How To Get Residency in Spain | A Comprehensive Guide

Capital: Madrid

Population: 49,442,844 (2025, 31st)

Ethnic Groups: 85.6% Spanish

Area: 505,994 km2 (51st)

Offical Language: Spanish

Currency: Euro (€)

GDP per Captial (PPP): $56,888 (35th)

Human Development Index: 0.918 (28th)

Country Profile:

Spain is a moderately developed country located in southwestern Europe, sharing the Iberian Peninsula with Portugal and Andorra. Spain is a major advanced capitalist economy, with the world’s fifteenth-largest economy by nominal GDP (fourth of the European Union) and the fifteenth-largest by PPP.

For decades, Spain has consistently ranked as one of the most desirable places to live on the planet. And it isn’t hard to see why.

We’re talking about more than 300 days of sunshine a year and a Mediterranean climate that—quite literally—lets you breathe a little easier. But beyond the weather, there’s that famous “plaza culture.” It’s a way of life where community and family aren’t just buzzwords; they’re the priority. Whether it’s a slow coffee in the morning or tapas with neighbors at sundown, the quality of life here is frankly hard to beat anywhere else.

Immigration & Visa System:

In April 2025, Spain officially pulled the plug on the Golden Visa. The days of ‘buying’ your residency through a half-million-euro property investment are over. This change has actually pushed more people toward the Non-Lucrative Visa—a non-working residency perfect for retirees or anyone who can live comfortably off passive income or significant savings.

If the Non-Lucrative Visa isn’t the right fit because you actually plan to work, by 2026, Spain has really opened up a “menu” of options tailored to almost every professional situation.

Let’s talk about what that looks like in practice.

First, there’s the route for those of you who want to join a Spanish company. If you find a role on the “shortage occupation list,” or if a company can prove they couldn’t find a local candidate, they can sponsor you directly for a standard work visa. If you’re a high-level specialist or have a top-tier job offer, you can fast-track the process through the Highly Qualified Professional Visa or the EU Blue Card—both of which are incredibly efficient for bringing your whole family along. And of course, if you’re already with a multinational, the Intra-Corporate Transfer makes moving to a Spanish branch relatively seamless.

For those who value independence, the Digital Nomad Visa has become the absolute standout. If you’re working remotely for a company back home, or if the vast majority of your clients are international, this is likely your best bet—it even comes with some significant tax advantages. If your dream is more “boots on the ground,” like opening a local café or shop, the Self-Employed Visa is your path. Or, if you’re an innovator with a scalable startup idea, the Entrepreneur Visa is specifically designed to attract that kind of talent to Spanish shores.

Finally, we have to mention the pathways for students and recent graduates, which are more flexible than ever. You can now come here for a degree and work up to 30 hours a week while you study to help support yourself. Then, once you graduate, you can transition to a Job Seeker Visa, giving you a full year to stay in the country, hit the pavement, and launch your career locally.

If you already have ties to Spain, there are additional options through family reunification or the Arraigo process, which allows residents to regularize their status based on social or family roots. For example, if you’ve lived in Spain continuously for three years and have a job offer, or if you’re a parent of a Spanish child, you may qualify for this path.

Other special categories include visas for researchers, artists, professional athletes, volunteers, and working holiday programs, each tailored to different professional and personal circumstances.

Residence Permits:

Once you’ve secured your visa, it’s important to remember that the journey isn’t quite over—the next crucial step is converting that visa into a formal residence permit. Think of your visa as the key that opens the door to Spain, but the residence permit is what actually allows you to stay, settle in, and access your full rights as a resident.

Typically, a Spanish visa is valid for anywhere from three months to a year. The clock starts ticking the moment you arrive; your first day of residency is officially marked by that entry stamp in your passport. From that date, you have exactly one month to apply for your TIE, or Foreigner Identity Card.

The good news is that as of 2026, the process has become significantly more efficient. Spain has fully transitioned to the ‘RELOEX’ system, which means the entire application is now digital and much smoother than the old paper-based methods.

Depending on how you apply, the duration of your stay can vary. If you’re applying for a work visa from outside the country, your first permit is generally granted for one year. However, there is a strategic advantage to applying while you’re already here on a tourist or Schengen stay—in those cases, your initial permit is often granted for three years right away. Regardless of the path you take, these permits are renewable for up to five years, provided your circumstances stay the same.

Permanent Residency & Citizenship

If you’re looking for long-term security, you can apply for Permanent Residency after living in Spain continuously for five years. To qualify, you cannot have been outside of Spain for more than 10 months total during those five years. Once granted, you have the same rights to live and work as any Spaniard and only need to renew the physical card every five years.

As for Spanish Citizenship, it isn’t the first choice for everyone because Spain technically does not allow dual citizenship for most countries (including the US, UK, Canada, and Australia). Choosing Spanish nationality usually means renouncing your original one.

If you do decide to go for it, for most people, it’s a ten-year wait. However, that timeline drops significantly if you have specific ties here. For citizens of Ibero-American countries, it’s only two years. If you’re married to a Spanish citizen, you can actually apply after just one year. There’s also a five-year track specifically for those with official refugee status.

When you’re ready to apply, it’s not just about the time spent on the ground; you have to prove what they call “Integration.” This involves passing two exams: the DELE A2, which tests your Spanish language skills, and the CCSE, which covers Spanish culture and the constitution. And, of course, you’ll need to maintain a completely clean criminal record throughout your residency.

Tax Implication:

Moving to Spain isn’t just about a change of scenery; it’s about a brand-new relationship with the taxman. In 2026, the rules are clearer than ever, but let’s be honest: the Spanish Tax Agency—Hacienda—has become incredibly efficient at tracking digital nomads and expats.

The first thing you need to wrap your head around is the 183-Day Rule. If you spend more than 183 days in Spain during a calendar year—and no, they don’t have to be consecutive—you are legally a Spanish Tax Resident.

This is a massive shift. Once you hit that threshold, Spain doesn’t just tax the money you make here; they tax your worldwide income. Whether it’s your salary from the US, a rental property in London, or dividends from Australia, Hacienda will want a piece of it. Standard tax rates are progressive, starting at 19% and climbing all the way to 47% for high earners. And keep in mind, depending on where you settle—like Catalonia or Valencia—regional taxes can push that total even higher.

However, there is a ‘golden ticket’ called the Beckham Law. If you’re moving for a specific job, or arriving on a Digital Nomad or Highly Qualified Professional visa, you can apply for this special regime.

Under the Beckham Law, you’re essentially taxed as a non-resident for up to six years. That means you pay a flat 24% tax rate on your Spanish income (up to €600,000), and crucially, your foreign income stays completely tax-free in Spain. It is a massive financial advantage, but you must apply within your first six months of arriving or starting your contract. Miss that window, and you’re stuck with those high progressive rates.

For those with significant assets, you also need to watch out for the Wealth Tax. If your global assets—think property, cash, and stocks—are worth more than €700,000, you could owe an annual percentage on your total net worth. But here’s a pro tip: where you choose to live matters! Regions like Madrid and Andalusia currently offer 100% relief, effectively bringing that tax down to zero.

Finally, don’t forget the Modelo 720. This is an informative form where you declare any assets you own abroad worth over €50,000. It isn’t a tax itself, but the fines for ‘forgetting’ to file it can be brutal. And if you’re into crypto, 2026 also requires the Modelo 721 for digital assets held outside of Spain.

Passport Power:

Spain allows dual citizenship only for nationals of countries with which it has a specific historical or bilateral treaty.

These countries include: Latin American countries (specifically Ibero-American nations like Mexico, Argentina,

Colombia, etc., including Brazil), Portugal, Andorra,

The Philippines, Equatorial Guinea, France and Sephardic Jews.

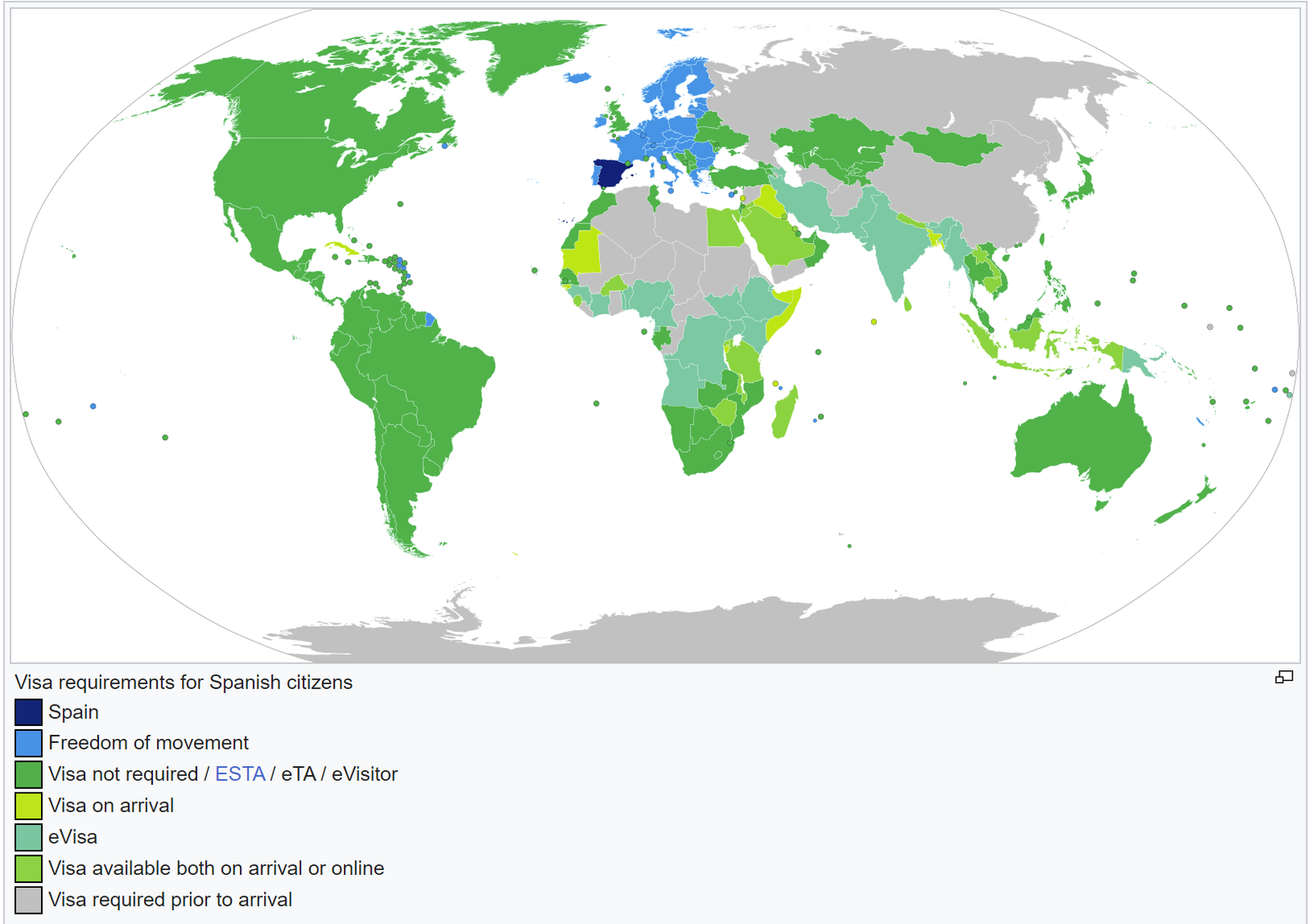

Spanish passports are ranked third globally, allowing holders to travel freely (via visa-free or visa-on-arrival) to a total of 189 countries and regions worldwide, including most parts of the Americas, Oceania, and Europe.

Official Links:

Spain Directorate-General for International Trade and Investment: https://prie.comercio.gob.es/en-us/Paginas/index.aspx

Spain Ministry of Interior Affairs: https://www.exteriores.gob.es/es/Paginas/index.aspx

Spain employee visa: https://www.exteriores.gob.es/Consulados/londres/en/ServiciosConsulares/Paginas/Consular/Visado-de-trabajo-por-cuenta-ajena.aspx

Shortage occupation list:https://www.sepe.es/HomeSepe/empresas/profesiones-de-dificil-cobertura/profesiones-mas-demandadas

Spainish visa for highly qualified individuals and intra-company transfers:https://www.exteriores.gob.es/Consulados/londres/en/ServiciosConsulares/Paginas/Consular/Visado-para-trabajador-altamente-cualificado-y-para-traslado-intraempresarial.aspx

Spain Digital nomad visa: https://www.exteriores.gob.es/Consulados/washington/en/ServiciosConsulares/Paginas/Consular/Telework-visa.aspx

Spainish self-employed visa :https://www.exteriores.gob.es/Consulados/washington/en/ServiciosConsulares/Paginas/Consular/Visado-de-trabajo-por-cuenta-propia.aspx

Spainish Entrepreneur Visa: https://www.exteriores.gob.es/Consulados/londres/en/ServiciosConsulares/Paginas/Consular/Visado-para-emprendedor.aspx

Spainish Non-lucrative visa:https://www.exteriores.gob.es/Consulados/losangeles/en/ServiciosConsulares/Paginas/Consular/Visado-de-residencia-no-lucrativa.aspx