How To Get Residency in Greece: A Comprehensive Guide

Capital: Athens

Population: 10,413,982 (2023, 89th)

Ethnic groups: Greek 91.6%, Albanian 4.4%

Area: 131,957 km2 (95th)

Offical Language: Greek

Currency: Euro

GDP per Captial: $41,188 (2024 estimated, 52nd)

Country Profile:

Greece is situated at the crossroads of Europe, Asia, and Africa. It is a member of both the European Union and the Schengen Area and is renowned globally for its rich cultural history, vibrant tourism sector, strategic shipping industry, and strategic location.

Currently, Greece ranks as the world’s 54th largest economy and the 11th largest in the Euro zone, classifying it among developed nations. The service and shipping sectors are vital components of its economy.

Visa & Immigration System:

Greece offers non-EU citizens a variety of pathways for long-term residency, which broadly fall under five categories, including routes like family reunification, refugee status, and standard work visas.

For those without an immediate professional, economic, or familial connection to the country, three primary relocation options are available:

1. The Golden Visa: As one of the world’s leading residency by investment programs, the Greece Golden Visa grants residency in exchange for an investment ranging from €250,000 to €800,000. Eligible investments include real estate, funds, bank deposits, government bonds, and equity in companies.

A key feature is the flexibility: it does not require actual residency in Greece and can cover the applicant, their children, and parents. The residency status is maintained as long as the investment is held.

2. The Financially Independent Person (FIP) Visa: This visa is designed for non-EU nationals with sufficient passive income or substantial savings. The current financial requirement is a monthly passive income of €3,500. FIP holders are permitted to live freely in Greece without an investment, but they cannot be employed locally.

3. The Digital Nomad Visa: This permit is aimed at remote workers who wish to live in Greece while working for companies or clients registered outside the country, thus not relying on the Greek labor market. The current minimum financial requirement is a monthly income of €3,500.

Applicants can include a spouse and immediate children, though the required income threshold will increase for each dependent.

Dependents:

For most Greek long-term residency visas, the main applicant’s spouse, children under 18, and children over 18 who are financially or mentally dependent can apply as dependents and reside in the country.

However, the Golden Visa offers a broader scope for family inclusion: with a single investment, the main applicant can bring their spouse, children, and both sets of parents (of the principal applicant and their spouse) to live in Greece.

Permanent Residency & Citizenship:

Foreigners can generally apply for long-term residency in Greece after legally residing in the country for five continuous years on a temporary residence permit like the Digital Nomad Residence Permit.

After seven years of legal residency in Greece, you can apply for Greek citizenship through naturalization, provided you meet other requirements, such as passing a Greek language and culture exam.

Tax Implication:

Greece offers several special tax regimes to attract foreign residents, entrepreneurs, and skilled professionals. These regimes provide significant tax advantages on income for a specific period.

The Greek Income Tax Code (ITC) includes three main special tax regimes (Articles 5A, 5B, and 5C) for individuals transferring their tax residence to Greece:

1. High Net-Worth Individuals (Article 5A) – Investor Non-Dom Regime:

Target Group: High net-worth individuals who invest in Greece.

Main Benefit: A flat annual tax of €100,000 on all foreign-sourced income, regardless of the amount.

Duration: Up to 15 tax years.

Key Conditions:

- Must not have been a Greek tax resident for 7 out of the last 8 years before the transfer.

- Must invest at least €500,000 in Greece (e.g., in real estate, companies, or securities) within three years of application.

- An additional flat annual tax of €20,000 can be paid for each relative (spouse, children) who also benefits from this regime.

- Foreign-sourced income is not reported in the Greek annual tax return.

- Exemption from inheritance and gift tax on foreign assets.

2. Foreign Pensioners

(Article 5B):

Target Group: Individuals who receive a foreign pension.

Main Benefit: A flat tax rate of 7% on their total foreign-sourced income.

Duration: Up to 15 tax years.

Key Conditions:

- Must not have been a Greek tax resident for 5 out of the last 6 years before the transfer.

- Must transfer their tax residence from a country that has a tax cooperation agreement with Greece.

- Greek-sourced income is taxed at the regular progressive rates.

3. Professionals and Employees (Article 5C) – Skilled Migrant Non-Dom Regime:

Target Group: Employees and self-employed individuals (freelancers) filling a new position or starting a new business activity in Greece.

Main Benefit: 50% exemption from income tax and the special solidarity contribution on their Greek-sourced employment or business income.

Duration: For 7 consecutive tax years.

Key Conditions:

- Must not have been a Greek tax resident for 5 out of the last 6 years before the transfer.

- Must transfer their tax residence from an EU/EEA country or a country with a tax cooperation agreement with Greece.

- Must be working under an employment contract with a Greek entity or a permanent establishment of a foreign company, or be an entrepreneur (sole proprietor) operating a new business activity in Greece.

- Must declare an intention to stay in Greece for at least two years.

- Exemption from certain annual imputed income calculations (based on residence or private vehicles) for the seven-year period.

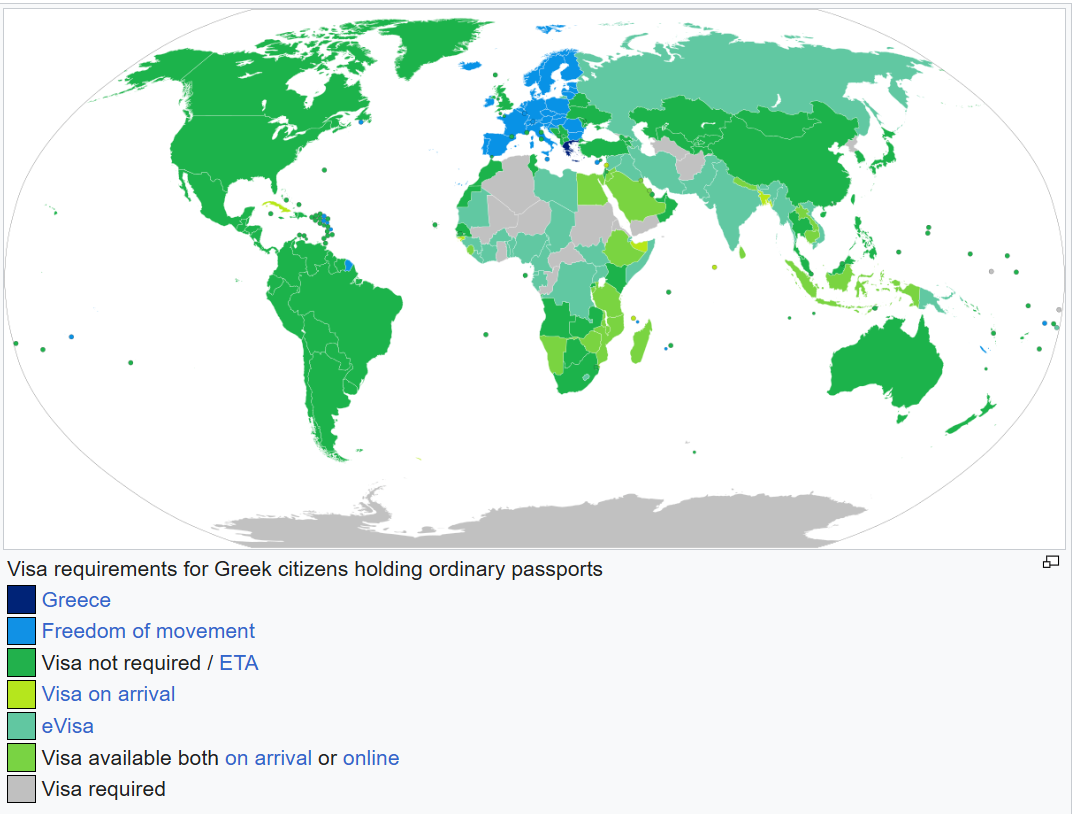

Passport Power:

Greece recognizes dual citizenship, and is a member of the European Union and belongs to the Schengen Area. Its passport is ranked 6th globally and allows free travel (visa-free or visa on arrival) to 186 countries and regions around the world (as of Oct 27th, 2025).

Official Links:

Greece ministry of foreign affairs:https://www.mfa.gr/en/visas/

Greece E-visa:https://evisa.gr/

Greece digit nomad visa official site:https://workfromgreece.gr/