Home > North America > How To Get Residency In Curaçao | An Incomplete Guide

How To Get Residency In Curaçao | An Incomplete Guide

Capital: Willemstad

Population: 155,826 (2023, 177th)

Ethic Group: 75.4% Afro-Curaçaoans/Mixed, 9% Dutch, 3.6% Dominican, 3% Colombian, 1.2% Haitian, 1.2% Surinamese, 1.1% Venezuelan, 1.1% Aruban

Area: 444 km2 (181st)

Offical Language: Papiamentu, Dutch and English

Currency: Netherlands Antillean Guilder (As of May 7th, 2025, 1AND = 0.55866 USD)

GDP per Captial: $35,484 (2021, 45th)

Human Development Index: 0.811

Regional Profile:

Curaçao, a Dutch territory, is an autonomous island situated in the southern Caribbean Sea, close to the coast of Venezuela. While the Netherlands fully manages Curaçao’s foreign affairs and defense, the island enjoys self-governance over its domestic matters.

The economy of Curaçao is primarily driven by tourism, offshore finance, oil refining, and maritime shipping. Tourism serves as the cornerstone of the economy, drawing numerous visitors eager to experience its stunning beaches, world-class diving sites, and vibrant cultural scene.

Culturally, Curaçao is a multilingual society. Dutch is the official language, but Papiamentu-a creole language that blends Portuguese, Spanish, Dutch, French, and Arawak-along with Spanish and English, are widely spoken throughout the island.

Immigration and Visa Systems:

Most well-known immigration program in Curaçao is its Capital Investment Immigration Program (CIIP), which many see as a convenient indirect route to immigrate to the Netherlands and obtain European Union citizenship.

CIIP is divided into three main categories based on the amount of investment. We will provide a detailed introduction to this program later.

In addition to the CIIP, since 2021, Curaçao has also offered a digital nomad visa program called the “Home in Curaçao Program” for remote workers.

This digital nomad visa aims to attract more overseas visitors to the island. The visa is valid for six months and can be renewed once for an additional six months. If you are interested in Curaçao’s digital nomad visa, you can visit www.athomeincuracao.com for detailed information or to apply directly

Curaçao Capital Investment Immigration Program:

Program Profile:

After the Netherlands abolished its residency by investment program on the mainland, the Curaçao Investor Permit Program (CIIP), launched in 2014, has become the world’s only immigration program through which investment can lead to Dutch nationality.

Currently, the CIIP offers overseas investors three investment options:

1. Invest 500,000 Netherlands Antillean Guilders (approximately USD 280,000) to obtain a three-year residence permit in Curaçao;

2. Invest 750,000 Netherlands Antillean Guilders (approximately USD 425,000) to obtain a five-year residence permit in Curaçao;

3. Invest 1,500,000 Netherlands Antillean Guilders (approximately USD 850,000) to apply directly for permanent residence in Curaçao.

Investors under the CIIP may select from three approved sectors:

1. Purchasing real estate in Curaçao;

2. Starting, acquiring, or holding shares in a Curaçao-based company;

3. Purchasing securities publicly issued on the Dutch Caribbean Securities Exchange (DCSX).

Besides meeting the financial investment requirements, applicants must also satisfy basic conditions such as having a clean criminal record, sufficient financial means to support their family while living in Curaçao, and obtaining health insurance coverage valid locally.

Application Process:

Application process for the Curaçao Investor Permit Program mainly consists of the following steps:

1. Completing investment: At this stage, you need to decide on your investment plan and amount, then complete the investment either in Curaçao or remotely.

2. Submitting application: After completing the investment and preparing all required documents, you can submit your visa application.

Required documents for this program include:

Applicant identity documents: valid passports (main and dependent applicants) and color copies, passport-sized photos; birth certificates, marriage certificates, and other documents proving the relationship between main and dependent applicants;

Proof of completed investment: you need to provide documents proving the investment has been made, including bank statements;

Proof of financial means: you must demonstrate that after the investment, you still have sufficient income or assets to support your family living in Curaçao;

Police clearance certificates: all adult main and dependent applicants must provide a police clearance certificate issued within the last six months;

Proof of health insurance: you need to purchase valid health insurance in Curaçao for each main and dependent applicant annually.

3. Visa issuance: After an approximately two-week processing period, once the investment visa is approved, you are free to move to and live in Curaçao.

Dependents:

Spouse and children under 18 years old of the main applicant can obtain the visa together as dependents under the Curaçao Investor Program.”

Visa Validity:

Under the Curaçao CIIP program, whether holding a three-year, five-year, or permanent residence visa, visa holders must spend at least one day per year physically present in Curaçao to maintain their visa.

As long as you visit the island once a year, you can continue to renew your investment visa under the original conditions.

According to Dutch nationality law, foreigners who have legally and continuously resided in Curaçao for five years (with a legal local address, spending at least four months per year in Curaçao, and at least nine months per year in the Netherlands) and who pass the Dutch civic integration test, including a language exam, become eligible to apply for Dutch citizenship.

It is important to note that the Netherlands does not recognize dual citizenship. Therefore, investors who naturalize as Dutch citizens through Curaçao’s CIIP must renounce their original nationality upon obtaining Dutch citizenship.

Tax Implication:

Curaçao operates a distinct tax system that blends standard tax principles with strategic incentives designed to attract both international businesses and high-net-worth individuals, though the regime is continually being updated to align with global transparency standards.

Here is an overview of the tax implications in Curaçao:

Corporate Income Tax (Profit Tax):

Curaçao’s corporate tax system is based on a Territorial Principle, meaning that generally, only domestic-source income is subject to local profit tax.

Standard Rates: The standard Profit Tax is progressive:

- 15% on the first ANG 500,000 (Curaçao Guilder) of taxable profit.

- 22% on taxable profit exceeding ANG 500,000.

Foreign-Source Income: Profits derived from business activities conducted outside Curaçao are typically treated as foreign-source income and are generally not subject to the standard Profit Tax, provided the activities meet substance requirements.

Special Incentives & Exemptions:

- Curaçao Investment Company (CIC): Certain investment companies may elect a 0% profit tax rate if they meet specific conditions, making them attractive for holding passive investments.

- E-Zone Regime: Preferential tax treatment, often including a reduced profit tax rate (historically 2% to 3%), is available for companies conducting international trade or services within designated economic zones, provided they meet substance requirements.

- Participation Exemption: Dividends and capital gains arising from a qualifying substantial shareholding in another company are generally 100% exempt from Profit Tax, subject to specific anti-abuse rules.

Personal Income Tax (PIT):

Curaçao residents are subject to income tax on their worldwide income. However, the system incorporates a notable incentive for qualifying high-net-worth individuals:

Standard Rates: The Personal Income Tax (PIT) system is progressive, with a maximum marginal rate currently reaching around 46.5%.

The Pensionado/Rentier Scheme: This special tax regime is available to qualifying foreign retirees or individuals (pensionados) who relocate to Curaçao. Under this scheme, the individual can choose a beneficial tax arrangement for their worldwide foreign income (excluding local business or employment income):

- Option 1: A flat rate of 10% on their worldwide income from foreign sources (e.g., pensions, interest, and dividends).

- Option 2: Taxation based on a fixed amount of foreign income (an imputed income), regardless of the actual amount, with the resulting tax liability paid at the standard progressive rates.

Lack of Capital Gains and Wealth Tax: Curaçao does not levy a general capital gains tax or a wealth tax on its residents.

Indirect Taxes and Levies:

Turnover Tax (ToT): A form of indirect tax, which functions similarly to VAT but is generally charged at a lower rate (typically 6% or 8% depending on the good or service) on the sales of goods and services by businesses.

Real Estate Tax: A tax is levied on the value of local immovable property.

Inheritance and Gift Tax: These taxes apply to the assets of a resident of Curaçao, with rates varying depending on the relationship to the deceased/donor.

Passport Utility:

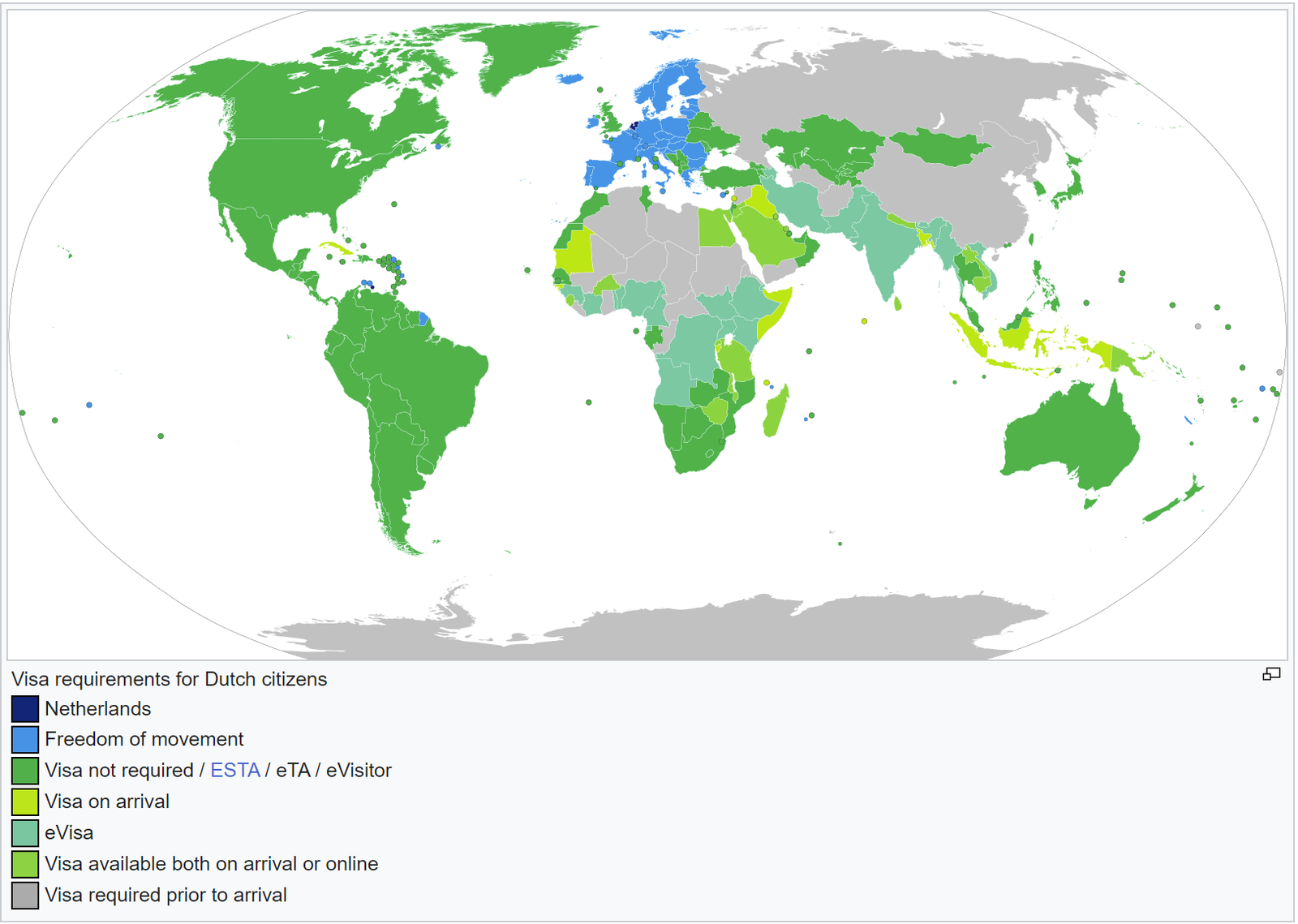

Apart from refugees, the Netherlands does not recognize dual citizenship. The Dutch passport ranks 4th in the world, and citizens can travel freely (either visa-free or with visa on arrival) to 188 countries and regions around the globe.

Official Links:

Home In Curaçao Program:https://athomeincuracao.com/remote-workers/application-remote-workers/

Government Of Curaçao:https://athomeincuracao.com/

Home > North America > How To Get Residency In Curaçao | An Incomplete Guide