How To Get Residency in Italy: A Comprehensive Guide

Capital: Rome

Population: 58,934,177 (2025, 25th)

Ethnic groups: 91.3% Italian

Area: 301,340 km2 (71st)

Offical Language: Italian

Currency: Euro

GDP per Captial (PPP): $63,076 (2025 estimated, 29th)

Human Development Index: 0.915 (29th)

Country Profile:

Italy, a European country with a rich history dating back to ancient Rome, is renowned for its influential art, architecture, and culinary traditions. Its landscape varies from the snowy Alps in the north to the sun-kissed Mediterranean beaches in the south.

Italy is home to more UNESCO World Heritage sites than any other country, showcasing its wealth of cultural treasures. Major cities like Rome, Florence, and Venice are steeped in history and art, while its cuisine, epitomized by pizza, pasta, and wine, plays a crucial role in its cultural identity.

Visa & Immigration System:

Italy’s long-term residency visas can be broadly categorized into two major types: In Quota Visas and Extra-Quota Visas.

In Quota Visas:

In Quota Visas, as the name suggests, are those for which the Italian government sets an annual limit (quota) on the number of people who can apply, along with specific application window periods. If you fail to submit your application during the window period or if the quota is reached, you will have to wait for the next year’s window and quota, even if you meet all the visa requirements.

This category includes:

-

Ordinary work visas.

-

Seasonal work visas.

-

Startup visas.

-

Self-employment visas (further divided into visas for freelancers and for foreign managers or auditors of Italian companies).

For example: In 2025, the application window for Italy’s quota visas started in January, with a total annual limit of 165,000 work visas allowed by the government. Of these 165,000 visas, 93,550 slots were allocated for seasonal workers, 70,720 for non-seasonal workers, and 730 for self-employment and startup applicants.

Extra-Quota Visas:

Extra-quota visas follow the normal issuance process. As long as you meet the application criteria, you can obtain the visa as there is no numerical limit on the number of permits issued.

This category includes:

-

EU Blue Card

-

Investor Visa (commonly known as the Golden Visa)

-

Elective Residency Visa (ERV)

-

Intra-Company Transfer Visas

-

Digital Nomad Visa

-

Work visas for occupations experiencing labor shortages

Main Pathways for Permanent Relocation to Italy

Specifically, excluding special methods like family reunification or asylum, non-EU nationals seeking long-term settlement in Italy have the following main pathways:

1. “Curve” Route: Obtaining residency status in another EU country first, and then moving to Italy.

2. Employment-Based Immigration: Immigrating to Italy via work visas, the EU Blue Card (which requires a minimum annual income of €70,000 or more to apply for in Italy), or Intra-Company Transfer Visas.

2. Income-Based Visas: Moving to Italy through visas based on a minimum income, such as the Digital Nomad Visa (requiring remote annual income starting at €26,000), the Self-Employment Visa (requiring a minimum self-employment annual income starting at €8,500), or the Elective Residency Visa (requiring minimum annual passive income starting at €32,000).

3. Residency By Investment Programs: Immigrating to Italy through the Start-up Visa or the Investor Visa (which requires a minimum investment of €250,000).

The long-term residence permits obtained through the methods listed above typically have an initial validity of one to two years and can be continuously renewed under the original qualifying conditions upon expiry.

Permanent Residency & Citizenship:

To gain Italian permanent residency (long-term resident permit), you must first live in Italy legally and continuously for five years, demonstrate sufficient income, and pass an Italian language test at the A2 level.

Italian citizenship by naturalization is generally available after ten years of continuous legal residence, provided you also show financial self-sufficiency and pass a B1 level Italian language test.

Tax Implication:

Italy’s tax system, governed primarily by the Agenzia delle Entrate (Italian Revenue Agency), is based on an individual’s tax residency status, which fundamentally determines their tax obligations.

Personal Income Tax:

The primary national tax is the Personal Income Tax (Imposta sul reddito delle persone fisiche or IRPEF), which is progressive and applied to taxable income.

In addition to the national IRPEF, residents are also subject to two additional local taxes:

-

Regional Income Tax: This rate varies by region, generally ranging from 1.23% to 3.33%.

-

Municipal Income Tax: This rate varies by municipality, generally ranging from 0% to 0.9%.

For the 2025 tax year, the national IRPEF system is simplified into three brackets:

-

23% on income up to €28,000

-

35% on income between €28,001 and €50,000

-

43% on income above €50,000

Special Tax Regimes:

Italy offers several favorable tax regimes aimed at attracting human and financial capital, which provide significant tax relief for eligible new residents.

-

Flat Tax for High-Net-Worth Individuals (HNWIs): Individuals who have not been Italian tax residents for at least nine out of the ten previous years can opt to pay a flat annual tax of €200,000 on all their foreign-sourced income, regardless of the actual amount. This regime is valid for up to 15 years and exempts them from declaring foreign assets and paying wealth taxes on them. An additional flat fee is applied to family members.

-

Tax Regime for Inpatriate Workers: Highly qualified workers who move their residence to Italy may benefit from an exclusion of a portion of their income from taxation. For those relocating from 2024 onward, a significant percentage of their Italian employment or self-employment income is subject to an income tax exemption, potentially reducing the taxable base to 50% (or even lower under specific conditions, such as having dependent children or moving to the Southern regions).

-

7% Flat Tax for Retirees: Foreign retirees who move their tax residence to a municipality in Southern Italy with a population under 20,000, having not been a resident for the past five years, can opt for a flat tax of 7% on all their foreign-sourced income (including pensions) for a period of ten years.

Other Key Taxes:

-

Capital Gains: Gains realized from the sale of financial assets are generally subject to a flat tax rate of 26%.

-

Rental Income: Rental income can be taxed at the progressive IRPEF rates or, for certain residential leases, under a substitute flat tax regime called Cedolare Secca (typically 21%), which replaces IRPEF, regional, and municipal taxes.

-

Wealth Taxes (IVIE and IVAFE): Italian tax residents must pay a wealth tax on foreign-held real estate (IVIE, currently 0.76%) and financial assets (IVAFE, currently 0.2%).

-

Inheritance and Gift Tax: Rates are low and vary based on the relationship between the donor and beneficiary, with substantial tax-free thresholds for spouses and direct descendants (€1 million).

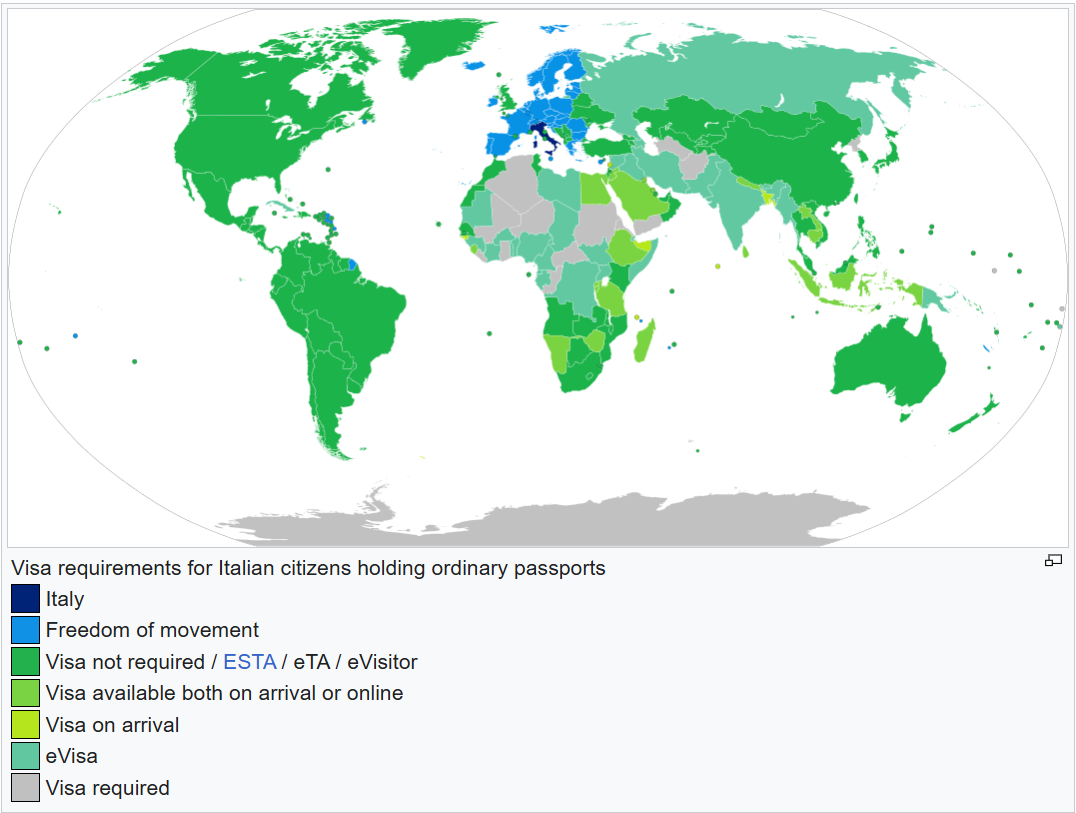

Passport Power:

Italy does not recognize dual citizenship, except in cases of citizenship by descent. Italian passport is ranked 4th globally, visa holders can freely travel (visa-free or obtain visa on arrival) to 188 countries and regions worldwide. (Oct 28th, 2025)

Official Links:

Investor visa for Italy Ministry of Enterprises and Made in Italy: http://investorvisa.mise.gov.it/

Italian Government Site Visa Page: https://www.esteri.it/en/servizi-consolari-e-visti

SPID Public Digital Identity System: https://www.spid.gov.it/en/