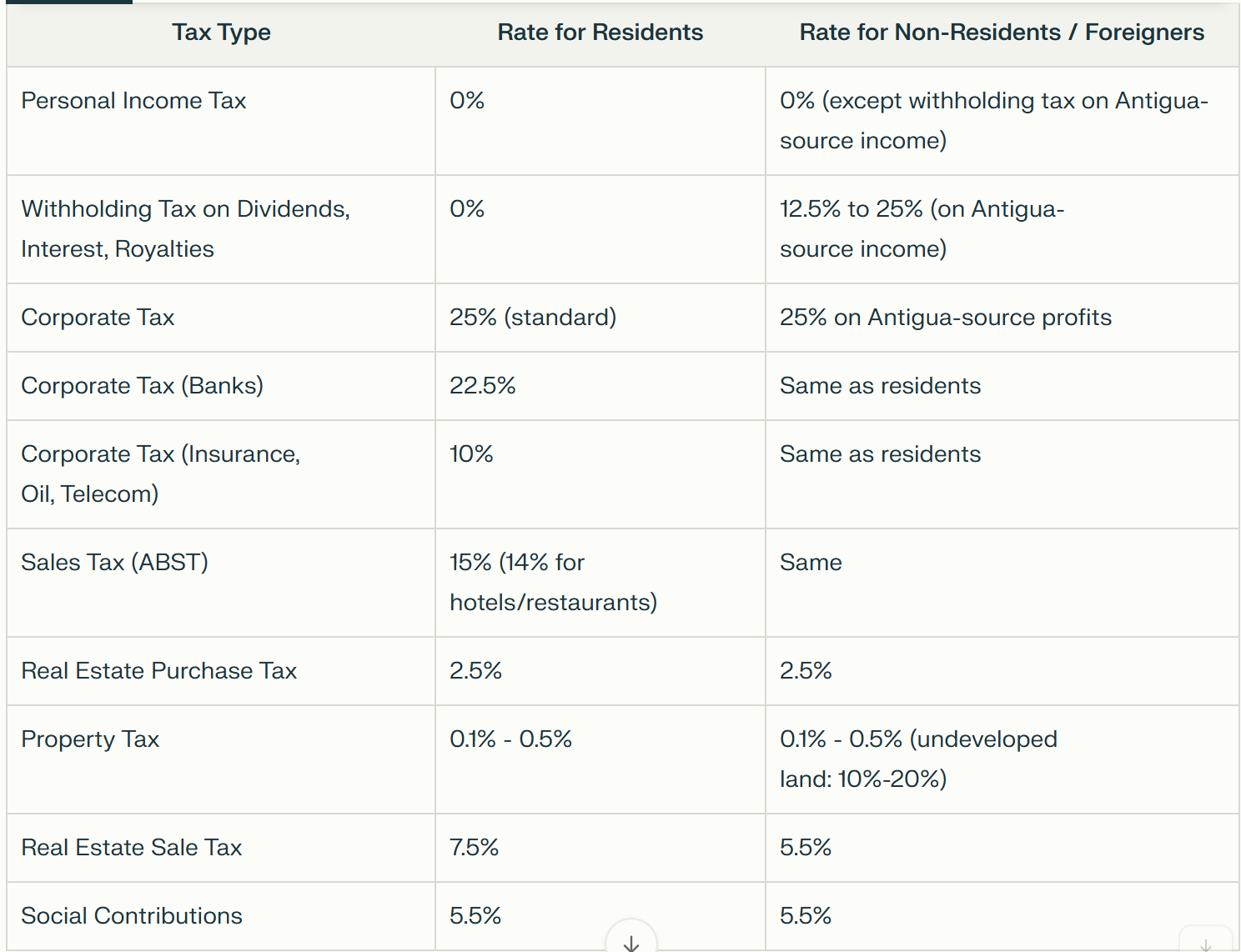

Antigua and Barbuda abolished personal income tax in 2016. Residents are not required to pay personal income tax on either local income or global income, including dividends, royalties, interest, inheritance, wealth, or capital gains.

Some of the main types of taxes in Antigua are shown in the following chart:

Passport Power:

Antigua and Barbuda recognizes dual citizenship, its passport ranked 25th globally. As of May 2025, citizens can travel freely (visa-free or on arrival visa) to 152 countries and regions worldwide. (July 1st, 2024)

Official links:

Antigua and Barbuda CBI program: https://cip.gov.ag

Antigua and Barbuda NDR visa: https://nomad.gov.ag/ui

Antigua and Barbuda Tax Residency Program: https://antiguabarbuda.com/dario-item-tax-residency-program/

Useful Links:

Antigua and Barbuda Travel Guide 2025: https://amzn.to/3KDiQx3

Antigua and the Antiguans: A Full Account of the Colony and Its Inhabitants from the Time of the Caribs to the Present Day: https://amzn.to/3KzMIKN

All About Antigua and Barbuda: Discover the history and heritage of this twin Island Nation, through some of its top sites and attractions: https://amzn.to/48mxLp3

Caribbean Islands eSIM: https://amzn.to/42ziWvL

World Seven Continents Antigua and Barbuda Coat of Arms National Emblem Stickers Different Sizes Sticker: https://amzn.to/4q74YLO

Home > North America > Antigua And Barbuda > How To Get Residency in Antigua and Barbuda: A Comprehensive Guide