Home > South America > Paraguay > How To Get Residency In Paraguay: A Comprehensive Guide

How To Get Residency in Paraguay: A Comprehensive Guide

Capital: Asunción

Population: 6,413,627 (2025, 113th)

Ethic Group: 75% Mixed, 20% White, 1.7% Indigenous

Area: 406,752 km2 (59th)

Offical Language: Spanish & Guarani

Currency: Guaraní (As of July 1, 2025, 1 Paraguayan Guarani = 0.00013 USD)

GDP per Captial (PPP): $21,273 (2025 estimated, 84th)

Human Development Index: 0.756 (2023, 99th)

Country Profile:

Paraguay is a landlocked country in South America, bordered by Argentina, Brazil, and Bolivia. Geographically, the entire country is divided into eastern and western parts by the Paraguay River.

Economically, Paraguay heavily relies on agriculture and hydroelectric power. The world’s second-largest hydroelectric power station, the Itaipu Dam, is located on the border between Paraguay and Brazil.

Culturally, Paraguay is deeply influenced by Guarani and Spanish cultures. Music, dance, and various crafts are symbols of Paraguayan culture.

Visa and Immigration System:

Permanent Residency By Investment Program:

Paraguay was once renowned for its unique “residency by deposit” program, which allowed individuals to obtain permanent residency by simply depositing approximately $5,000 in a local bank.

However, this program was discontinued at the end of 2022. Today, Paraguay’s most prominent immigration pathway is its “permanent residency by investment” program. This accelerated route to permanent residency involves establishing a company and presenting a credible business plan that outlines a phased investment of $70,000 over ten years for the company’s development.

Compared to similar programs in other countries, Paraguay’s permanent residency program offers three key advantages:

1. Low Investment and Fast Processing: The required investment amount is relatively modest, and the entire permanent residency by investment process can be remarkably swift, often completed in as little as 45 days and rarely exceeding three months.

2. Minimal Physical Presence: Maintaining your residency status is straightforward, requiring only a single entry into Paraguay every three years and a permanent residency card renewal every ten years.

3. Undisclosed Nationality on Card: The permanent residency card itself does not display the holder’s nationality, instead showing only their place of birth and name.

Temporary Residency:

Besides the investment route, foreigners seeking permanent residency in Paraguay must first secure temporary residency. After holding temporary residency and living legally in Paraguay for two years, they can then apply for permanent residency, provided they also meet other requirements related to education, professional skills, and taxes.

For citizens of Western countries like the US and Europe, or developed Asian nations such as Japan and South Korea, obtaining a local temporary residency permit is generally quite straightforward, often requiring just a single in-person visit to Paraguay.

However, for individuals from other countries, a specific type of Paraguayan temporary residency permit is required. This could be a work visa, student visa, freelancer visa, or retirement visa, among others.

Generally, these permits are valid for one year and can be renewed up to five times under the original conditions, meaning you could live in Paraguay for a maximum of six years on a temporary residency permit.

Among these temporary residency permits, the retirement visa is primarily intended for retirees, but individuals who are not retired yet have sufficient passive income can also apply. Regarding the economic requirements, the Paraguayan retirement visa requires applicants to have an income level that is 100 times the local minimum wage. Specifically, the monthly income should not be less than 7,015,600 Guaraníes, approximately $1,300.

Citizenship:

Foreigners who have legally resided in Paraguay for two years, and can prove they have a university degree or equivalent technical qualification, or have been paying taxes in Paraguay for two years, are eligible to apply for permanent residency in Paraguay.

Permanent residents of Paraguay who have resided in the country continuously for three years, spending at least 183 days each year, are at least 18 years old, have no criminal record, engage in legitimate professional activities (such as business, work, research, etc.), show basic knowledge of Spanish or Guarani, as well as the country’s history, geography, and politics, are eligible to apply for citizenship.

Tax Implication:

Paraguay is often noted for its simple tax structure and low rates, which aim to attract foreign investment. The defining characteristic is the Territorial Tax Principle.

1. The Territorial Tax Principle:

-

Focus on Source: Paraguay taxes income based on its source.

-

Taxed Income: Only income generated from sources within Paraguay is subject to taxation.

-

Foreign Income: Income generated outside of Paraguay (foreign-source income) is generally not taxed in the country.

2. Key National Taxes:

Paraguay’s main tax revenue comes from corporate income, personal income, and a value-added tax.

A. Corporate and Business Taxes:

-

Corporate Income Tax (IRE): The standard rate is a flat 10% on net taxable income derived from Paraguayan sources. Simplified regimes exist for smaller enterprises.

-

Dividends and Profits Tax (IDU): This is a withholding tax applied when profits or dividends are distributed by a corporation.

The rate is 8% for resident beneficiaries, and 15% for non-resident beneficiaries.

-

Non-Resident Income Tax (INR): Levied at 15% on Paraguayan-source income paid to non-residents (e.g., royalties, interest, technical assistance fees).

B. Personal Income Tax (IRP):

-

This tax is applied to income from personal services and capital gains sourced in Paraguay.

-

The system uses progressive rates that range up to 10% on net taxable income, depending on the income bracket. The primary rates are 8%, 9%, and 10%.

C. Consumption Tax:

Value Added Tax (IVA): This is the main indirect tax, the general rate is 10%. A reduced rate of 5% applies to certain essential items, such as medicines, some foodstuffs, and residential rental.

3. Attractive Investment Regimes:

Paraguay offers a special regime, Maquila Regime, to incentivize investment and exports. This system is highly favorable for export-oriented manufacturing. It imposes a single tax of 1% on the added value of the goods or services produced for export.

4. Notably Absent Taxes:

Paraguay does not impose several taxes that are common in many other countries, making it attractive for high-net-worth individuals:

-

No Wealth Tax.

-

No Inheritance Tax.

-

No Gift Tax.

Passport Power:

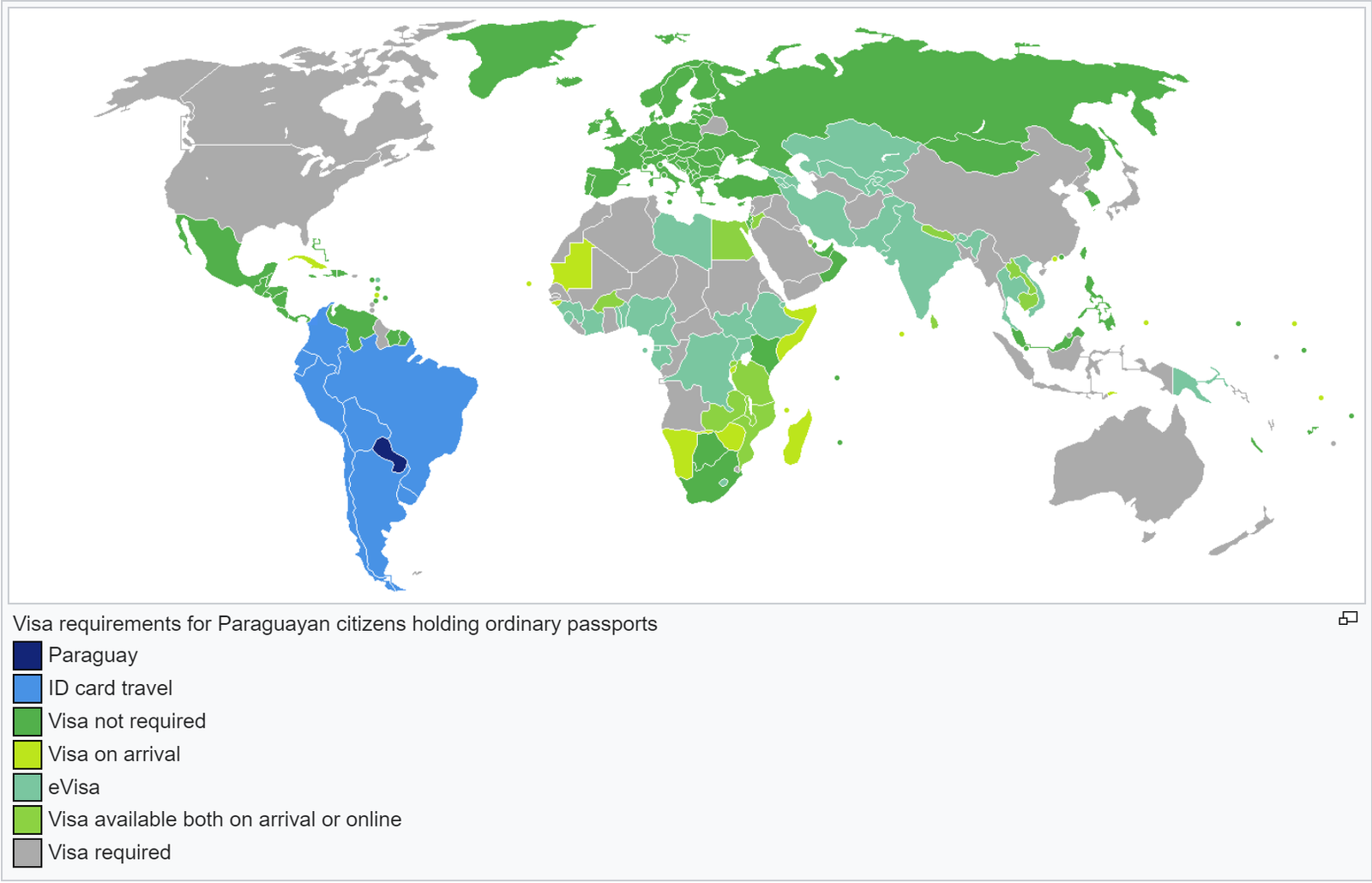

With the exception of individuals of Italian and Spanish descent, Paraguay does not recognize dual citizenship. The Paraguayan passport is ranked 31st globally, allowing holders visa-free or visa-on-arrival access to 148 countries and territories worldwide (July 1, 2025).

Paraguay is a member of the Southern Common Market (Mercosur). As shown in the map below, citizens of member countries under this agreement can freely work and live in any other member country. After two years, if they can provide proof of financial means to support themselves and their family, they can directly obtain a permanent residency visa in the host country. Holding Paraguayan citizenship makes living in South America very convenient.

Official Links:

Paraguay Migration Office: https://migraciones.gov.py/

Home > South America > Paraguay > How To Get Residency In Paraguay | A Complete Guide