How To Get Residency in Malta: A Comprehensive Guide

Capital: Valletta

Population: 542,051 (2021)

Ethnic groups: 89.1% Caucasian, 5.2% Asian, 1.7% Arab, 1.5% African, 1.3% Hispanic / Latino

Area: 316 km2 (186th)

Offical Language: Maltese, English

Currency: Euro

GDP per Captial (PPP): $67,682 (2024 estimated, 20th)

Human Development Index: 0.924 (2023, 24th)

Country Profile:

The Republic of Malta is a small island nation located in Southern Europe, right in the heart of the Mediterranean Sea. The country is made up of five islands, but only three—Malta, Gozo, and Comino—are inhabited.

Located about 90 kilometers south of Sicily, Italy, Malta is a member of the Commonwealth, the European Union (EU), and the Schengen Area. The nation’s economy is primarily built on the service, finance, and tourism industries.

Comino Island is a globally renowned bird and nature reserve, often referred to as the “Heart of the Mediterranean” and the “Garden of Europe.”

Visa & Immigration System:

Euro, EEA & Swiss Citizens:

Malta, a member of both the EU and the Schengen Area, offers the Malta Ordinary Residence Programme as a long-term residency option. This permit is valid for five years and can be renewed.

For citizens of the EU, the European Economic Area (EEA), and Switzerland, it’s a straightforward way to live in Malta for more than three months. To be eligible, you simply need to prove you have sufficient financial resources and can demonstrate genuine residency with a local Maltese address.

Third Country Nationals:

For most people from non-EU regions, you are legally defined as a TCN: third-country national in Malta.

Within Malta’s immigration system, a third-country national cannot stay for more than 90 consecutive days unless they have one of the following legal reasons:

1. Employment:

-

For Remote Workers: If you have a remote job with a monthly income of at least €3,500, you may be eligible to apply for Malta’s Nomad Residence Permit. This non-immigrant visa can be applied for entirely online, is valid for one year, and can be renewed up to three times, allowing for a total stay of four years in Malta.

-

For Local Employees: If you are employed by a Maltese company, you can apply for a Single Permit. This permit functions as both a residence and work permit, and it is directly tied to your employer. If you sign an employment contract, your employer can apply for the Single Permit on your behalf. However, if your employment is terminated or you wish to change jobs, you must apply for a new Single Permit, as the previous one will be invalidated.

-

For Investors and Entrepreneurs:

If you plan to become a shareholder in a Maltese company to obtain a Single Permit, you must invest at least €500,000. Additionally, the company must provide a credible and convincing business plan.

If your aim is to apply for a Single Permit through entrepreneurship, your new company must generally be an innovative or high-tech enterprise. It must also have a strong business plan that is approved under the Key Employee Initiative (KEI) for innovators.

2. Residency Based on Self-Employment: Foreigners who wish to be self-employed in Malta cannot apply for a Single Permit. Instead, you need to apply for a separate Employment Licence from Malta’s Jobsplus and a separate visa.

Malta has very strict requirements for self-employed individuals. To apply for self-employment residency, you must meet one of the following three conditions:

-

Commit to investing €500,000 in Malta within six months of receiving the work permit.

-

Work in a high-tech industry with a credible business plan and commit to hiring at least three local full-time employees within 18 months of receiving the work permit.

-

Your company project is endorsed by Malta Enterprise.

3. Financially Independent Persons: Malta offers three residence visa programs for financially independent foreigners who can contribute to the country without working locally: the Malta Global Residence Programme (MGRP), the Malta Retirement Programme (MRP), and the Malta Permanent Residence Programme (MPRP).

-

The MGRP is a tax residency program that requires applicants to either buy or rent a high-value property in Malta, pay a one-time administrative fee (generally no less than €6,000), and commit to becoming a Maltese tax resident by paying at least €15,000 in annual taxes. In return, you get a one-year MGRP residence permit that can be renewed and can eventually lead to permanent residency or citizenship.

-

The MRP is almost identical to the MPRP in form but requires applicants to be at least 55 years old, become a Maltese tax resident, pay at least €7,500 in annual taxes, and have at least 75% of their disposable income from pension sources, which must be regularly transferred to Malta. If you enter Malta on a retirement visa, your annual income tax rate is 15%. To meet the €7,500 tax threshold, your annual income must be at least €50,000, with 75% of it coming from your pension.

-

The MPRP operates similarly to the MGRP and MRP. Applicants must buy or rent a property in Malta and pay a significant government fee in exchange for Maltese permanent residency. The minimum theoretical cost for the MPRP is €184,000 (renting) or €517,500 (buying).

4. Study, research, training, and volunteer purposes.

5. Family members of a Maltese resident.

-

If you apply for the MGRP or MPRP, your children, spouse, parents, grandparents, and grandchildren can all immigrate as dependents.

-

For other Maltese residence permits, your spouse and financially dependent children can also obtain a residence permit as dependents.

-

Maltese citizens can apply for residence permits for their immediate family members at any time.

6. Health reasons.

7. Refugee and political asylum.

In addition to the programs mentioned above, the Maltese government previously offered a highly sought-after citizenship-by-investment program. It allowed foreign investors to quickly obtain Maltese citizenship by making a substantial financial contribution.

However, due to continuous pressure from the European Union, the program was progressively scaled back. It was effectively terminated on April 29, 2025, and is no longer accepting new applications.

In response, on July 16, 2025, Malta’s Minister for Home Affairs announced that the government is drafting a new bill to introduce a different citizenship-by-investment scheme. This new program would be designed for investors who can make exceptional contributions to the country. As of now, the draft bill is still a work in progress, and whether it will be successfully introduced and approved by the EU remains uncertain.

Citizenship:

To be eligible to apply for Maltese citizenship, a foreigner must meet several requirements:

Residency: You must have lived legally in Malta for a total of five years. This includes two specific periods:

- You must have lived in Malta continuously for the 12 months immediately before you apply, without leaving the country.

- In the six years leading up to that 12-month period, you must have resided in Malta for at least four years in total.

Good Character: You need to be vouched for by at least two Maltese citizens who can confirm you are of good moral character.

Language: You must pass a language test in either English or Maltese.

Passport Power:

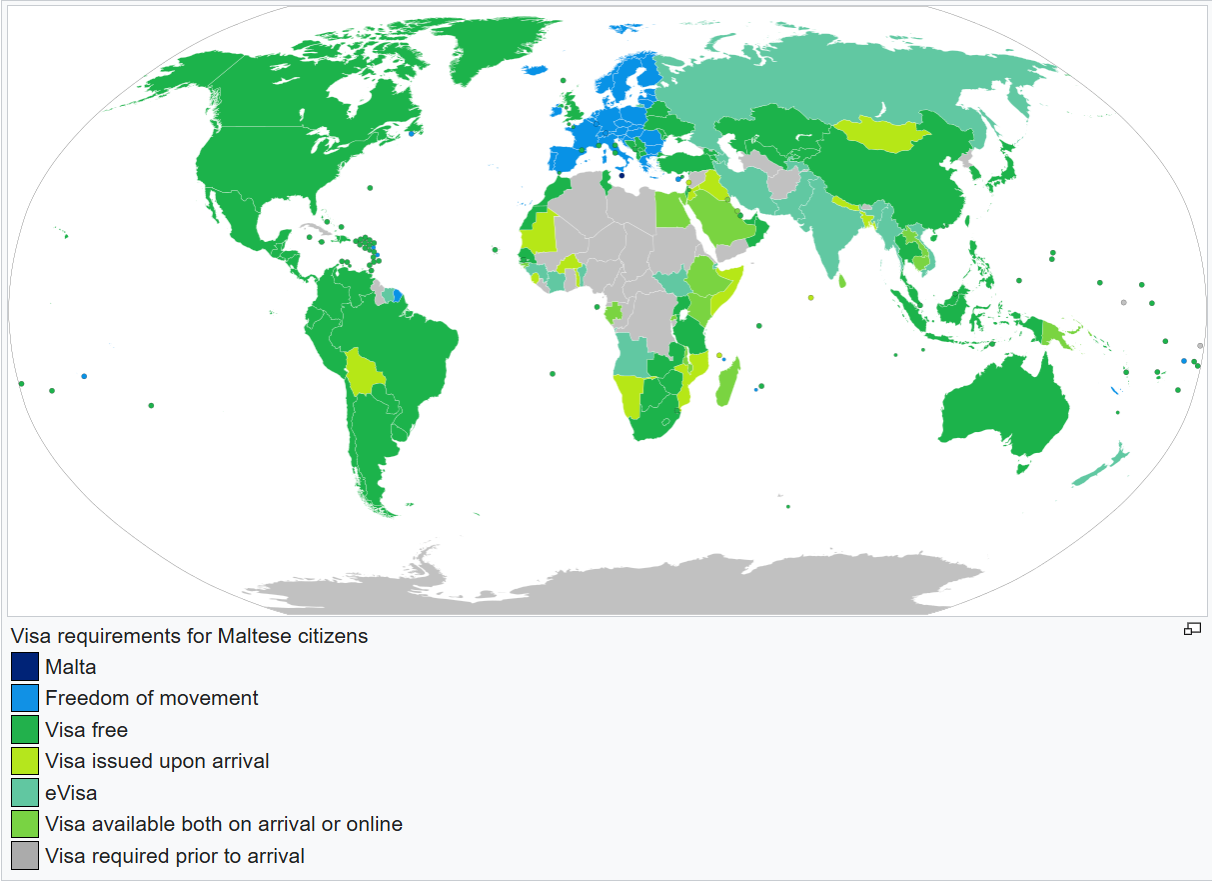

Malta is a member of the Commonwealth, the European Union, and one of the Schengen countries. It allows dual citizenship and its passport is ranked 7th globally. Holders of this passport enjoy visa-free or visa-on-arrival access to 188 countries or regions worldwide. (Sep 17th, 2025)

Official Links:

Community Malta Agency:https://komunita.gov.mt/en/

Malta Permanent Residence Programme: https://residencymalta.gov.mt/the-mprp-programme/

Global Residence Programme: https://mtca.gov.mt/personal-tax/individual/special-schemes/global-residence-programme-rules

Malta Retirement Program: https://mtca.gov.mt/personal-tax/individual/special-schemes/malta-retirement-programme

Malta Nomad Residence Permit: https://nomad.residencymalta.gov.mt/

Useful Links:

Malta Travel Guidebook 2025 – 2026 (FULL COLOR): https://amzn.to/470wYYD

DK Top 10 Malta and Gozo (Pocket Travel Guide): https://amzn.to/3J2wusY

The History of Malta: A Mediterranean Gem of History and Culture: https://amzn.to/4oasl56

A Sunny Place for Shady People: How Malta Became One of the Most Curious and Corrupt Places in the World: https://amzn.to/4nHFFOB

How to Move to Malta: A Comprehensive Guide: https://amzn.to/4q34lT8

Orange Holiday Europe Prepaid eSIM 12GB Internet Data | 30 Days-Use | Data tethering Allowed | 30min & 200 SMS from Europe to Any Country Worldwide: https://amzn.to/46TEapj

Malta Flag Shield Patch (3 Inch): https://amzn.to/3KEK7iC